Not All Taxes are Created Equal

New research released today by the Australia Institute outlines five sets of principles that will help evaluate the merits of different taxes. Taxation is the price we pay to live in a civilisation, however, with such a great number of tax possibilities, it is increasingly important to evaluate our taxation choices.

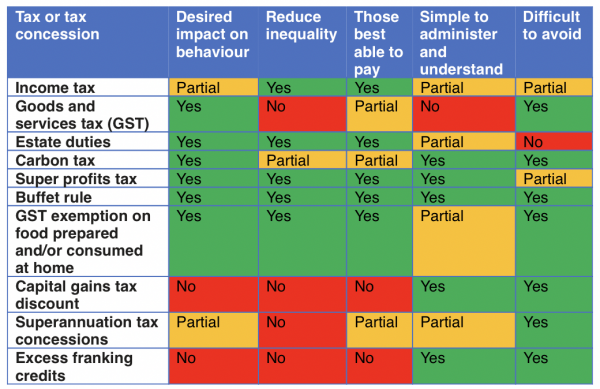

The new report sets out five principles that will help evaluate the strengths and weaknesses of different taxes:

- Principle 1 – The tax measure should minimise changes in behaviour, unless it is a behaviour is something that as a society we would like less of (e.g. smoking), in which case it should be effective at changing that behaviour

- Principle 2 – The tax measure should reduce inequality

- Principle 3 – The tax measure should be levelled on those who are best able to pay

- Principle 4 – The tax measure should be simple to comply with, simple to administer and easy to understand, and

- Principle 5 – The tax measure should be difficult for those it is levelled on, to avoid

“As the economy recovers from the pandemic, Australia will soon need to have a conversation about what we should tax and what the right amount of tax is,” said Matt Grudnoff, senior economist at the Australia Institute.

“While many are concerned about the size of our taxes, consideration must also be given to the shape of our taxes because as this research shows, not all tax measures are created equal.

“The tax debate is awash with the voices of the self-interested. What Australian policymakers need are solid tools to evaluate the pros and cons of different taxes, to sort the self-interest and ideology from the genuine constructive policy advice.

“Australia taxes wealth lightly compared to other OECD nations. With inequality in Australia only getting worse, we need a debate and better policies about taxing wealth properly and reducing inequality rather than exacerbating it.”

Related research

General Enquiries

Emily Bird Office Manager

Media Enquiries

Glenn Connley Senior Media Advisor