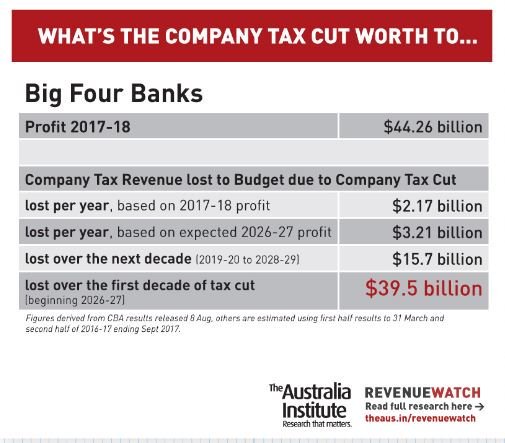

Big Four Banks

New analysis by The Australia Institute shows that based on the big four banks’ reporting, the company tax cut would be a $39.49 billion gift over the first decade of the cut to just these four companies.

|

Big Four Banks |

$ million |

|

Profit 2017-18 |

44,262 |

|

Benefit from company tax cut based on 2017-18 profit |

2,173 |

|

Benefit from company tax cut based on expected 2026-27 profit |

3,214 |

|

Benefit from company tax cut for next decade 2019-20 to 2028-29 |

15,715 |

|

Benefit from company tax cut for decade beginning 2026-27 |

39,489 |

The big four banks’ profits use CBA results released 8 Aug 2018. The others are estimated by using the first half results to 31 March and the second half of 2016-17 ending September 2017.

When the full cuts come in (2026-27) the lost company tax revenue just to these four companies would be the equivalent of employing 43,522 nurses, 39,214 school teachers or 32,499 police officers.

(Based on the average payments for different occupations in May 2016 and updating for the actual and projected wage price index, and projecting forward the big four banks’ profits.)

Between the Lines Newsletter

The biggest stories and the best analysis from the team at the Australia Institute, delivered to your inbox every fortnight.

You might also like

10 reasons why Australia does not need company tax cuts

1/ Giving business billions of dollars in tax cuts means starving schools, hospitals and other services. Giving business billions of dollars in tax cuts means billions of dollars less for services like schools and hospitals. If Australia cut company tax from 30% to 25% this would give business about $20 billion in its first year,

5 ways and 63 billion reasons to improve Australia’s tax system

With a federal election just around the corner, new analysis from The Australia Institute reveals 63 billion reasons why our next Parliament should improve the nation’s tax system.

Business groups want the government to overhaul the tax system? Excellent – we have some ideas.

The landslide win by the ALP has seen business groups come out demanding the government listen to their demands despite having provided them no support, and plenty of opposition, over the past 3 years.