Australia’s biggest tax break: Capital Gains Exemption

The single largest tax concession in the revenue strapped Australian Federal Budget is the Capital Gains Tax (CGT) exemption on the primary residence. The exemption forgoes $46 billion annually – a greater sum than the government spends on the Age Pension, Defence or Medicare.

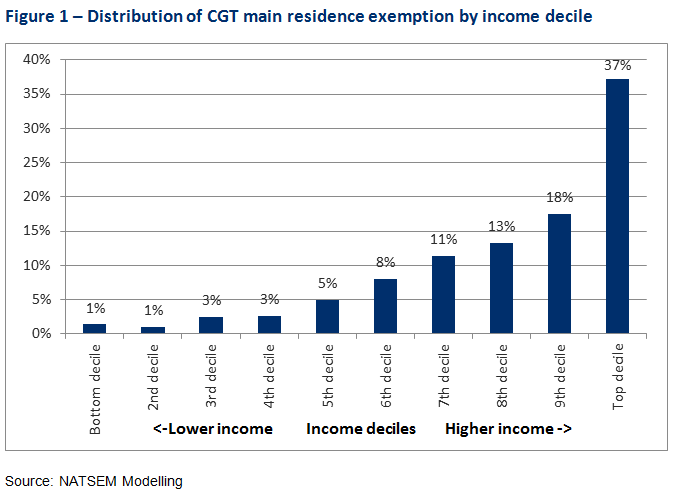

A new report by The Australia Institute, with modelling commissioned from NATSEM, also reveals that the top 20% of income by household reap more than half of the benefit of the CGT exemption (see figure 1 below).

Full report available – see attachement below.

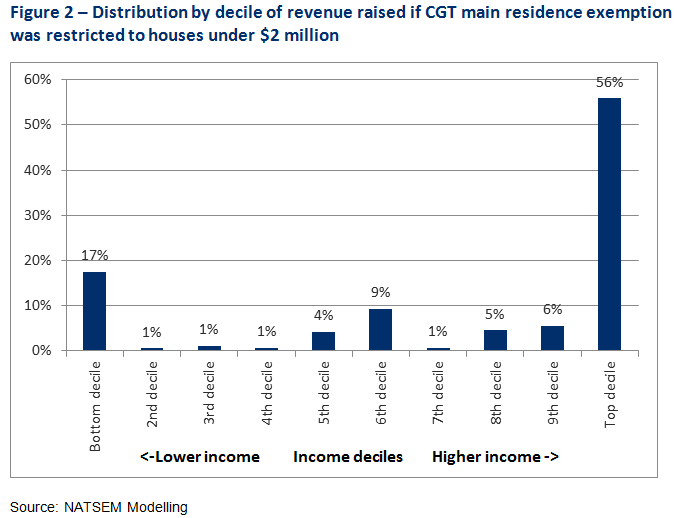

The report also models ending the exemption for houses worth more than $2 million, which despite making up less than 1% of Australian properties, would still draw an estimated $11.8 billion in new revenue over 4 years.

“The CGT exemption is costing the budget a fortune; $46 billion a year and rising – more than Australia’s entire defence budget,” Executive Director of The Australia Institute, Ben Oquist said.

“The primary house tax exemption was raised at the Australian Financial Review/Australian Newspaper Reform Summit in 2015. We’ve now done the work to put the numbers behind the idea.

“Along with superannuation, capital gains should be a target for any serious tax reform in 2016. Limiting CGT exemption to houses under $2 million would be good for the budget, the economy, and equity in Australia,” Oquist said.

“Any Treasurer who is fair dinkum about reducing the deficit must admit that the Capital Gains Tax exemption is a massive cost to the budget,” Senior Economist at The Australia Institute and report author, Matt Grudnoff said.

“Additionally, the benefits of the exemption are extremely inequitable, with the 87 per cent of the benefit going to top half of the income scale.

“The modelling we’ve done shows that the revenue problem can be addressed in a progressive way and that CGT exemptions are an enormous burden for the budget,” Grudnoff said.

Related documents

Related research

General Enquiries

Emily Bird Office Manager

Media Enquiries

Glenn Connley Senior Media Advisor