The Scissor List – Budget 2014

- The Imaginary Crisis

- The Budget Blow By Blow

- The Devil Is In The Detail

- TAI In The Media

- Infographic

The Imaginary Crisis

When the previous government introduced a resource rent tax on the miners to fund a range of government services and income support for low income earners, it was called ‘class warfare’. In last nights budget, when the Abbott Government announced its intention to slash spending on health, education and income support in order to fund corporate tax cuts, it was called ‘tax reform’.

Public debate about politics is broken in Australia. While budgets provide clear numerical evidence of who wins and who loses, the public debate about those numbers is filled with meaningless clichés about ‘sustainability’ and ‘sharing the burden’. A treasurer talking about equity a lot, like a child to an imaginary friend, doesn’t make it exist.

Take the new $20 billion ‘health research fund’. Last night Mr Hockey announced that we would fund future medical research by introducing a fee to visit the doctor. Just why the sickest in our society should fund better health outcomes for future generations was left unsaid.

Similarly, the budget papers make clear that Tony Abbott’s vision of nation building is as narrow as his understanding of 21st Century transport.

Determined to build freeways to the detriment of both the climate and those who are forced to commute long distances to work, this is another budgetary measure that shows a man ignorant to the needs of many Australians. While Mr Hockey talks with pride about his big new investment in roads, he is strategically silent on the cuts to rail projects spelt out in the budget.

Mr Abbott and Mr Hockey have spent years telling us about the parlous state of Australian public finances yet last night, in a puff of budgetary smoke, the crisis vanished. Gone now are references to crisis: it’s now time to start investing in the future. But while much is made of the future budgetary problems we must prevent, literally nothing was said in the budget about employing a similar approach to the very real threats climate change.

The budget makes quite clear who wins and who loses. And the budget makes quite clear which problems are deemed important and which ones are deemed irrelevant.

Democratically elected governments are, of course, free to spend money on any problem they want, and to cut money from programs they don’t care about.

But when the definition of ‘a problem’ is based not on the existence of objective evidence but on the desire of politicians to highlight or ignore an issue, we have a major problem.

This budget does an excellent job of solving the imaginary problems of a government determined to enforce their own ideological vision. What it doesn’t do, is provide any solutions to the very real problems we will be facing as a community. Entrenching poverty, making it more difficult for those already struggling to pay rent and their medical bills to see a doctor when they’re sick, forcing the elderly to continue on at work, and limiting protections on the environment, amongst a raft of other similar decisions, will make Australia more inequitable than it is has ever been. The very wealthy will be laughing all the way to the bank. The poor will be the punch line.

The Australia Institute is working hard to ensure Australia is more, not less, equal. We’ve been there from the start, calling out lies, misinformation, and strange imaginary problems. We audited the auditors (you can read the report here); we saw the inequity of superannuation tax concession back as early as 2009 and we’ve proposed a well-received policy for a universal pension to ensure an equitable retirement for all Australians.

You can support us to continue this work by becoming a monthly donor. We’ll keep a focus on equity, and we’ll keep a focus on honesty. Somebody has to. We are.

The Budget Blow by Blow

Health

The big announcement in health is the creation of Medical Research Future Fund (MRFF) which will fund medical research sometime in the future. It will be funded by cutting frontline health services to the tune of $6.2 billion over the forward estimates. The savings will come from cuts to hospitals, public dental programs, and forcing patients to pay more to get medicine and see the doctor.

While the government is keen to push the line of contributing to the future, that will be cold comfort for those who are sick now. The MRFF will not fund front line services in the future. This is a permanent cut to the health budget.

The co-payment to see the GP, set at $7, is designed to discourage people from visiting their doctor and to raise revenue. Health experts will tell you that addressing illness and disease early leads to better health outcomes, and less expensive treatment. Discouraging people from seeing their doctor will reduce spending in the short term, but is likely to cost more in the long term. As for raising revenue it is difficult to think of a stranger basis of taxation. You can level tax on income or spending or profit, but using sickness seems extremely odd.

