Australia’s Tax Concession System Stacked Against Women

New economic modelling commissioned by the Australia Institute from the Centre for Social Research and Methods, shows that four tax concessions: negative gearing, superannuation tax concessions, capital gain tax discount and refunding excess franking credits, cost the Federal Budget $60 billion per year; and for every dollar that goes to women, two dollars goes to men.

Key Findings:

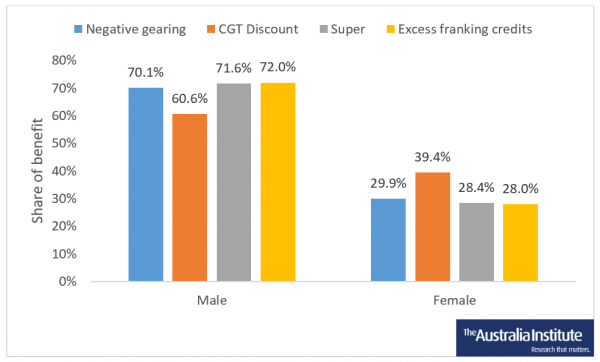

- Analysing the gender distribution of the benefit of these tax concessions find that for three tax concessions: negative gearing, superannuation tax concessions and excess franking credits, for every dollar which goes to women, more than two dollars goes to men. Meanwhile, for every dollar of the capital gains tax discount that goes to women, $1.50 goes to men.

- These four tax concessions: negative gearing, superannuation tax concessions, capital gain tax discount and excess franking credits cost $60.1 billion per year; $42 billion of the benefit goes to men, while $18 billion go to women. Men receive $24 billion more of the benefit than women per year.

- Furthermore, the research shows that even accounting for the increased share in income tax paid by men compared to women due to having higher average incomes than women, that men still receive an oversized benefit of these tax concessions.

- Analysing the income distribution of the benefit of these tax concessions finds that the top 10% most wealthy receive 41% of the benefit ($24.7 billion per year), while the bottom 50% of Australians get only 18% ($11 billion per year).

“The way the economy is designed is stacked against women every step of the way. Gender pay gap, childcare, superannuation, and our research shows even Australia’s system of tax concessions are stacked against women,” said Eliza Littleton, research economist at the Australia Institute.

“Even accounting for the proportion of tax paid by men compared to women, our analysis shows that men receive an oversized benefit from these tax concessions. Just from these four tax concessions, every year wealthy men receive an extra $24 billion dollars more than women – further entrenching inequality,” Ms Littleton said.

“Reforming the superannuation system and closing tax loopholes would go a long way to improving the economic divide between men and women in Australia,” said Matt Grudnoff, senior economist at the Australia Institute.

“Wealthy people have worked out that tax concessions are a great loophole to avoid paying tax. We need to close these tax loopholes in order to address inequality in Australia,” Mr Grudnoff said.

Related research

General Enquiries

Emily Bird Office Manager

Media Enquiries

David Barnott-Clement Media Advisor