Stage 3 Better: A way for the government to deliver better, fairer tax cuts and save money

The Stage 3 tax cuts cost too much, deliver little benefit to those who need it, and leave Australia less fair. We propose 4 ways to make Stage 3 Better

The Stage 3 cuts due to come into effect in July 2024 are the most expensive and most inequitable tax cuts in Australia’s history. If they were listed as expenditure, they would be the ninth most expensive program item in the budget.

The Parliamentary Budget Office’s latest calculations estimate that over the first 10 years after the cuts come into effect, they will mean that the Federal Government will collect $320 billion less tax revenue than it would have done otherwise. In the first year alone, the cuts are estimated to cost $21 billion in foregone revenue. This is $1 billion less than the entire budget surplus for 2022–23, equal to the annual budgeted expenditure for financial support for People with Disability in 2024–25, and some $6 billion more than the amount budgeted for Job Seeker Income Support.

This might be justifiable were the Stage 3 tax cuts good policy that benefits a majority of Australians and set us up for the future.

In reality they deliver more then 70% of the benefit to the richest 20% of tax payers and cost so much that limits the ability for the government to respond to spending challenges due to rising costs and the need to move the economy to net zero.

Scrapping the Stage 3 tax cuts however is politically difficult. But rather than view the Stage 3 cuts as a burden, we argue the Albanese government should see them as an opportunity for them to deliver real tax reform than leave median and average income earner better off and the budget much more able to adapt to the challenges we face.

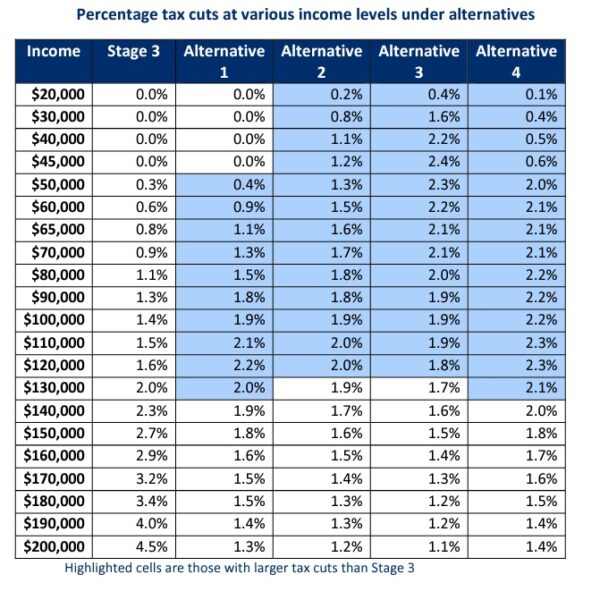

We propose 4 alternatives:

Alternative one

Reduce the 32.5% rate to 29% for people earning between $45,001 and $120,000

This would give the biggest tax cut to people on $120,000 or less (2.2%)

Everyone earning up to $130,700 would receive a larger tax cut (%) than under the existing Stage 3

Taxpayers would save $130 billion over a decade

Alternative two

Reduce the 19% tax rate for those earning between $18,201 and $45,000 to 17%, and lower the 32.5% tax rate for those earning between $45,001 and $120,000 to 30%

This would give the biggest cut to people on $120,000 or less (2%)

Everyone earning up to $127,600 would receive a larger tax cut (%) than under Stage 3 as it stands

Taxpayers would save $111 billion over a decade

Alternative three

Lower the 19% tax rate for those earning between $18,201 and $45,000 to 15%, and the 32.5% tax rate for those earning between $45,001 and $120,000 to 31%

This would give the biggest tax cut to those earning $45,000 (2.4%)

All taxpayers earning up to $124,600 receive a larger tax cut (%) than would be the case under Stage 3

Taxpayers would save $92 billion over a decade

Alternative four

Lower the 19% tax rate to 18%, raising the $45,000 threshold to $50,000. Cut the 32.5% to 30% tax rate for those earning between $45,001 and $120,000, with the threshold raised to $50,001.

This would give the largest tax cut to those earning $120,000 (2.3%)

Everyone earning up to $132,400 would receive a larger tax cut (%) than would be the case under Stage 3

Taxpayers would save $70 billion over a decade

All four alternatives cost less than Stage 3.

All four alternatives deliver better tax cuts to those most affected by bracket creep and rising inflation.

All four alternatives give the government the ability to deliver tax cuts and improve services, infrastructure, income support.

Stage 3 Better.

Related research

Between the Lines Newsletter

The biggest stories and the best analysis from the team at the Australia Institute, delivered to your inbox every fortnight.

You might also like

10 reasons why Australia does not need company tax cuts

1/ Giving business billions of dollars in tax cuts means starving schools, hospitals and other services. Giving business billions of dollars in tax cuts means billions of dollars less for services like schools and hospitals. If Australia cut company tax from 30% to 25% this would give business about $20 billion in its first year,

Business groups want the government to overhaul the tax system? Excellent – we have some ideas.

The landslide win by the ALP has seen business groups come out demanding the government listen to their demands despite having provided them no support, and plenty of opposition, over the past 3 years.

5 ways and 63 billion reasons to improve Australia’s tax system

With a federal election just around the corner, new analysis from The Australia Institute reveals 63 billion reasons why our next Parliament should improve the nation’s tax system.