House prices after a brief fall in 2022 rose consistently during 2023 and housing affordability is now as bad as ever

In 2023 dwelling prices rose on average nearly 5% – well ahead of wages and household incomes. It means prospective house buyers now find themselves looking back with envy at 2020, which is a truly horrifying statement to write given 2020 was already terrible!

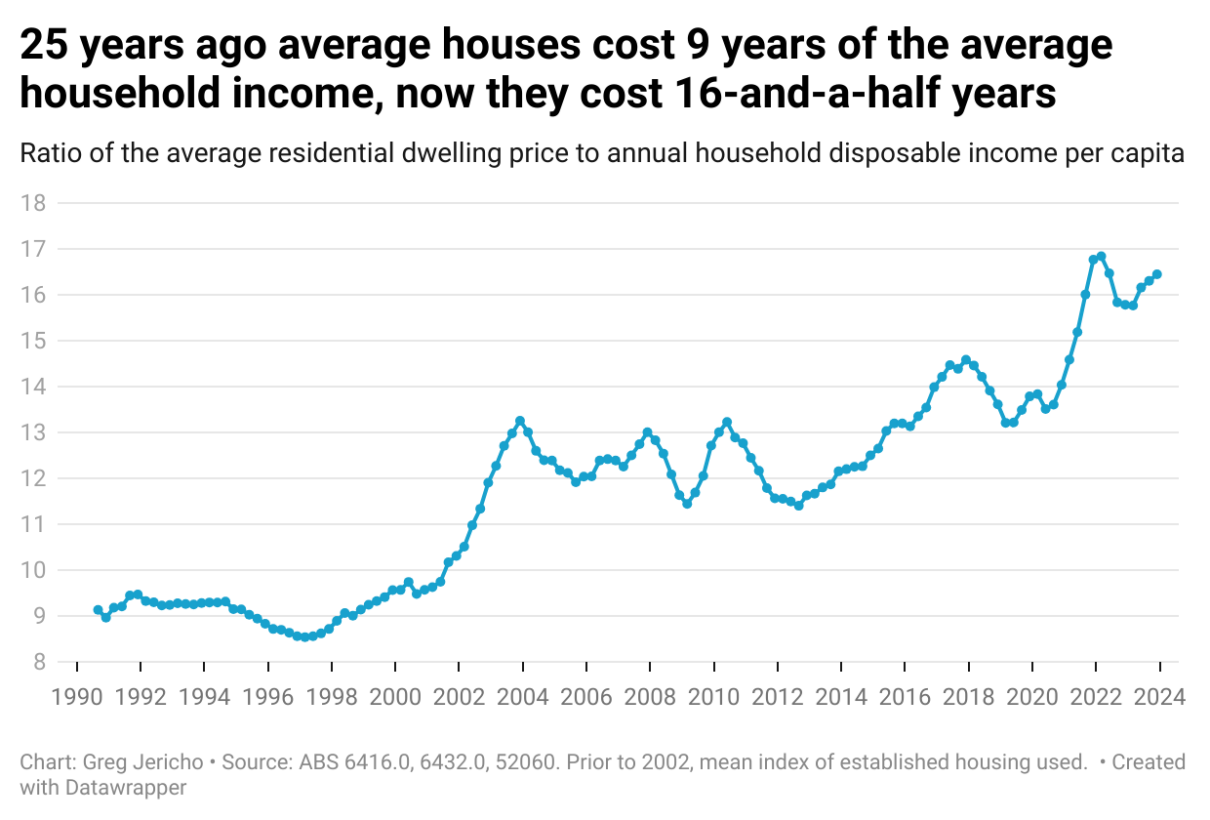

One of the best ways to examine the cost of buying a house is to compare the average dwelling price over the past 30 years with that of the household disposable income per capita. This in effect gives us a measure of how many years’ worth of average income an average dwelling is worth.

In 1990 and through the entirety of the decade that followed, the average dwelling across Australia was worth around 9.5 times that of annual household income per capita.

But then in 2000 the government introduced the 50% capital gains discount which combined with negative gearing made housing speculation very profitable. This was then followed by the introduction and soon doubling of the First Home Owner Grant which likewise served only to spur demand for housing.

This set fire to the housing market and destroyed affordability.

By 2020 rather than being 9.5 times the average household income dwelling prices were 13.5 times. Alas that now looks like a good time.

In December last year the average dwelling in Australia cost 16.4 times that of household income per capita. That increase in the ratio is the equivalent of an extra $167,000 in the price of a dwelling – or roughly an extra$33,000 on a 20% deposit.

Housing affordability is at such a crisis point that young Australians no longer need to look back very far to find a time to be envious of those who could afford to buy a home.

We must urgently and significantly increase the building of public housing, while also removing the distortions on the demand side – the 50% capital gains tax discount must be reduced as a priority to move the housing market away from being a speculative investment to one where those wishing to have a place to live are given the best change to do so.

Between the Lines Newsletter

The biggest stories and the best analysis from the team at the Australia Institute, delivered to your inbox every fortnight.

You might also like

Housing affordability crisis – Saving for a deposit forever

The dream of saving for a deposit on a house is now so far beyond most poeple that even if you have a high paying job, you still can never save enough.

Housing affordability to get worse as big corporates do annual tax magic

Renting a place to live is getting more expensive and house price rises are tipped to accelerate.

Is this growth…good?!

Rooftop solar and data centres are drivers of Australia’s economic growth, but do they really bring the same value to Australian society?