9 in 10 Taxpayers to Pay More Tax Under Current Government Plan to Scrap LMITO

An electorate analysis of the Federal Government’s current plan to scrap the LMITO (Low and Middle Income Tax Offset) after 2021-22, shows most taxpayers will be worse off when the legislated Stage 3 tax cuts to high income earners comes into effect in 2024-25.

Key Findings:

- Scrapping the LMITO will see 90% of taxpayers pay more tax, with the LMITO – as the name suggests — mainly benefitting middle income earners.

- The electorates that have the biggest proportion of taxpayers getting the most benefit from the LMITO are largely Labor Party electorates

- Eight of the top 10 and 14 of the top 20 electorates with the largest proportion of taxpayers earning between $37,000 and $90,000 per year Labor Party electorates.

- Meanwhile, Stage 3 tax cuts mainly go to high income earners and are currently legislated to start in 2024-25

- Most taxpayers will be worse off after the Stage 3 tax cuts come into effect.

- The electorates that have the biggest proportion of taxpayers who will benefit most from the Stage 3 tax cuts are largely Liberal Party electorates

- Seven of the top 10 and 12 of the top 20 electorates with the largest proportion of taxpayers earning more than $180,000 per year are Liberal Party electorates.

- National Party electorates dominate those electorates that have the largest proportion of taxpayers getting no benefit from stage 3 tax cuts, along with Labor Party electorates.

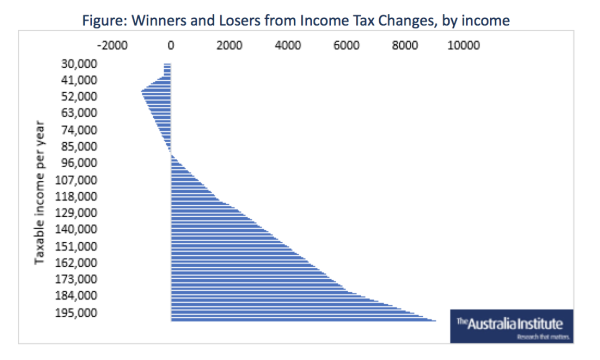

- All taxpayers earning less than $90,000 a year (which is two thirds of taxpayers) will be worse off. Meanwhile, those earning over $90,000 a year (one third of taxpayers) will be better off.

Figure: Winners and Losers from Income Tax Changes, by income

“Our analysis of the winners and losers of LMITO and Stage 3 tax cuts helps explain why the Liberal Party have been such strong advocates for the stage 3 tax cuts and less concerned about the LMITO coming to an end,” said Matt Grudnoff, senior economist at the Australia Institute.

“Of the top 10 electorates that have the largest proportion of taxpayers who will receive the greatest benefit from the stage 3 tax cuts, seven are Liberal, two are Labor and one is independent.

“The stage three income tax cuts will provide the biggest benefits to those who need them the least. While the benefits of a strong tax base are obvious, it’s time for a robust national debate about whether we want the tax system to make Australia more equal or less equal as Australians emerge from the pandemic.”

Related research

General Enquiries

Emily Bird Office Manager

Media Enquiries

Glenn Connley Senior Media Advisor