On Monday the Productivity Commission released its snapshot of inequality report.

As a “snapshot”, the report is just presenting the current situation rather than offering solutions. But unfortunately, it also perpetuates the lie that inequality and poverty is beyond our ability to fix.

It took only two paragraphs for warning bells to start ringing in my ears. On the opening page, the commission notes “the initial period of the pandemic saw an unprecedented fall in income inequality”. This of course did not happen by accident but “as a result of the significant increase in support payments from the Australian Government”.

These increases “included the Coronavirus Supplement, which was paid to income support recipients, such as those receiving JobSeeker and Youth Allowance”.

The budget reveals what governments actually care about. And Labor has chosen to keep jobseekers in poverty

Greg Jericho

All good so far. The government increased payments $550 a fortnight and it caused “an unprecedented fall in income inequality”.

But then comes the kicker.

The Productivity Commission states with a misguided certainty that only comes from a lifetime of adherence to the God of small government and market forces that these payments were “not fiscally sustainable in the long term”.

Excuse me?

Not fiscally sustainable? Sorry, but that is just flat out wrong. And irresponsibly so.

There is no budgetary or economic reason that makes increasing jobseeker (or other payments) by $550 “not fiscally sustainable”.

Let’s do some comparisons.

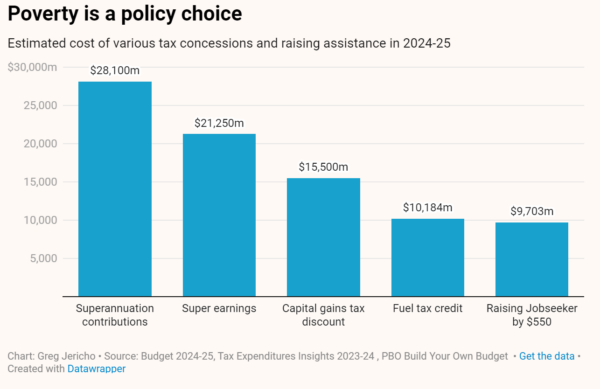

In 2024-25, the government is expected to forgo $28bn in revenue because of tax concessions on superannuation contributions, $15.2bn of which goes to the top 20% of income earners. The government will also forgo $21.3bn through tax concessions for superannuation earnings, $12.1bn of which goes to the top 20%.

I await the commission suggesting this is fiscally unsustainable.

Disposable income soared for richest Australians after pandemic began but went backwards for the rest, report says

t also costs the government $15.5bn to provide a 50% capital gains discount – and $13.6bn of that goes to the richest 20%. Fiscally unsustainable?

Next year the government has budgeted to provide $10.2bn in fuel tax credits, the vast majority of which goes to mining companies – hardly those who are doing it tough. But not fiscally unsustainable it seems.

So how much would it cost to raise jobseeker by $550 a fortnight?

Using the Parliamentary Budget Office’s build your own budget tool, we can calculate that it would cost about $9.7bn next year.

So let’s stop with the view that inequality cannot be improved.

We know how to do it. In 2020 the government chose to do it, and since then governments have chosen not to do it but have instead kept choosing to hand the richest 10% nearly $13bn a year in tax discounts on their profits when they sell their investment properties and the like.

This choice is even more stark given that the Productivity Commission’s report reveals that, while inequality fell during the pandemic, it has risen quickly since then.

Even taking into account the increased assistance during the pandemic, the richest 10% did the best over the three years from 2018-19 to 2021-22.

We see this as well in the measure of inequality known as the Gini coefficient. The level of inequality this century was lowest in 2020-21 during the pandemic, and in 2022-23 it hit the highest level:

Nothing about this is surprising. And we should never allow anyone to confuse us about why this is happening.

Inequality is reduced when those on low incomes get more (dare we say, appropriate) assistance.

Sign up for Guardian Australia’s free morning and afternoon email newsletters for your daily news roundup

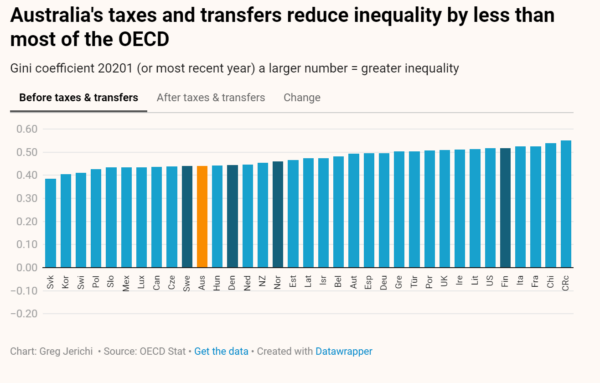

The Productivity Commission notes that “taxes and transfers significantly reduce inequality by equalising incomes across the distribution”. This is obvious across the entire world.

But Australia is one of the worst at doing it. Before taxes and transfers (things like jobseeker and the age pension), Australia is the 11th most equal economy among the OECD. But after taxes and transfers, when comparing actual household disposable incomes, Australia falls to the 20th most equal.

The tragedy is our tax and transfer system is actually very efficient at reducing poverty. But we just don’t do enough.

Or to be more accurate, the government chooses to not do enough.

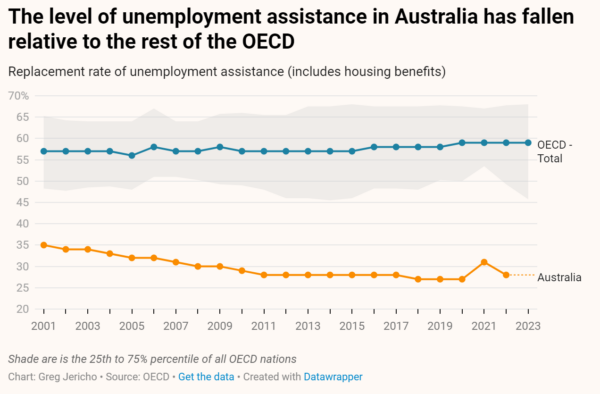

Remember that Australia has the lowest relative unemployment assistance of any nation in the OECD and increasing it by $550 a fortnight would not even get us to the OECD average:

And this is not a natural order of things – governments since around 1996 have chosen to make life relatively harder for the unemployed than in other rich economies:

The Productivity Commission’s snapshot is a welcome addition to the policy debate around inequality and poverty – it contains much needed inflation. After all you can’t improve what you don’t measure. But let us not pretend the solutions are unknown.

The government knows how to do it. The government did it in 2020. It worked.

Never fall for the line that reducing inequality or lifting people out of poverty is a task that is either too complex or costly for us to undertake.

Between the Lines Newsletter

The biggest stories and the best analysis from the team at the Australia Institute, delivered to your inbox every fortnight.

You might also like

How private job agencies are capturing welfare payments

New data shows that only one-in-nine jobseekers (11.7%) found long term employment via a job agency in the financial year ending in June 2025.

Shame and harm at every JobSeeker turn – and now with added AI slop

“Single JobSeeker [payment] just hit $400 a week. Let me know how you’d go if you were getting that little and were randomly not paid.” This comment, from the people behind Nobody Deserves Poverty, points to the ignored cruelty at the heart of one of Australia’s most shameful open secrets. The mutual obligations system –

The housing crisis is turning into an inequality crisis

The rising concentration of property and investment assets in the hands of wealthier Australians is making housing crisis worse and deepening economic divides.