Poverty

Those in need of government assistance will feel the brunt of this budget. The government will save $1.2 billion by forcing unemployed people under the age of 30 to wait 6 months before applying for Newstart (the dole).

The disability pension will also now be indexed to the CPI which will cut it by about 1% per year. All up social services will see the biggest cuts. $15.4 billion over the forward estimates or more than 40% of the government’s total savings will come out of the pockets of our most vulnerable.

Ageing

Pensioners will be worse off by $1.9 billion because of changes to the way pensions are indexed and by pausing the thresholds. The Treasurer has been keen to say that the pension is unsustainable (an awful lot of things seem to be unsustainable to our Treasurer these days), but he is also completely unconcerned with the far more rapid increase in super tax concessions. In fact super tax concessions don’t even get a mention.

Before the budget Hockey said that four fifths of retirees are getting some form of pension and by 2050 that will not change. This is clearly an acknowledgement that super tax concessions do nothing to take pressure off the pension.

Education

The Australian education system has always been based on the principle that education should be universal, ie available to everyone; and that access to higher education relies only on merit. These principles are under serious attack. The government is pushing our country towards a user-pays system, where the size of your bank account is as important as your knowledge and hard work.

University fees are to be deregulated which will see universities able to charge whatever they like for degrees. This will likely see our best universities increase their fees, closing them off to less well-off students. At the same time HELP, the government’s student loan scheme will see rises in interest rates, and the rate at which repayments kick in will be lowered.

It’s not just university students that will be hit. Apprentices will also see cuts to government assistance to be replaced with a $20,000 government loan. Apparently government debt is a horrible thing to be avoided at all costs, however apprentice debt something to be embraced.

Overall the government is cutting $3.8 billion dollars out of education funding, breaking a pre-election promise not to cut education.

Family Tax Benefit

While most of the changes in the budget are going to hurt low income households there are some changes that will target those that are better off. Some of the changes to Family Tax Benefit (FBT), like lowering the income limit from 150,000 to 100,000 are an attempt to remove ‘middle class welfare’. That is welfare paid to people can look after themselves.

Some of the other changes to the FBT will hurt low income families, such as maintaining the rates at the same amount for two years. The changes to the FBT are a mixed bag, with some better targeting of welfare payments alongside cuts to those in genuine need. Overall the government will save $6.5 billion from changes to the FBT.

The climate

While this year’s budget buzz word from the government is ‘sustainability’, this clearly doesn’t extend to the planet. Climate change programs and agencies are being cut, and the carbon price is to be repealed. While the government has committed to an emission reduction fund, most experts are dubious of how successful it will be. Given Hockey’s distaste for wind farms, it’s not looking too good.

While the government may be unconvinced by a problem that 97% of climate scientist think is a very serious issue, they are determined to take precautions against some potential problems. The government recommitted to increasing defence spending to two per cent of GDP. This will see spending on defence rise by more than $10 billion per year to protect us against an as yet unspecified threat.

The winners

The big winner from this budget is business. While the government has asked low and middle income households to do the heavy lifting, it appears they will also have to carry business, particularly the big mining companies. The miners get a $5 billion tax cut in the form of the repeal of the mining tax. While the government re-indexes excise on fuel, the big miners keep their fuel tax credit scheme which allows them to write the tax off against their profits.

The strangest changes

Something that may have passed people by was the government decision to link things to the consumer price index (CPI). The CPI measures the rate of price increases (inflation) of the average household. It was extremely odd then for the government to decide to link hospital and school funding to the CPI. Just what increases in consumer goods has to do with the cost of running a hospital or school is left unsaid.

It puts us in the bizarre situation where a cyclone that wipes out Queensland’s banana crop and therefore increases the CPI, will also increase funding to hospitals. At the same time if a free trade agreement with Korea decreases the price of cars, and hence the CPI, funding to schools will also go down.

