5 ways and 63 billion reasons to improve Australia’s tax system

With a federal election just around the corner, new analysis from The Australia Institute reveals 63 billion reasons why our next Parliament should improve the nation’s tax system.

When old and new MPs return to Canberra after the election, they’ll have a unique opportunity to tackle Australia’s biggest challenges on inequality, sustainability, health and education.

There is a need for more spending in disability care, childcare, aged care, health care, education and housing. There are also calls for more spending in defence. Regardless of which parties form government after the next election, they are going to need more revenue.

Fortunately, significant revenue can be raised relatively easily, and in ways which will make Australia fairer and safer.

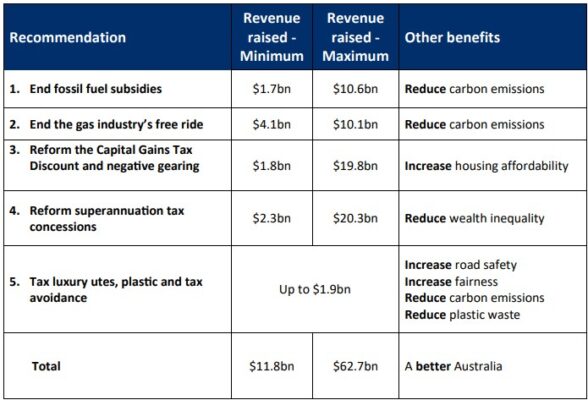

By cutting fossil fuel subsidies, ending the gas industry’s free ride, reforming negative gearing and closing tax loopholes for superannuation and luxury utes, Treasury would raise between $12 billion and $63 billion.

- $12 billion could fund 70,000 extra jobs to improve education, health and a host of other public services.

- $63 billion would enable the government to raise support payments above the poverty line and double spending on education and housing.

Not only would these changes be easy to implement, they’d be popular.

And – after all that – Australians would still be paying significantly less tax than taxpayers in equivalent developed countries.

The Australia Institute’s new Discussion Paper, Raising Revenue Right, has five realistic recommendations for Australia’s 48th Parliament:

“Australia is a low-tax country, raising just 30% in tax revenue as a share of the economy, well below the average of 34.9% across developed countries,” said Greg Jericho, Chief Economist at The Australia Institute.

“Countries which raise more tax and spend more on public services tend to have healthier, happier communities and higher incomes.

“Tax is the price we pay to live in a good society. Currently, Australia is underpaying and, as a result, the country has higher levels of poverty and insufficient funding for education, health and other services.

“The revenue ideas presented here are not new. They are already at the centre of debate. Some are supported by current MPs.

“These are the obvious ones. There would still be room for the 49th Parliament to examine other necessary reforms like reintroducing a carbon tax, bringing in an inheritance tax and a tax on sugary drinks.

“This report presents five policy areas where we could not only raise more revenue, we could reduce inequality, lower emissions, improve housing affordability, make roads safer, reduce plastic waste, and create a fairer tax system.”

The full report can be found here: Raising revenue right – Better tax ideas for the 48th parliament

Related research

General Enquiries

Emily Bird Office Manager

Media Enquiries

Glenn Connley Senior Media Advisor