Gen Z Receive Only 2.8% of “Cooked” Stage 3 Tax Cuts in First Year: Research

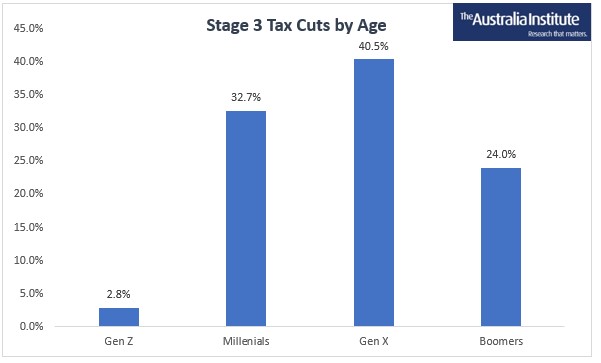

New research has revealed that Gen Z would receive only 2.8% of the first year of the Stage 3 Tax Cuts legislated by the Morrison Government.

The newly released age-based data break down reveals that in financial year 2024-2025, those under 25 years old would receive only 2.8% of the billions in tax cuts which primarily go to older, higher income earners.

The controversial Stage 3 tax cuts will cost the budget $244 billion over 10 years, and $17.7b in their first year and have been subject to criticism from economists, the former head of the Reserve Bank of Australia Bernie Fraser, politicians and unions.

“The Stage 3 Tax cuts are economically reckless and unfair. This is particularly true for young people who will only receive 2.8% of the benefit in the first year of operation, despite making up 12.7% of taxpayers,” said Eliza Littleton, Research Economist at the Australia Institute.

“No matter how you dissect Scott Morrison’s Stage 3 tax cuts – whether by age, gender or income – they disproportionately go to those who need them the least, with around 50% going to people earning over $180K per year, mostly older men.

“While young people will not benefit much at all from the $244 billion tax cuts for high income earners, we could be investing that money to help young people by investing in education, health, housing, wage increases and nation-building services to reduce the cost of living.

“Basically, from an age perspective, the Stage 3 tax cuts are cooked.”

Summary on Stage 3 tax cuts:

- Will cost the budget around a quarter of a trillion dollars

- Australia Institute tracking polls shows the more people learn about Stage 3 the more likely they are to support its repeal

- Will hand $9,075 to the highest income earners while giving $0 to those on the minimum wage

- Represent a huge opportunity cost for investment in the future

- Will give occupations like CEOs of large corporations, surgeons, and federal politicians a $9,075 a year tax cut. While aged care workers, hairdressers, and café workers will get nothing.

- Men will get twice as much of the tax cut as women. Half will go to the top 10%, 72% going to the top 20% while the bottom half get only 5% and the bottom 20% get nothing.

- In their first year, Stage 3 will cost more ($17.7b) than the entire Pharmaceutical Benefits Scheme (PBS = $16.4b)

- Will permanently make our tax system less progressive by removing an entire income tax bracket.

- Only 2.8% of the tax cut goes to Gen Z in the first year.

General Enquiries

Emily Bird Office Manager

Media Enquiries

David Barnott-Clement Media Advisor