The biggest expense with running hospitals and schools is the wages of teachers, nurses and doctors. These tend to rise at the same rate as average wages which is about 3.5% per year. While the CPI rises on average at about 2.5% a year. By linking funding to the CPI the government is effectively cutting hospital and school funding every year. While this might save the government money it will also impact on the quality of services they provide.

The meanest things

This budget is littered with examples of cuts that will hurt the most disadvantaged. These include a $390 million cut from public dental programs and $7.6 billion from foreign aid. The government is also getting rid of the national rental affordability scheme which helps those on low incomes be able to afford housing.

Apparently politicians are feeling the pain as well. They will be taking a pay freeze. How much will that save? $5 million a year. Well, at least they are doing something.

The Devil Is In The Detail

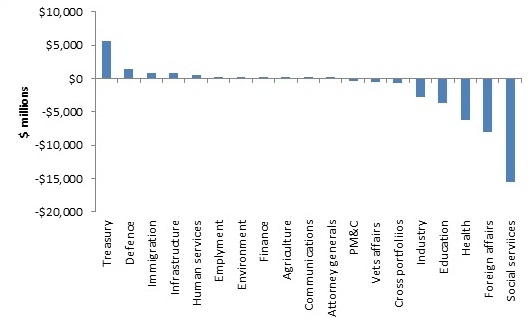

Beyond the headlines and sound bites the government’s real intentions are in the forward estimates, which is how the budget will be delivered over the next four years. The devil is in the detail. The change in government spending between 2013-14 and 2017-18 is plotted in Figure 1.

Figure 1: Total change in spending over the forward estimates

There are two clear winners:

Treasury gets $5.6 billion, largely due to the $3.9 billion ‘Asset Recycling Initiative’ – an incentive payment to encourage the states to sell or privatise their assets. Treasury was also boosted in the January release of the Mid-year Economic and Fiscal Outlook (MYEFO) by an additional $8.8 billion to administer.

Defence spending too is boosted, mainly through super payments to former military personnel whose CPI indexation is now increased ‘with reference also to a benchmark level of Male Total Average Weekly Earnings’. This higher indexation arrangement for former military personnel is exactly what the government plans to take away from age pensioners as of 2017.

And then there are the big losers:

Social services goes down $15.5 billion. The cuts are to come from:

- cessation of the seniors supplement for healthcare card holders,

- cuts to Family Tax Benefit (FTB) B by reducing income thresholds; and limiting payments to only families with children under six years old,

- freezing all FTB payment rates without indexation for two years,

- denying payments for unemployed under 30’s for up to six months; and putting those under 25 onto the cheaper youth allowance.

- cancelling indexation of the thresholds for income and asset tests for the age, disability, carer and veteran’s pensions.

These cuts follow $7.1 billion in cuts in the MYEFO, which included cuts to the school kids bonus, the low income co-contribution for superannuation, and other similar measures caused by the repeal of the Minerals Resource Rent Tax (which has not yet been passed by the Senate).

Foreign affairs is next on the scissor list, with a cut of $8.1 billion of which $7.6 billion was the cut in foreign aid. The world’s poorest are required to do a large part of the ‘heavy lifting’ to solve our imaginary debt crisis. Then came health cuts worth $6.2 billion mainly from sick Australians having to pay an extra $7 each time they visit their doctor as well as for their pathology and imaging services. From 2017-18 there will also be heavy cuts in health funding for the states. Education was next with cuts of $3.7 billion. These are mainly from reductions in thresholds for repaying the Higher Education Loan Program (HELP). Students who aren’t able to pay off their debts fast enough are also hit a second time by increasing the escalation factor on any outstanding debt. Instead of indexing against the CPI it will increase at the government 10 year bond rate which is currently averaging around 4 per cent. Industry was another big loser with a cut of $2.8 billion mainly affecting industry support.

There were two major revenue measures. The Temporary Budget Repair Levy imposes a three year tax of two per cent on incomes above $180,000, which affects only about the top four per cent of tax payers, and will raise $3.1 billion. The reintroduction of indexation for the fuel excise is the only other addition to revenue and will raise $4.0 billion.

