Real wage falls and rate rises make for a double whammy

When you combine the increase in interest rates and falling real wages, you get a picture of households being hit two ways.

Tomorrow the Reserve Bank will consider whether to raise interest rates to 4.35%, which would make for 425 basis points worth of rises since May last year.

The reason for raising interest rates is to limit demand. This was the purpose behind raising interest rates in 2006-2008 during the mining boom when incomes were rising strongly.

But it is worth remembering when the RBA began raising rates in May 2006 real wages were rising strongly. Although real wage growth is good for workers, when combined with profligate government spending and income tax cuts, as we saw during that period, it can produce inflationary pressures that are countered by raised interest rates.

By contrast over the past 18 months, as the RBA has raised the cash rate 400 basis points, real wages have been falling.

This is important when we consider the impact of rate rises.

Rate rises serve to reduce disposable income as mortgage payments are effectively unavoidable payments that reduce after-tax income.

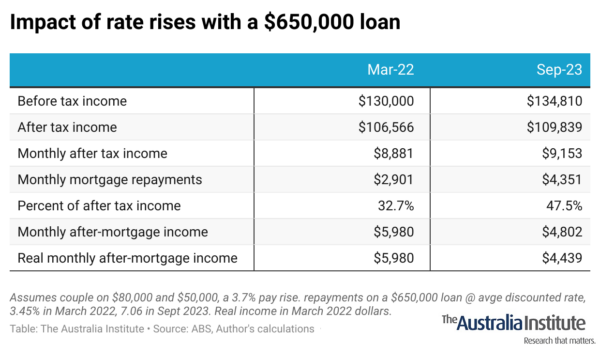

Consider a couple on a combined income of $130,000 ($80,000 and $50,000) in March 2022 with a $650,000 home loan, which was roughly the average new loan size across Australia at the time. Repayments at the average discount interest rates for home loans at the time of 3.45% were $2,901 a month. This left the couple with $5,980 left each month to spend on non-mortgage goods and services – or around 67% of their after-tax income.

If the couple both get a 3.7% wage rise (in keeping with the average wage price index growth in Mach 2023) their pre-tax income rises to $134,810. Because of bracket creep their after-tax income only increases 3.1% leaving them with $109,839. But the discounted interest rate is now 7.06%. That has raised their monthly repayments by $1,450 to $4,351.

That now leaves them with just $4,802 left to spend a month – a decline of 20%.

But importantly since March 2022 inflation has risen 8.2%.

This means in March 2022 terms, their after-tax and after-mortgage income has fallen to $4,439 – a fall of 26%.

The combination of falling real wages and rising interest rates is having a double impact on households.

It means that the Reserve Bank is not so much dampening demand from growing incomes as keeping households heads below water.

They should not raise interest rates tomorrow, and at the very least should wait until the next wage price index figures are released next week before making a decision on increasing rates at all.

Between the Lines Newsletter

The biggest stories and the best analysis from the team at the Australia Institute, delivered to your inbox every fortnight.

You might also like

The Wage Price Index shows pay packets are up. So why doesn’t it feel that way?

The latest figures from the Australian Bureau of Statistics show wages are growing at a reasonable rate, but a deeper look shows a big problem might be about to bite Australian workers.

If business groups had their way, workers on the minimum wage would now be $160 a week worse off

Had the Fair Work Commission taken the advice of business groups, Australia lowest paid would now earn $160 less a week.

Delayed RBA cut is welcome, but borrowers are still lagging

The RBA has cut interest rates – five weeks too late.