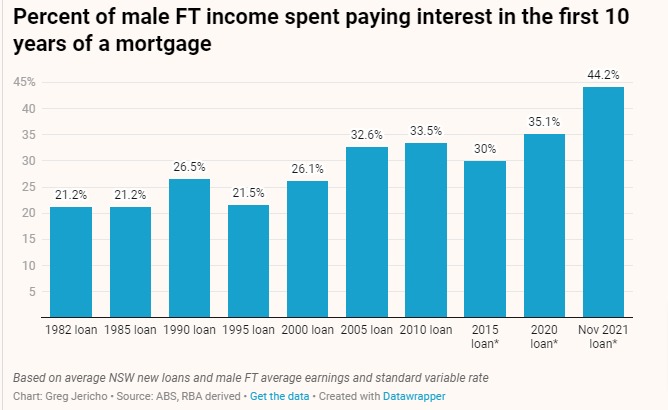

For most of the past decade the talk about housing affordability has focussed on house prices. As fiscal policy director, Greg Jericho notes in his Guardian Australia column, falling interest rates since November 2010 have made paying off a mortgage less onerous than it otherwise would have given the soaring house prices.

But that is about to change.

The signal that interest rates are going to rise by possibly 2.5% points over the next 18 months means that for new mortgage holders the cost of repaying a mortgage is going to be harder than ever before – harder even than when interest rates hit 17% in 1990.

It is a hit that will only exacerbate standard of living problems as wages will struggle to keep up with the rising cost of of holding a mortgage – especially given the belief that wage rises need to be contained below inflation rises continues in economic debate.

Between the Lines Newsletter

The biggest stories and the best analysis from the team at the Australia Institute, delivered to your inbox every fortnight.

You might also like

Corporate Profits Must Take Hit to Save Workers

Historically high corporate profits must take a hit if workers are to claw back real wage losses from the inflationary crisis, according to new research from the Australia Institute’s Centre for Future Work.

“Right to Disconnect” Essential as Devices Intrude Into Workers’ Lives

Australia’s Parliament is set to pass a new set of reforms to the Fair Work Act and other labour laws, that would enshrine certain protections for workers against being contacted or ordered to perform work outside of normal working hours. This “Right to Disconnect” is an important step in limiting the steady encroachment of work

New laws for ‘employee-like’ gig workers are good but far from perfect

The Workplace Relations Minister Tony Burke has described proposed new laws to regulate digital platform work as building a ramp with employees at the top, independent contractors at the bottom, and gig platform workers halfway up. The new laws will allow the Fair Work Commission to set minimum standards for ‘employee-like workers’ on digital platforms.