Australia’s tax and welfare system always scored well for the redistribution of income from high income earners towards lower income earners amongst OECD countries. This budget will change that. It will also change the way we view those living in poverty. Where once we considered ourselves a generous nation, and prided ourselves on assisting the vulnerable, we have embraced the idea of the ‘unworthy poor’ and are happy to use them to assist the very wealthy stay that way. The maintenance of super tax concessions for the wealthy at the cost of pensioners is one clear demonstration of this.

Two years ago Joe Hockey in a speech in London said he admired the Hong Kong social welfare system and called an end to the ‘age of entitlement’. In his budget speech last night the Treasurer said that we are ‘a nation of lifters, not leaners’. This budget leans heavily on the poor.

TAI In The Media

Denniss: stand down, there is no budget emergency after all

Reports of the budged emergency have been wildly inflated in order to give the rich a free pass, writes Richard Denniss, economist and executive director of The Australia Institute.

Treasurer Joe Hockey expects unemployment to rise and business investment to fall. He plans to shed 16,000 public sector jobs into a labour market that Treasury says is softening. Indeed, Treasury states that the proportion of people who are employed or looking for work will continue to fall, “reflecting the expectation that employment growth will not be strong enough to entice discouraged workers to resume their job search”. That’s Treasury code for “people will stop looking for jobs because there won’t be many to look for”.

Abbott Delivers A Billionaires’ Bonus

Matt Grudnoff thinks the 2014 Budget might just be the biggest and best one ever … if you’re a billionaire miner

To paraphrase Winston Churchill — never in the field of budget conflict has so much been extracted by so few at the expense of so many.

While the rest of us face a horror budget where we are told to keep calm and carry on, the miners are walking away puffing a cigar and doing the “Victory” sign

Read Matt in the New Matilda here

The Senate: how will Abbott convince the unruly red-benchers?

Last night’s federal budget is more of a discussion starter than the final word when it comes to policy change in this term of government. Given the numbers in the Senate, the list of “new commitments” announced by Treasurer Joe Hockey are best interpreted as a wish-list rather than the likely end result.

Australian Budget 2014: the panel verdict

At a time when unemployment is rising, economic growth is sluggish and our terms of trade are in decline, the government has decided to take $36bn out of the economy. Usually economists suggest the budget is used to counter the business cycle. That means when the economy is declining, the government should spend more and tax less. Pulling money out of the economy will push economic growth down and put upward pressure on unemployment.>

