Federal funding for private schools

In 2024, the Commonwealth Government will spend an estimated $29.1 billion on schools in Australia. More than half of this – $17.8 billion – will go to private schools.

It is no wonder then, that state and territory governments are calling for increases to federal contributions.

With school funding in the spotlight, now is a good time to consider how the Commonwealth Government could best spend its education budget.

In addition to charging tuition fees and receiving public funding to operate, private schools are eligible for tax concessions on any money donated to their building funds. This means that most of the construction private schools do is tax-deductible – as long as the building can be considered educational.

When you think of what buildings and facilities are necessary for children to complete the national curriculum, you might think of a library, a classroom, or a science lab. These buildings have unambiguous educational benefits – schools cannot really function without them, and they are commonplace in both public and private schools. But this does not stop private schools from using their tax-deductible building funds to build boatsheds, rifle ranges, hypoxic chambers, grandstands, orchestra pits, cafes for students, indoor swimming pools, and on-site physiotherapy clinics.

From polling conducted by the Australia Institute, we can say that most Australians do not think this kind of extra-curricular expenditure deserves tax deductions. The only kinds of buildings that the majority of Australians (3 in 4) think should be eligible for a tax deduction are libraries (76%), classrooms (74%), and science labs (73%).

If the public does not support giving tax deductions for private schools to build new facilities unless they have a clear educational benefit, then the tax deductibility status given to school building funds needs to be re-examined. Indeed, a 2023 Productivity Commission inquiry found that giving deductible gift receipt status to private school building funds is an ineffective use of government support, unless there is an explicit equity objective. There is no reason that private schools couldn’t continue to ask for donations for whatever kind of building they might like, but the taxpayer shouldn’t be helping to pay. Removing these tax subsidies would help support equity in school funding, instead of undermining it.

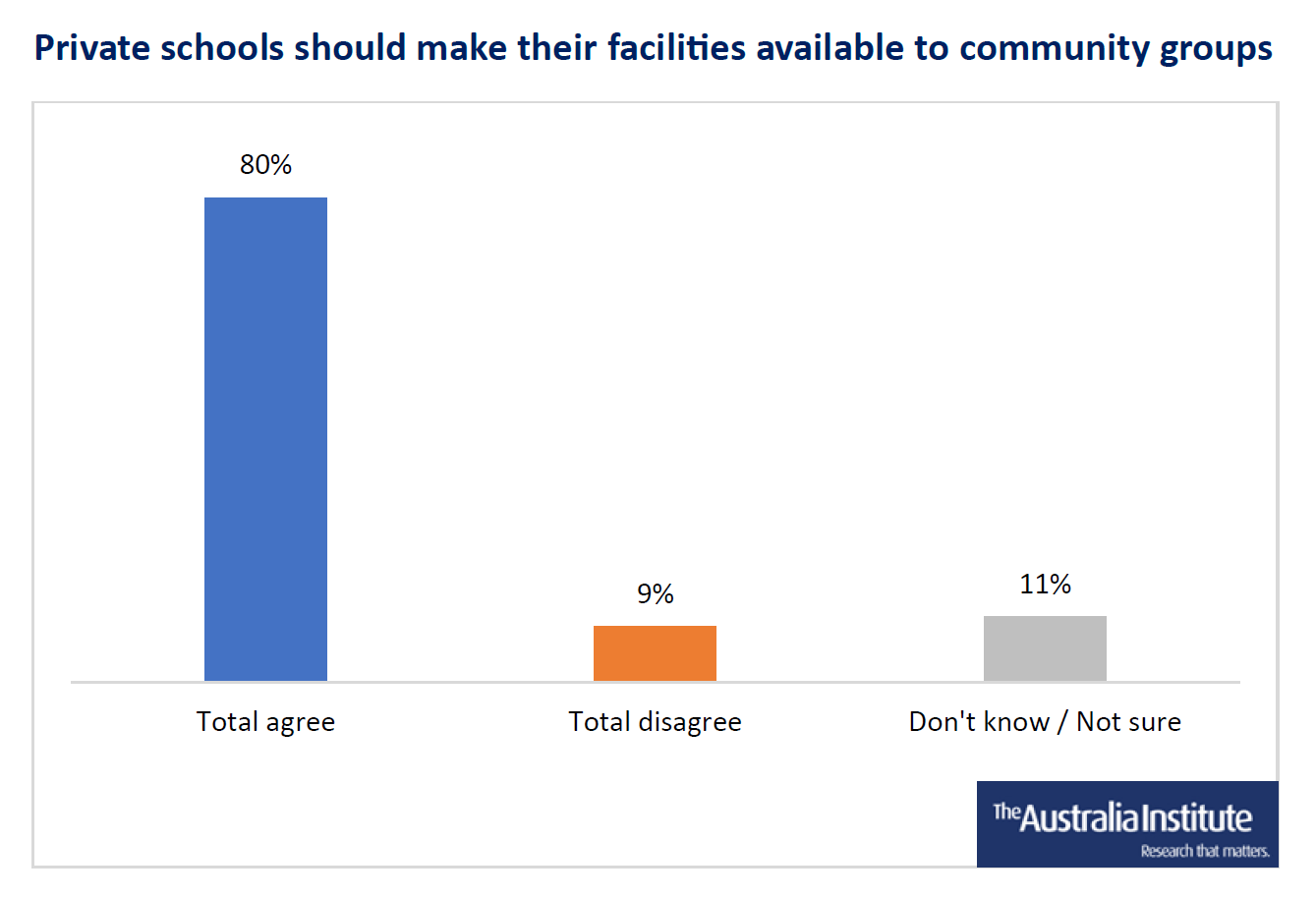

Another idea that could help ensure more public benefit comes from the tax concessions given to private schools would be to require private schools to make their facilities available for community groups to use outside of school hours. Australia Institute polling shows that this is an idea with which an overwhelming majority of Australians (80%) agree.

Read more about funding a fairer education system.

Between the Lines Newsletter

The biggest stories and the best analysis from the team at the Australia Institute, delivered to your inbox every fortnight.

You might also like

Australian high schools the most expensive in the world – new research

As the 2026 school year gets underway, new research by The Australia Institute reveals that Australia is the most expensive place in the developed world for families to send a child to high school.

Private health insurance is for the rich – the rest would rather better public health

ATO figures show that private health insurance is favoured by the rich and it should be subject to GST