Cut tax and increase revenue? > Check the facts

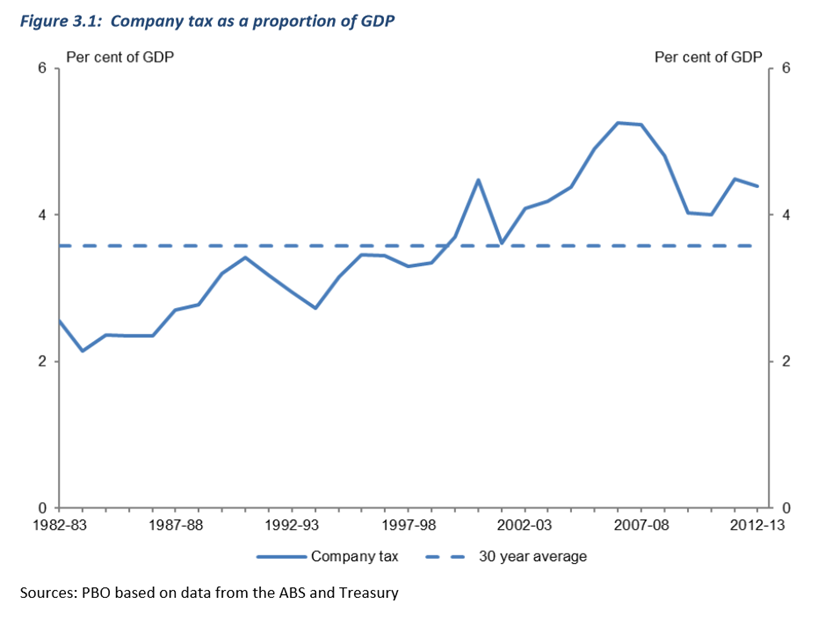

Senator Day claimed on Sky News that: “evidence from around the world is that if you want more revenue, and I’m not suggesting we give them any more revenue, but if they want more revenue, they should lower taxes and not increase them.” [15 August 2014] Day has previously cited examples to support this theory from Sweden, the USA, Russia, and Australia. In each of his examples, Day uses a different standard to determine success (e.g. an increase as a proportion of GDP and in absolute terms; personal income tax and corporate tax, etc.). Here, we focus on corporate tax rates. Governments do not increase their revenue by lowering taxes unless taxes were exceptionally high to begin with. Australia’s company tax rate is low relative to the OECD weighted average. A study of the tax rates of 12 OECD countries found that Sweden was the only example where tax revenue should increase by cutting the corporate tax rate, as company tax was set at 60 per cent, nearly double the OECD average. Day does not mention the other 11 countries. Russia’s introduction of a flat 13 per cent corporate tax rate reduced tax evasion. Revenue increased due to a crackdown on under-reporting. An IMF report found no corresponding productivity increase, showing that cutting company tax rates did not generate additional investment or activity. Australia’s company tax rate was reduced in 2001 from 34 to 30 per cent. Company tax as a percentage of GDP fell in the year following the tax cut, but it is impossible to determine whether this was as a result of the change to company tax rate. Revenue also fell in 2009-10 without any change to the company tax rate. Company tax receipts are volatile being affected by many variables, including the global economic environment. For this reason, one cannot directly deduce that any change to company tax receipts is a result of changes to the company tax rate. Nevertheless, as the graph below shows, company tax as a proportion of GDP has been increasing for 30 years, before and after the 2001 cut.  The Coalition Government estimates that a 1.5 per cent cut in the company tax rate will mean $5 billion less tax revenue collected, not more, as Day’s claim would suggest. Australia’s economic growth, which improves tax revenue, is not promoted by cuts to company tax rates. Since 2001 unemployment has averaged 5.2 per cent despite a 30 per cent company tax rate. Between 1950 and 1987, to contrast, when the company tax rate was 45 to 49 per cent, the average unemployment rate was 3.3 per cent. Similarly, real economic growth averaged 3.8 per cent between 1960 and 1987 but fell to 3.1 per cent in the period since 2001.

The Coalition Government estimates that a 1.5 per cent cut in the company tax rate will mean $5 billion less tax revenue collected, not more, as Day’s claim would suggest. Australia’s economic growth, which improves tax revenue, is not promoted by cuts to company tax rates. Since 2001 unemployment has averaged 5.2 per cent despite a 30 per cent company tax rate. Between 1950 and 1987, to contrast, when the company tax rate was 45 to 49 per cent, the average unemployment rate was 3.3 per cent. Similarly, real economic growth averaged 3.8 per cent between 1960 and 1987 but fell to 3.1 per cent in the period since 2001.

Between the Lines Newsletter

The biggest stories and the best analysis from the team at the Australia Institute, delivered to your inbox every fortnight.

You might also like

5 ways and 63 billion reasons to improve Australia’s tax system

With a federal election just around the corner, new analysis from The Australia Institute reveals 63 billion reasons why our next Parliament should improve the nation’s tax system.

10 reasons why Australia does not need company tax cuts

1/ Giving business billions of dollars in tax cuts means starving schools, hospitals and other services. Giving business billions of dollars in tax cuts means billions of dollars less for services like schools and hospitals. If Australia cut company tax from 30% to 25% this would give business about $20 billion in its first year,

Business groups want the government to overhaul the tax system? Excellent – we have some ideas.

The landslide win by the ALP has seen business groups come out demanding the government listen to their demands despite having provided them no support, and plenty of opposition, over the past 3 years.