Read Matt in the Guardian’s Budget Panel

You can catch Richard debating Judith Sloan tonight at 5.30 on ABC’s The Drum

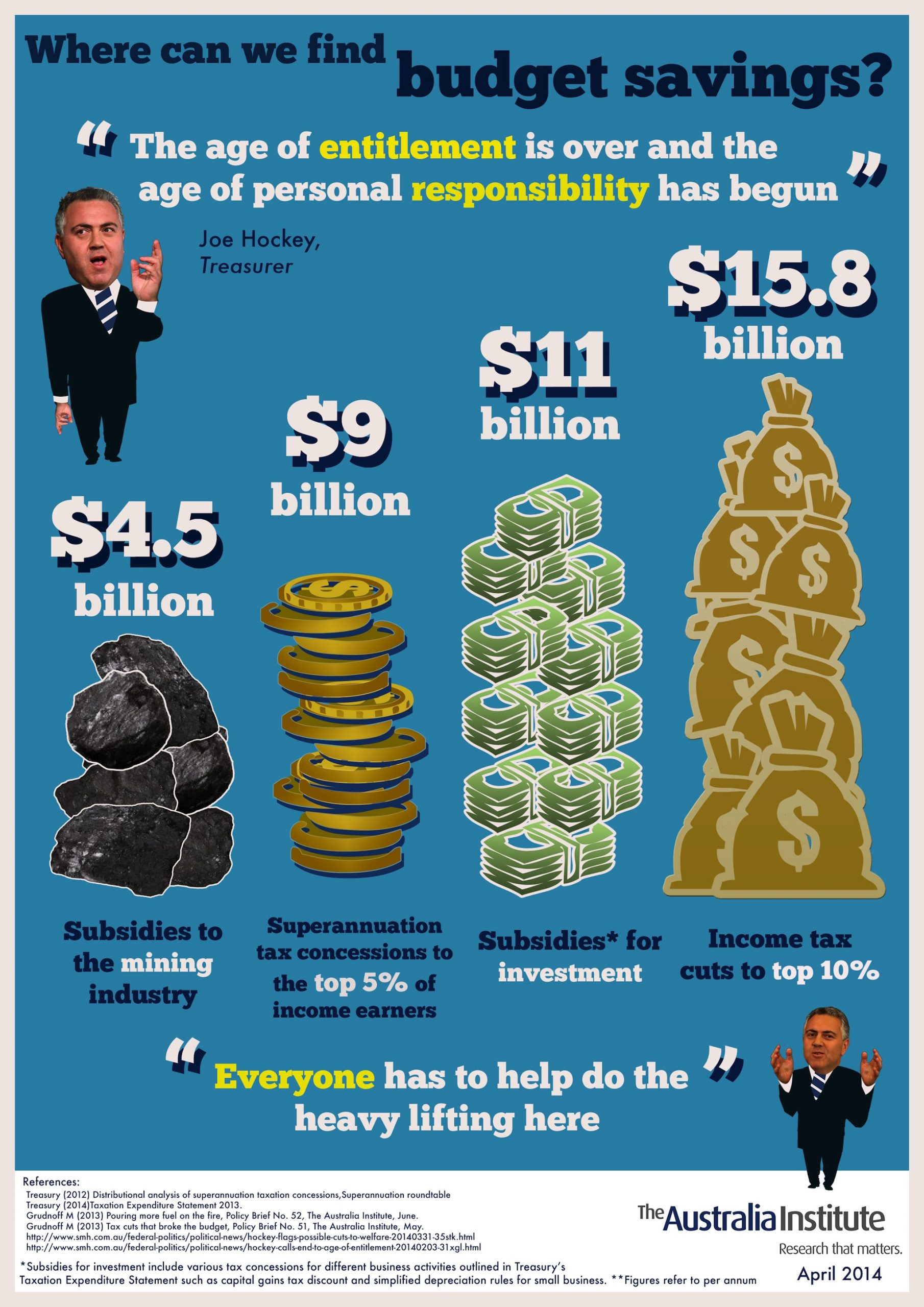

Infographic

In the run up to the federal budget Prime Minister Abbott and Treasurer Hockey talked up the apparent budget emergency Australia faced to justify the cuts they wanted to make. Last night’s budget revealed that the scissor list was weighted to those on lower incomes rather than the largesse provided to corporations and the well-off. If only the government had shared our latest infographic on Facebook.

Between the Lines Newsletter

The biggest stories and the best analysis from the team at the Australia Institute, delivered to your inbox every fortnight.

You might also like

How Australia helped Japan build a gas empire | Between the Lines

The Wrap with Amy Remeikis In just a few short days the 48th Parliament will sit for the first time and we will start to see the answer to the question we have been asking become clear; what will Labor do with power? In many ways, we already have the answer, at least when it

One more time? | Between the Lines

The Wrap with Amy Remeikis If the polls, the trend, and the vibe are all right, then voters are about to give the Albanese government another chance. But you can feel the reluctance. The only question that seems to remain is whether Labor will govern in its own right, or as a majority. From the

There are no more excuses | Between the Lines

The Wrap with Amy Remeikis Well it didn’t take long for it to be business as usual, did it? Not even two weeks out from a humiliating loss, the Coalition is still pretending it remains just as relevant as ever, with shadow finance minister Jane Hume issuing orders to the government on its planned modest