It’s not just mining – non-mining profits have also driven inflation

As the Reserve Bank continues to raise rates, it continues to misread the nature of inflation that is being driven largely by profits.

In May 2023, on ABC’s Q & A program, audience member Amy Brown cited our profits research when asking the panel of politicians when they’re going to “act on behalf” of the constituents who elected them, instead of corporations.

In response to our research revealing the impact of profits on inflation, the RBA has essentially argued that the increase in profits is all about the mining sector. Even more oddly, is suggests that mining profits don’t affect Australian prices. Australian households however know the reality – the cost of gas and electricity has risen sharply and similarly the cost of goods manufactured overseas from Australian resources has also soared. Steel used for construction for example, rose up to 67% in the 2 and half years from the end of 2019 to the middle of last year.

In an effort to demonstrate that non-mining profits have not risen extraordinarily, typically the RBA has used a graph showing non-mining profits stable as a share of TOTAL GDP. This was however misleading, due to the dramatic increase in the mining sector’s share of nominal GDP (up from 5% to 16% since 2002), and the corresponding erosion of non-mining private sector industries as a share of nominal GDP (down from 78% to 66% in the same time).

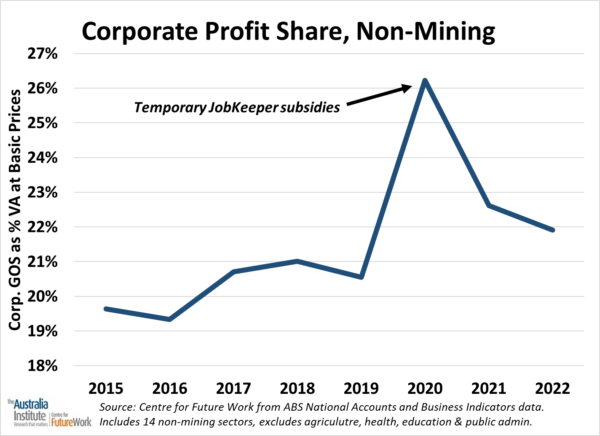

A more appropriate measure is to show non-mining profits as a share of NON-MINING GDP. Doing so demonstrates that while not to the same extreme as mining profits, non-mining profits have increased notably since the pandemic after trending upwards since 2016.

Non-mining profits surged in 2020 thanks to JobKeeper subsidies. After the elimination of those subsidies, profits declined but remain higher relative to total income, value added, and wages in the non-mining sector, compared to pre-COVID norms. Not only have non-mining companies in aggregate been able to fully pass on higher input costs arising from the super-profitable mining sector, but they have also increased their own margins at the same time – and this has contributed incrementally to the inflation experienced since then.

It is also worth noting that the ABS treatment of the finance sector is incomplete. Its data on profits (and GDP, for that matter) refers only to produced services from the finance sector, not their saving & lending business which accounts for most bank profits.

Given even the RBA and business groups acknowledge that finance profits have risen strongly during the pandemic and as interest rates have risen, this means the true growth in non-mining profits is larger than described above, once we include the bulk of bank profits.

There is of course variability in non-mining profits across different sectors, depending on their strategic location in the overall supply chain. Sectors which occupy ‘pinch points’ in the overall economy, and were hence able to leverage supply chain disruptions into excess profits, include especially manufacturing, transportation, and wholesale trade. Other sectors had less strategic power, and profits were not so strong.

We have always acknowledged that some sectors (including arts & recreation, and hospitality) have seen profits decline since the pandemic.

But to argue that profits have not played an oversized role in inflation is to suggest that Australian companies, despite the concentrated markets in which many operate, are not acting in a manner that economists acknowledge companies in the USA, UK and Europe have been.

Overall, our analysis is consistent with that of other global researchers (like Isabella Weber in the US) who have pointed to the structural and power determinants of excess profits since the pandemic, and have described the varying degrees of pass-through achieved by industries with differing degrees of structural or strategic power.

Related research

Between the Lines Newsletter

The biggest stories and the best analysis from the team at the Australia Institute, delivered to your inbox every fortnight.

You might also like

Corporate Profits Must Take Hit to Save Workers

Historically high corporate profits must take a hit if workers are to claw back real wage losses from the inflationary crisis, according to new research from the Australia Institute’s Centre for Future Work.

Opening statement to the ACTU Price Gouging Inquiry

This week Professor Allan Fels, the former head of the Australian Competition and Consumer Commission (ACCC), has begun an inquiry into price gouging across a range of industries, including banks, insurance companies, supermarkets, and energy providers. The inquiry commissioned by the ACTU comes off the back of the highest inflation in 30 years and the biggest falls in real wages on record.

Blame Game on Inflation has Only Just Begun

Every inflationary episode embodies a power struggle within society over who benefits from inflation, who loses out – and who will bear the cost of getting inflation back down.