A bigger surplus this year and a bit bigger deficit next year! Does it matter?

As I noted last month, not really. But while the surplus might not matter, the choices in the budget do, so let’s have a look at what the budget tells us about the economy and some of the choices the government has made.

No real change in the budget balance

One of the things to remember about the treasurer announcing a changed budget deficit or surplus is that it really just means the Treasury estimates were more wrong than they expected.

It is no different from if, for example, in January the AFL predicted 80,000 people would turn up to the Anzac Day game between Collingwood and Essendon, but then because the weather is nice and Essendon are winning more than expected, 93,000 turn up.

If the AFL had instead predicted a crowd of 93,000, that wouldn’t make the day any better or worse, just that the AFL was better at predicting the crowd.

The same with the budget. Last year the budget predicted a deficit of $13.9bn with $668bn in revenue. By December, the midyear economic and fiscal outlook (Myefo) predicted a deficit of $1.1bn with revenue of $685.3bn.

And now we have a surplus of $9.3bn with revenue of $692.3bn.

It didn’t come from any great policy moves by the government but by the predictions of “economic parameters” being wrong.

While the government will crow about the surplus, come 1 July we’re into a new financial year and back into predicted deficits – bigger than expected in December but still smaller than was predicted a year ago. And this all just highlights how silly the debate over “improved” or “worse” budget bottom lines is.

Four of the budget years have smaller deficits (or a bigger surplus) compared with what was predicted a year ago, but three have bigger deficits compared with the Myefo figures.

This is neither good nor bad. What matters is what the government is choosing to fund and how and who and what it chooses to tax.

Let’s not forget stage three

Because it was announced back in February, the changes to the stage-three tax cuts are easy to forget, but they remain a major part of this budget and things could have been a lot worse:

Under the old stage-three cuts, people on $200,000 were going to get a 4.5% ($9,075) tax cut, while those on median incomes of $67,600 were getting just $565 (0.8%). Now median income earners get a 2.0% ($1,369) tax cut, which is only slightly below the 2.2% ($4,529) cut going to those on $200,000.

Not perfect. But a very good choice by the government.

Choices made on jobseeker

But those earning less than $8,200 are still wondering what’s in it for them. As I wrote two weeks ago, the government’s own Economic Inclusion Advisory Committee had recommended jobseeker be raised to 90% of the age pension. The government chose to ignore that recommendation. Instead, it is increasing jobseeker only for those with conditions that mean they are limited to working less than 14 hours a week. This will help about 4,700 people.

They have also chosen to increase commonwealth rental assistance by 10% off the back of a 15% rise last year, and everyone gets $300 off their power bill.

Both these measures will reduce inflation. Rental assistance goes to those on low to middle incomes who are hardly in a situation where they will take the extra money and spend wildly. And the energy rebate is large enough to make an impact on inflation but not enough to significantly affect overall demand in the economy.

These measures are welcome but what we know from earlier in the pandemic is that the best way to reduce poverty is to give those in poverty more money (seems a bit obvious).

The government has chosen to keep those on jobseeker in poverty – now almost $225 a week below the poverty line.

Lower inflation but lower wage growth

As reported, the budget predicts lower inflation than the Reserve Bank of Australia. This is not surprising, given that the RBA governor, Michele Bullock, had even noted that the RBA was not able to take into account the measures in the budget.

The RBA predicted that by June next year inflation would be 3.2%, while the government predicts it will be 2.75%. And yes, that sounds a big difference, but to be honest it’s not.

Think of it this way. If you spend $150 on shopping today, and in a year’s time prices have gone up by 3.2% that will then cost you $154.80; if prices only go up by 2.75% it will cost you just $154.13.

Neither 3.2% nor 2.75% should make any difference to interest rates – the next move should still be a cut and the issue of inflation will likely become one of political barracking rather than economics.

As ever when talking about living standards, you need to remember not just inflation but wages growth.

