Targeted: Review of limit on tax advice deductions

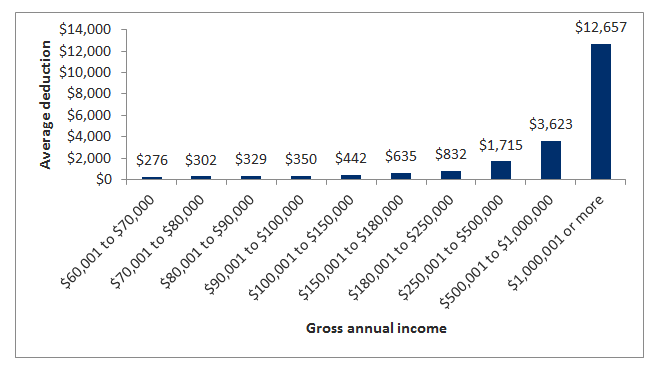

New analysis of tax data shows that limiting the deduction for managing tax affairs to $3,000 is likely to impact only very high income earners.

The majority of Australians make no claim for managing their tax affairs, and even amongst those in the top 3% of income earners, most claims do not exceed the $3,000 mark.

However, the policy does stand to net gains for the government due to the size of the claims of aggressive tax minimisers, some of whom claim over $1 million in deductions for tax advice annually.

- Those on over $1 million dollar incomes deduct an average of $12,657 for the management of their tax affairs.

- The average amount deducted for tax advice was $378 the median was $165.

- 47% of those submitting a tax return claim a deduction for expenses incurred in managing their tax affairs.

“A $3,000 dollar cap will go unnoticed by the vast majority of Australian taxpayers,” Senior Economist at The Australia Institute, Matt Grudnoff said.

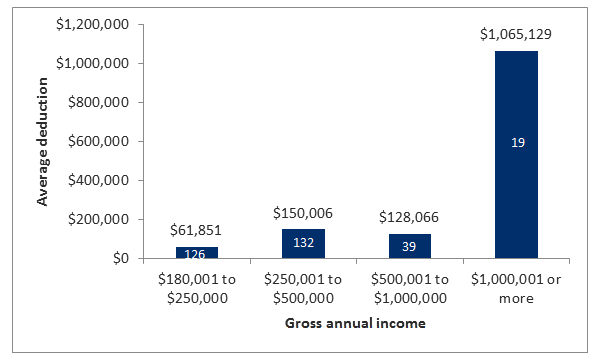

“One of the most remarkable figures we uncovered was the average deduction for those who earn over $1 million dollars and don’t pay any income tax. They spent, on average, over $1 million dollars on tax advice in a year.” (See table below)

“This loophole is legal, but when it’s being exploited in such an excessive way it probably doesn’t pass the pub test for most taxpayers,” Grudnoff said.

Average deductions for managing tax affairs, high gross income earners who paid no tax

Source: Taxation statistics 2014-15, Table 10. The number in white shows the number of people claiming the deduction in that tier.

Top 50% of income earners average deduction for managing tax affairs by income group

Source: Taxation statistics 2014-15, Table 10

Related documents

Related research

General Enquiries

Emily Bird Office Manager

Media Enquiries

Glenn Connley Senior Media Advisor