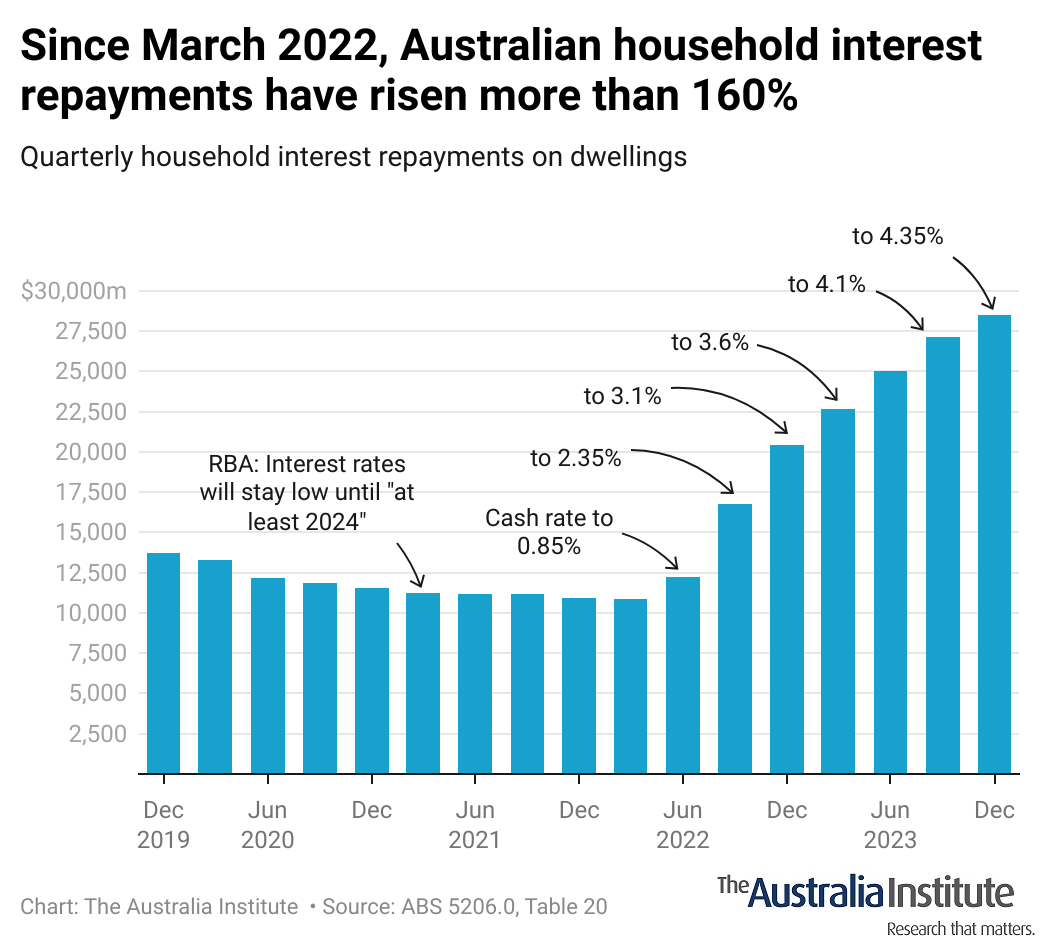

The latest raise in the cash rate has meant interest rates have increased by more in 4 months than they have anytime since 1994.

This is expected to have a dramatic impact on the economy with the Governor of the Reserve Bank announcing that the RBA expects GDP growth in 2023 and 2024 to be just 1.75%.

Labour market and fiscal policy director, Greg Jericho, in his Guardian Australia column, notes that this would be the the first time since the 1990 recession that there have been 2 consecutive years of growth below 2%.

The steep rise in rates, and the prospect of more to come suggests that the Reserve Bank’s efforts to curb inflation are likely to come at a high cost for workers.

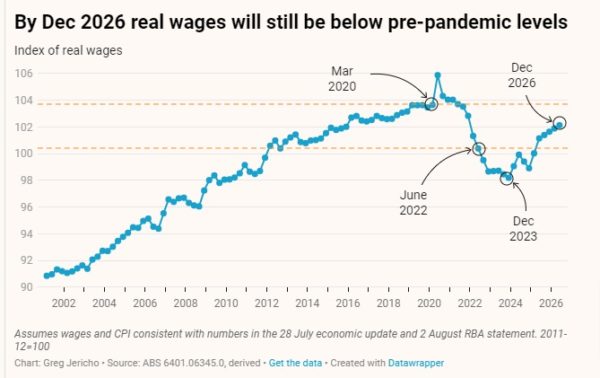

The past year has seen the biggest fall in real wages since the introduction of the GST and current estimates from the Treasury and the Reserve Bank suggest further falls to come until the end of next year. By that point real wages would be more than 5% below pre-pandemic levels – a truly disastrous result in what is supposedly a recovery period.

Between the Lines Newsletter

The biggest stories and the best analysis from the team at the Australia Institute, delivered to your inbox every fortnight.

You might also like

Corporate Profits Must Take Hit to Save Workers

Historically high corporate profits must take a hit if workers are to claw back real wage losses from the inflationary crisis, according to new research from the Australia Institute’s Centre for Future Work.

The RBA gets its wish as Australia’s economy slows dramatically

As interest rates have climbed, Australia’s economy has slowed – let us hope the RBA has not stalled it.

Stage 3 Better – Revenue Summit 2023

Presented to the Australia Institute’s Revenue Summit 2023, Greg Jericho’s address, “Stage 3 Better” outlines an exciting opportunity for the government to gain electoral ground and deliver better, fairer tax cuts for more Australians.