Business groups want the government to overhaul the tax system? Excellent – we have some ideas.

The landslide win by the ALP has seen business groups come out demanding the government listen to their demands despite having provided them no support, and plenty of opposition, over the past 3 years.

On the weekend, the AFR reported that “business chiefs called on Labor to prioritise a productivity agenda, which included unwinding or relaxing its industrial relations agenda from the first term, overhauling the tax system and removing regulatory barriers.”

It is hardly a shock that the groups who think the economy is just profits would dislike any industrial relations regime that provides employees with a chance to bargain for a higher wage and better conditions, and also want to remove regulatory barriers that might prevent even more environmental destruction than is already occurring.

But overhauling the tax system? On this, we agree!

So, let’s get to it.

First, however, let us establish sound ground rules – facts matter

1.Australia IS a low-taxing nation.

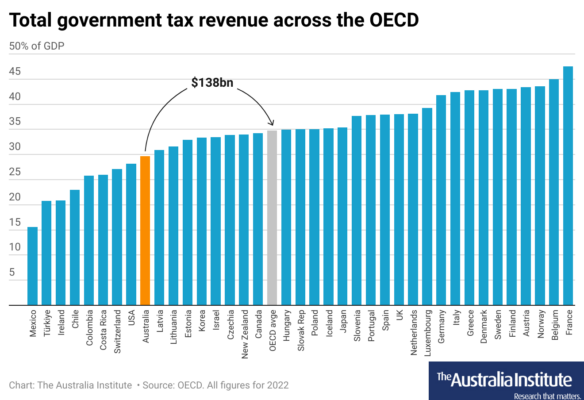

On the most recent figures, Australia has the ninth lowest level of tax among advanced economies in the OECD. In 2022, Australia’s tax revenue was worth 29.7% of GDP compared to the average across the OECD of 34.8% of GDP. That difference is equivalent to an extra $138bn more tax revenue.

Australians have shown that they favour a strong public sector – we need the revenue to deliver that

2. Australia has an average income tax rate.

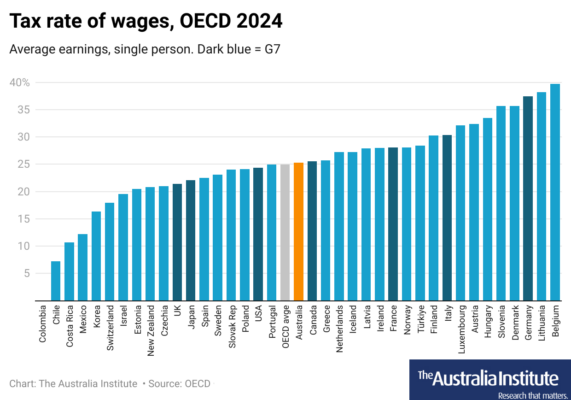

Those business groups now arguing for an overhaul of the tax system have for many years claimed that Australia is too dependent on income tax and that our level of income tax is stifling ambition.

We have regularly shown that to be false. Now, somewhat surprisingly, the Financial Review agrees. Reporting on a recent OECD report, the AFR noted “Australia was broadly in line with the OECD average of a 25 per cent total tax on wages, the Taxing Wages 2025 report showed.”

3. Australia is a great place to invest

Business groups always argue that higher company tax rates will drive away investment. But that always ignores that our major foreign investment is in mining. The iron ore, the coal, and the gas are here. Gas companies cannot move their operations to another country with a lower tax rate. Australia has the gas.

We also have the infrastructure, the stable government, strong laws, an educated workforce and closeness to Asian markets, which are all considered by companies when choosing to invest here. The most recent annual survey of mining companies by the Canadian Fraser Institute rated Western Australia the 4th best out of 86 places in the world to invest.

The Queensland state government showed business threats were just a bluff when it raised the coal royalty in the state. As our research found, the number of coal mines in Queensland increased after the coal royalty was raised.

The truth is such things don’t kill investment – they just deliver a fairer return to Australians.

