After the Stage 3 tax cuts only the top 10% highest paying occupations will be better off

The Stage 3 tax cuts will only balance out the tax increase from the end of the low-middle income tax offset for those earning above $97,000

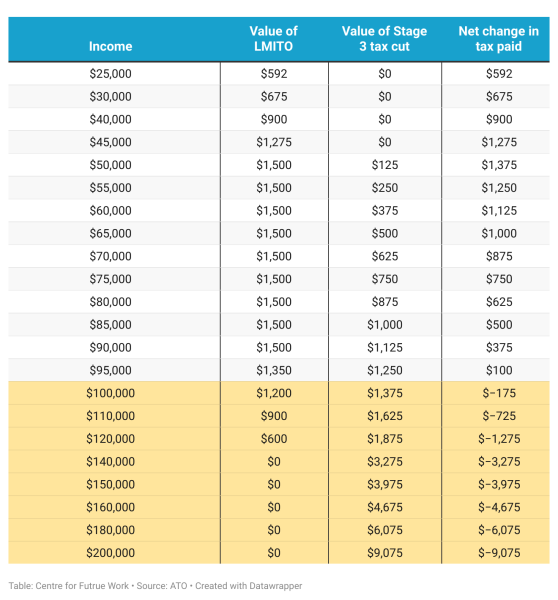

One of the selling points of the Stage 3 tax cuts has been that they will deliver tax cuts to everyone earning more than $45,000 – teachers, nurses and office workers. But such an argument only works if you ignore the impact of the removal of the low-middle income tax offset (LMITO) which has now been cancelled and will deliver a tax rise for workers in this financial year.

The LMITO starts at $675 and rises to be worth $1,500 for people earning $48,000 to $90,000. But for someone earning, for example, $50,000, the Stage 3 tax cut is only worth $125. Even for someone on $90,000 the Stage 3 cut is worth just $1,125 – some $325 less than they get from the LMITO.

Because the Stage 3 tax cut is geared to provide the greatest benefits to the highest income earners, this means combined with the removal of the LMITO, the benefits of the tax plan are even more skewed to the wealthy.

An Office Worker on $45,098 receives $1,341 from the LMITO but the stage 3 cuts delivers only $23. That means once the LMITO is removed and the Stage 3 tax cut comes into place they will pay some $1,318 more in tax than they did in the last financial year – or the equivalent of a 2.9% tax rise.

A Bus Driver on $58,446, which is almost exactly the median-income paying occupation, will also lose $1,500 from the removal of the LMITO, but will get only $336 from the Stage 3 tax cut. They get the equivalent of a 2% tax rise and will pay $1,164 more in tax than they did last year.

A Primary School Teacher who earns $74,012 will find themselves $774 worse off after losing $1,500 from the LMITO and getting just $726 from the Stage 3 cut.

Once those earning above $97,000 does the loss of the LMITO get cancelled out by Stage 3 tax cut. This means that only those in the top 10% paying occupations will be better off.

This highlights once and for all that the former government’s tax plan, with temporary benefits to low-middle income earners and permanent tax cuts for the wealthy, will exacerbate inequality and deliver benefits to those who need it the least.

Between the Lines Newsletter

The biggest stories and the best analysis from the team at the Australia Institute, delivered to your inbox every fortnight.

You might also like

10 reasons why Australia does not need company tax cuts

1/ Giving business billions of dollars in tax cuts means starving schools, hospitals and other services. Giving business billions of dollars in tax cuts means billions of dollars less for services like schools and hospitals. If Australia cut company tax from 30% to 25% this would give business about $20 billion in its first year,

5 ways and 63 billion reasons to improve Australia’s tax system

With a federal election just around the corner, new analysis from The Australia Institute reveals 63 billion reasons why our next Parliament should improve the nation’s tax system.

The Liberal Party defies its own history on tax

For decades, the Liberal Party has prided itself on being the “party of lower taxes”.