Deficits and debt: International comparisons

Budget time always brings discussion of deficits and debts. Claims are often exaggerated and almost always presented without context. Here we compare Australia’s budget deficit and public debt to other developed countries.

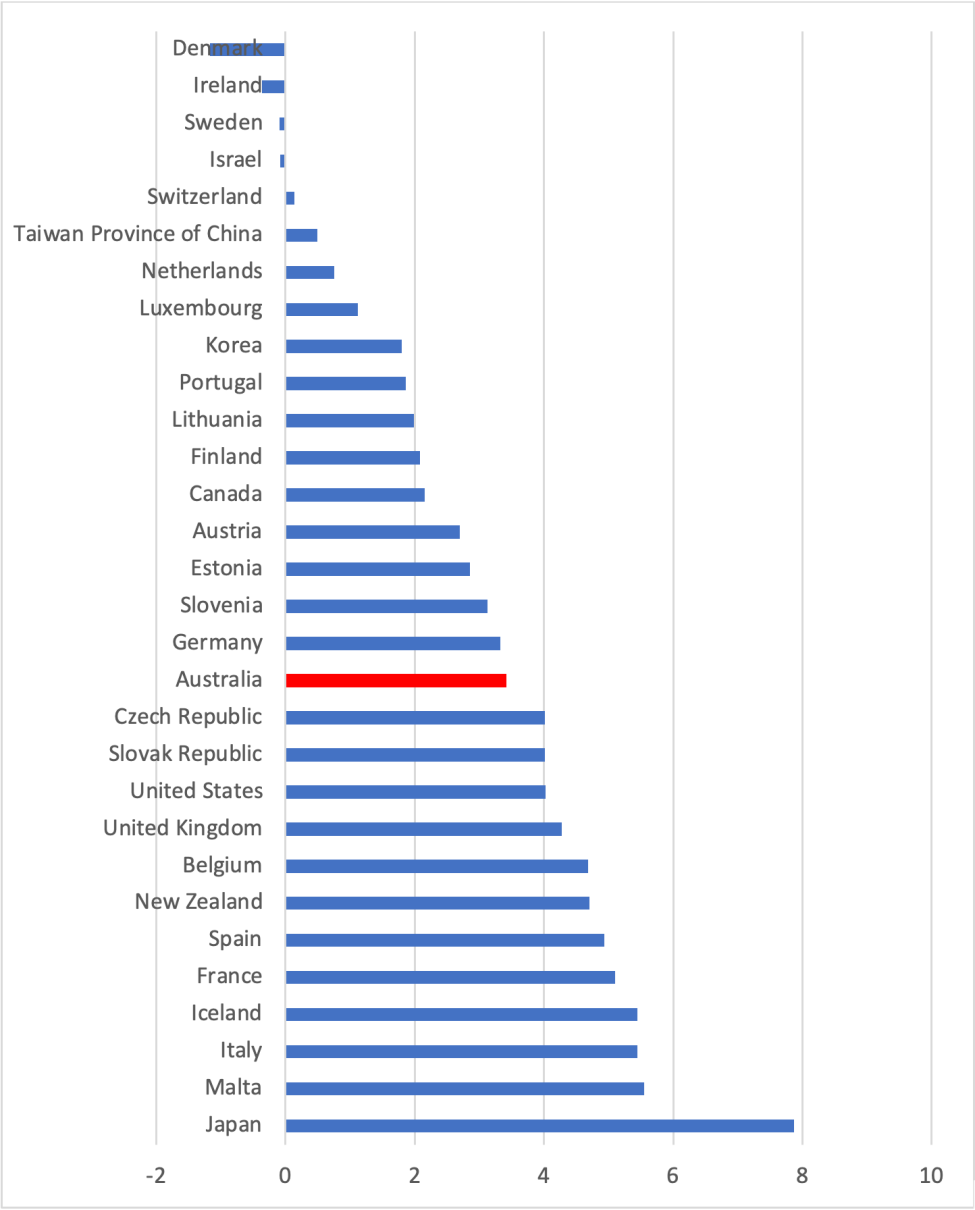

Figure 1 gives Australia’s federal budget deficit figure as a percent of GDP and compares it with other advanced countries as defined by the International Monetary Fund (IMF). Australia comes in the middle of the pack:

Figure 1 suggests Australia’s experience is close to that of comparable countries, even though the figure used by the IMF, 3.4 per cent of GDP, is larger than that announced in the budget, at 1.5 per cent of GDP.

