The report the Prime Minister cites against changes to negative gearing actually shows housing would be more affordable and rents barely affected.

Rather than show negative gearing changes are bad, a Deloitte report cited by the Prime Minister concludes they would improve housing affordability and home ownership.

After Nine media reported this week that the Treasury department was investigating changes to negative gearing and the capital gains tax discount, it took very little time for the usual suspects to come out suggesting that any changes would make things worse. However, the Deloitte report they cite actually shows things would be much better.

While it was not surprising that vested interests like the Property Council of Australia would try to drum up a scare campaign about changes to negative gearing, it was unfortunate that Prime Minister Anthony Albanese also echoed their lines by referring to modeling cited by the Property Council.

In his interview with ABC breakfast on Thursday morning, Anthony Albanese argued against changes to negative gearing, saying “the issue of negative gearing is one of supply. Will it add to supply or will it decrease supply? The figures and research that has been produced by organisations like the Property Council indicate that it would reduce supply and therefore not contribute to solving the issue. And that’s the issue.”

The Property Council itself came out gloating that the Prime Minister was citing their work. It noted that “The Prime Minister referenced past Property Council analysis through Deloitte… and that the analysis showed negative gearing changes shrink the number of new homes by about 4 per cent”.

However, analysis of this very research the Prime Minister and the Property Council refer to actually concludes that reducing the capital gains discount and negative gearing will improve housing affordability and have negligible impact on supply.

The research by Deloitte is located here.

The first thing to note is it was published in July 2019 and concerns the policies the then Bill Shorten-led ALP took to the 2019 election, and mostly forecasts out 11 years to 2030

It does not take too much thought to realise that estimates made before the pandemic in 2019 about what might occur in 2030 may have some methodological concerns. But even those worries aside, the report is in no way damning of the proposed changes.

The Prime Minister is correct that the report estimates by 2030 the “construction of new housing would be lower by 4.1%”. While this might seem fatal to the worth of any changes, the report then goes on to note that in reality this is barely even a rounding error. Because all new housing builds only account for about 2% of the total amount of housing stock, the report estimates that the changes to negative gearing and capital gains tax would only see the total level of housing stock reduced by just 0.4% compared to what otherwise would have been anticipated by 2030.

This means that the amount of housing stock will still rise – it will just be 0.4% less in 2030 than might have been the case if there had been no changes.

Is that a lot?

Well firstly this estimate was made before the pandemic and record low interest rates and also before the government’s own housing supply policy.

A 0.4% drop in the level of housing stock in 2030 would be around 47,000 fewer homes. To put this in context, the ALP has an aspirational goal of building 1 million new homes over 5 years (from 2024 to 2029).

The biggest impediment to housing supply is not possibly lower house prices that Deloitte argues will reduce the number of investors building new homes, but the supply of enough skilled labour.

The report itself also makes a big assumption on housing supply that is now based on outdated data. The report estimates that 30% of new houses are sold to investors. But since the report was published in 2019, the ABS released in 2020 better data that shows the figure is just 25%. Given the report’s estimate on fewer new builds in 2030 is based on a supposed decline in investors building new homes, this change would most likely have a material impact on the results.

But importantly the report also notes that supply is not actually the key issue for housing affordability when discussing negative gearing or the capital gains tax discount.

This is because the discount and negative gearing drive up house prices so much that it wipes away any benefit that might come from increased supply. This means the crucial point with regard to negative gearing changes and reductions in the capital gains tax discount is what it will do to prices, rather than supply.

The reduction of the capital gains discount and changes to negative gearing proposed in 2019 were estimated to reduce house prices by 4.3% in 2030 compared to what would have been expected. And unsurprisingly Deloitte estimate this lower house price growth leads to improvements in affordability.

The report definitively states that the proposed changes to negative gearing and capital gains tax in 2019 would improve housing affordability and in turn home ownership. It states that

by 2030 the share of home owners would have risen by 2½ percentage points.

Two and half percentage points might seem like small, and yet that would be the biggest increase in home ownership rates over a 10-year period since the 1970s. Estimating the number of households in 2030, it would mean an additional 300,000 households would be owner occupiers.

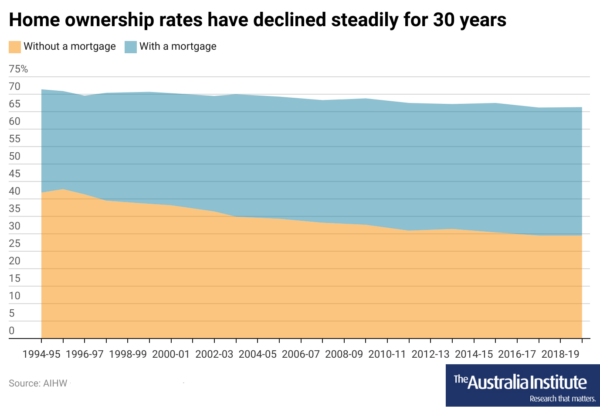

From 2009 to 2019 the rate of home ownership fell 2.5% points from 68.8% to 66.3%. In effect this policy would have reversed that fall but also led to the first significant increase in home ownership in 40 years. If that is not the key issue of a policy of housing affordability, then I am not sure what is!

Whenever the issue of negative gearing is raised, the usual suspects also argue that any reduction would cause rents to rise. The Deloitte report however estimates that there would be barely any change.

It notes

the impact on rents is projected to be relatively modest.

By 2030 it estimated average rents would be just 0.5% higher than they otherwise would be expected to be. To get some understanding of how minute this amount would be, in the 5 years since this report was published average rents have risen 21%.

The report also models the situation where only negative gearing changes are made and the capital gains tax discount is left untouched. In such a situation Deloitte estimates that rents in 2030 would be just 0.1% higher than expected.

It truly is time to put an end to suggestions that changing negative gearing will cause rents to rise.

Indeed the report notes that while “the share of property purchased by investors” is expected to fall it also notes that this just means that “some of the property which would otherwise have been purchased by investors is now purchased by new owner-occupiers”.

In effect “as investors exit the market in favour of new owner-occupiers the relative balance between demand and supply in the rental market remains unchanged with both demand and supply falling by the same amount”.

To recap: the very same report cited by the Prime Minister and the the Property Council of Australia on why there should be no changes to negative gearing actually found:

- Housing affordability will improve.

- Home ownership in 10 years would have risen 2.5% pts – the biggest 10-year improvement since the 1970s.

- The total stock of housing even with outdated assumptions of investor behaviour would be just 0.4% lower than otherwise would have been the case.

- Rents would barely change

If you are looking for a report to argue that the government should remove negative gearing and halve the capital gains tax discount you could hardly do better than the report cited by the Property Council of Australia.

The Prime Minister would do well to read the report to discover that the path to better housing affordability is demonstrably through removing the tax incentives that for 25 years now have distorted Australia’s housing market.

Between the Lines Newsletter

The biggest stories and the best analysis from the team at the Australia Institute, delivered to your inbox every fortnight.

You might also like

5 ways and 63 billion reasons to improve Australia’s tax system

With a federal election just around the corner, new analysis from The Australia Institute reveals 63 billion reasons why our next Parliament should improve the nation’s tax system.

One way to improve the “dumpster fire of dumb stuff” which is Australia’s housing policy

Everyone agrees we need to do something about housing in Australia. But first we need to ask a very obvious, but often ignored question: what is housing is for?

Harmless budget of missed opportunities

This pre-election budget is designed to annoy as few people as possible.