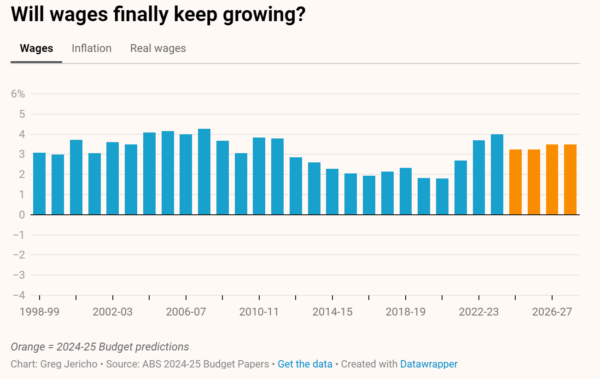

Both the RBA and the budget predict wages rising but, while the RBA estimates wages growing by 3.6% in June next year, the budget estimates just 3.25% growth:

All up over the next four years, the budget predicts that real wages will rise by 3%.

That’s certainly not at a pace that should have anyone except the most shrill members of the business community complaining about a “wages breakout”.

Even if these predictions come true, by the middle of 2028 the average value of Australian wages in real terms will still be 2% lower than before the pandemic.

This means that for someone earning $80,000 in March 2020, their wage in 2028 will be equivalent to just $78,420.

The economy is still weak

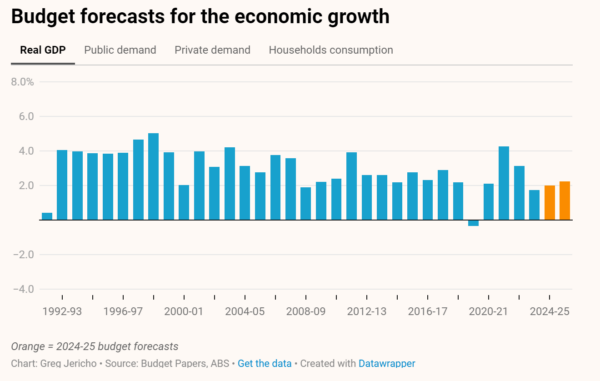

The government has lowered its estimates for GDP growth next year from 2.25% to 2.0%. It revised down the estimate for household spending growth for this year from a pathetic 0.5% in the Myefo figures to a truly scary 0.25%.

We are not spending. There is no sense whatsoever of too much demand from people. We are in effect not adding much to the economy at all.

That is dire.

In that context, and the mere 2% consumption growth forecast for next year, the increased public demand next year is well designed – austerity and a bigger surplus would have been to aim for lower inflation by way of a recession.

This weakness in the economy also reminds us that the fears about the “government fuelling inflation” is code for wanting more people to be unemployed.

Similarly, the worries that the Future Made in Australia policy is about killing off the private sector and committing to major government intervention are unfounded. Overwhelmingly the forecast spending on this policy is through tax incentives all contingent on companies investing in the first place.

Whether or not this is the last budget before the election, the government has kept a fair bit up its sleeve. Nearly 40% (or $5.75bn) of the new spending in 2025-26 and 2026-27 in this budget remains “not yet announced”.

So we wait for the announcement not only of the election, but also this new spending.

Between the Lines Newsletter

The biggest stories and the best analysis from the team at the Australia Institute, delivered to your inbox every fortnight.

You might also like

5 ways and 63 billion reasons to improve Australia’s tax system

With a federal election just around the corner, new analysis from The Australia Institute reveals 63 billion reasons why our next Parliament should improve the nation’s tax system.

A Budget that does no harm (sort of)

This “wimpy” budget tells us one thing: the election campaign is here.

Business groups want the government to overhaul the tax system? Excellent – we have some ideas.

The landslide win by the ALP has seen business groups come out demanding the government listen to their demands despite having provided them no support, and plenty of opposition, over the past 3 years.