Note that the Australian data in Figure 1 is for calendar year 2022 and not comparable with the figures from the revised 2022-23 budget, however this would not materially change the result. Note too that Figure 1 plots deficits, giving most countries in the chart a positive result. If we had plotted budget balance the figures would have been negative – a positive deficit is a negative balance. One country was removed from the IMF data set – Norway. With a budget surplus of 20.3 per cent of GDP, including Norway would have distorted the graph.

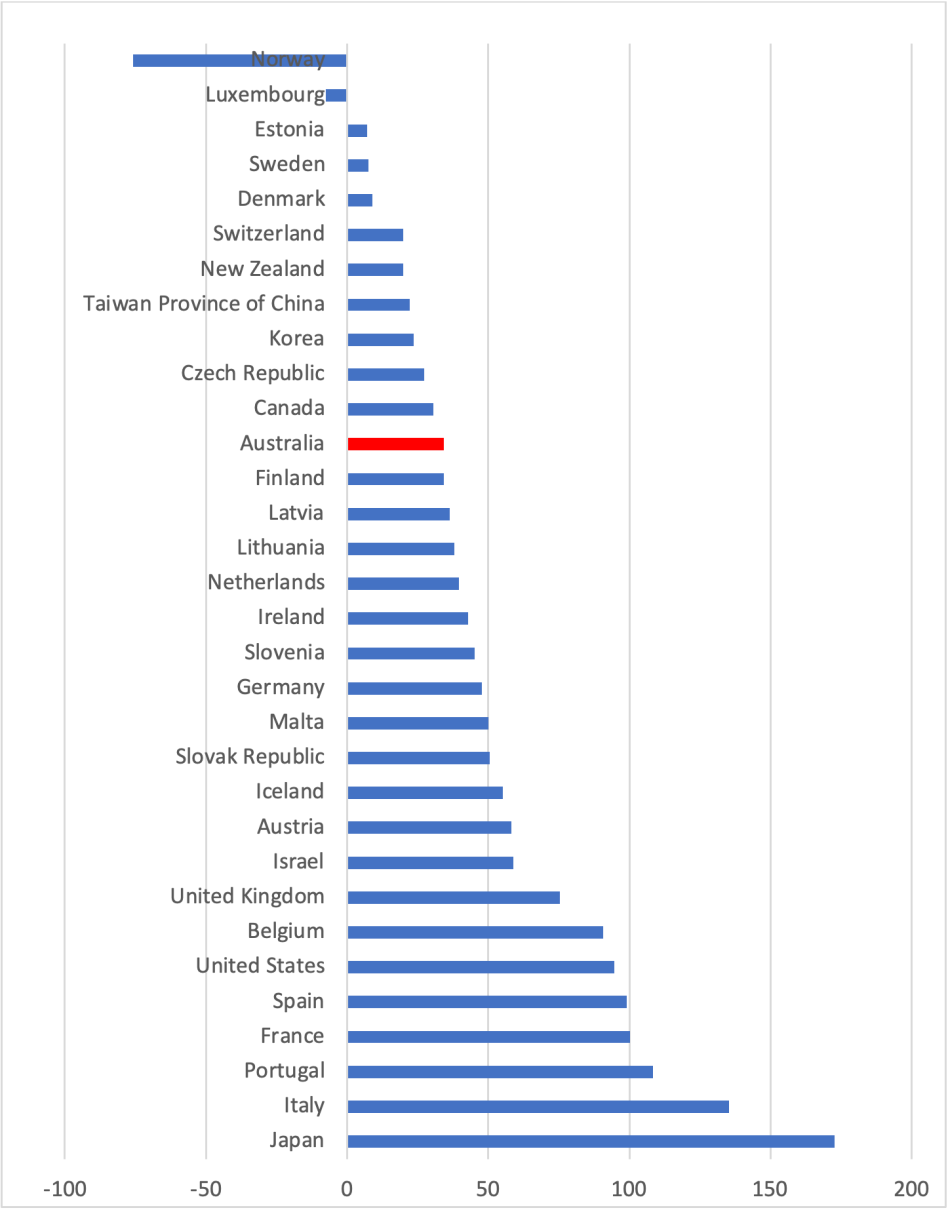

Government budget deficits add to government debt, which in a sense can be thought of as the cumulative result of all previous deficits and surpluses. Figure 2 compares Australia’s public debt with those of other advanced countries. Again, Australia’s situation is modest compared with other advanced countries.

Note that these figures are net debt which is lower than the gross amount of debt, mainly government securities on issue. To get net debt we deduct financial assets held by the government. A lot of those financial assets are held by the Future Fund for example. This is just like an individual who may have bank card debt but have some money in a transaction account. The net debt is lower than suggested by the bank card debt.