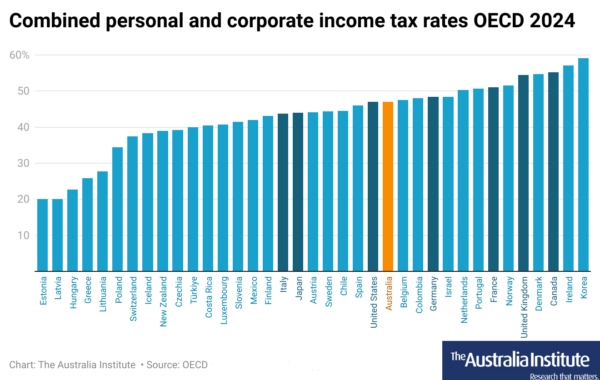

Also, lowering the tax system would not benefit Australians – it would just lower the tax foreign investors would pay. Due to dividend imputation a company tax rate would not change the level of tax Australian investors would pay. Currently, Australians pay the same rate of tax on Australian investments as Americans pay for American investments. Cutting the tax rate suggests that Americans should pay a lower tax for investing in Australia than they do for investing in America!

Raising revenue right

But we do agree with business groups that Australia needs to overhaul its tax system.

Prior to the election, we released our “Raising Revenue Right” paper that recommended changes to the tax system that would deliver a fairer and better Australia.

We showed that by cutting fossil fuel subsidies, ending the gas industry’s free ride, reforming capital gains tax and negative gearing and closing tax loopholes for superannuation and luxury utes, Treasury would raise between $12 billion and $63 billion.

These were quite conservative suggestions.

But the business groups are right – for an overhaul of the tax system, we need more.

We should tax more the things we want less of. We should have a tax system that works to reduce inequality and delivers a fair return to Australians.

Big Gas is taking the piss

Most LNG projects do not pay any royalties on their gas, and currently, no LNG export project has paid a dollar of Petroleum Resources Rent Tax. We are constantly told that if this were to change, companies would stop investing in Australian gas.

Are they threatening us with a good time?

Currently, foreign gas companies come here, extract our gas for free, pay little tax, employ few people and sell it for massive profits to foreign countries such as Japan, who then on-sell the gas.

Is this really what we are worried about losing?

Currently, as well, Australia’s tax system fails to properly tax company super profits, works to increase wealth inequality, while also distorting the housing market, and actively encourages behaviour that damages our environment, such as the use of plastics and purchase of big dumb utes.

These should be addressed in any overhaul of the tax system.

Other changes needed

Australia has no wealth tax. A recent report by David Richardson noted that Norway for example a wealth tax is assessed on global net worth, and imposed at 0.7% on wealth exceeding NOK 1.7m (about A$238,000). Australia could do the same – for example, setting a tax on wealth over $3m.

Australia could also broaden its tax base by tightening the use of deductions and exemptions. It is well known that companies use a generous loss deduction system, complex transfer pricing, and offshoring of operations to low-tax jurisdictions to avoid and reduce their tax. The closing of any of these practices needs to occur before any discussion of a lower company tax rate can be considered.

Several proponents of tax reform suggest the GST needs to be changed. Too often, the talk is of raising the rate, which will only serve to regressively hurt those on low-middle incomes. Rather, we could broaden the rate by including private education fees and private health fees and insurance.

Such measures would be progressive and, according to the latest tax and expenditures statement, would raise an extra $10bn in revenue, all of which could go to improving our public health and education systems, or pay some of the around $13bn cost of including dental in Medicare.

So yes, the tax system should be overhauled. But no one needs to listen to the demands of those groups whose views were soundly rejected by voters on the weekend.

Australian voters showed they want a progressive Australia with a strong public sector and where companies pay their fair share.

With its majority, the Albanese government has a great opportunity to deliver a fairer Australia – and now is the time to take it.

Between the Lines Newsletter

The biggest stories and the best analysis from the team at the Australia Institute, delivered to your inbox every fortnight.

You might also like

5 ways and 63 billion reasons to improve Australia’s tax system

With a federal election just around the corner, new analysis from The Australia Institute reveals 63 billion reasons why our next Parliament should improve the nation’s tax system.

If business groups had their way, workers on the minimum wage would now be $160 a week worse off

Had the Fair Work Commission taken the advice of business groups, Australia lowest paid would now earn $160 less a week.

10 reasons why Australia does not need company tax cuts

1/ Giving business billions of dollars in tax cuts means starving schools, hospitals and other services. Giving business billions of dollars in tax cuts means billions of dollars less for services like schools and hospitals. If Australia cut company tax from 30% to 25% this would give business about $20 billion in its first year,