No tax concession does less to stimulate innovation or employment than the capital gains tax exemption on luxury homes. Indeed, by encouraging the most wealthy Australians to park billions of dollars in spare bedrooms that gather dust and detritus from Christmases past, the exemption simply diverts capital away from productive uses.

A government that is committed to driving innovation would surely be committed to creating a tax system that rewards new investment in productive assets, rather than rewarding new investment in imported bathroom tiles. While new factories and new ideas deliver lasting dividends, new decor depreciates faster than the luxury cars preferred by property developers.

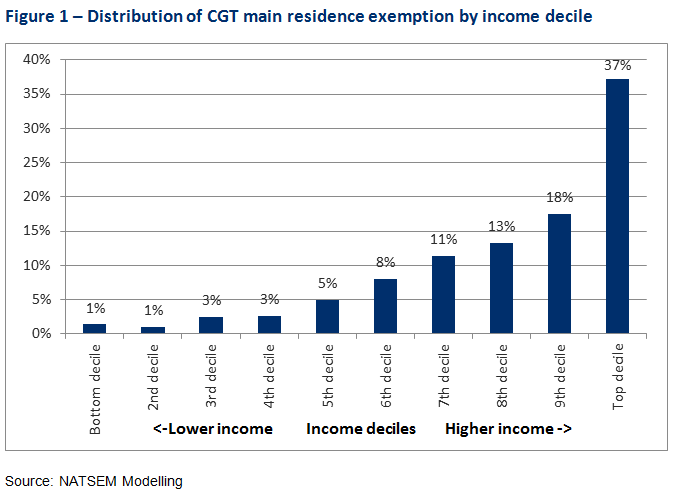

The Treasury says the policy of exempting the family home from capital gains tax will cost the budget $46 billion in 2016, and $188 billion over the forward estimates. NATSEM modelling, commissioned by The Australia Institute, shows that 55 per cent of that tax windfall flows to the wealthiest 20 per cent of the population, while the poorest fifth of the population receives a whopping 2 per cent of the benefit.

EFFICIENT AND LUCRATIVE REFORM

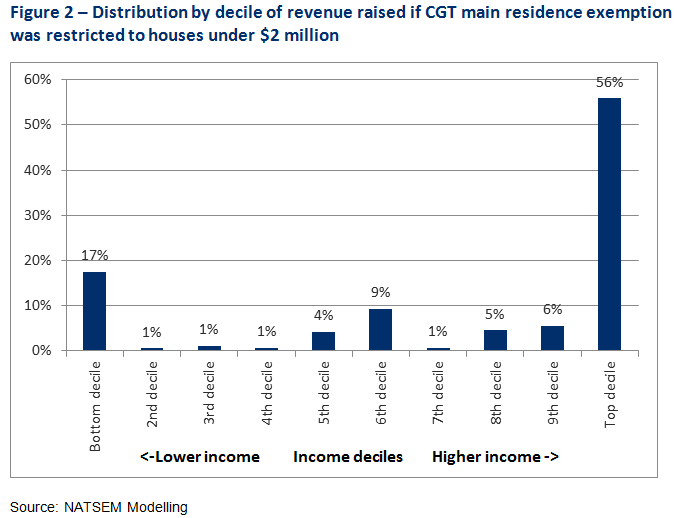

A simple, efficient and lucrative reform option for the Turnbull government would be to place a cap on the price of a house that was eligible for the existing exemption from capital gains tax. NATSEM estimates that the creation of such a threshold would deliver $12 billion over the next four years, 62 per cent of which would come from the top 20 per cent of income earners.

Things get really interesting when you line up the arguments used by those who defend the existing exemptions with the arguments used by economists who want to change behaviour to increase economic efficiency. “If capital gains tax was payable on luxury homes, demand for them would fall.” Good. “If capital gains tax was payable on luxury homes, older people would sell well-located houses that are far bigger than they need.” Good. “If capital gains tax was payable on luxury homes, the inheritances of the children of wealthy Baby Boomers would be diminished.” Good.

The “problems” identified by those who defend the importance of including multimillion-dollar “family compounds” in the definition of family home are actually evidence of the probable effectiveness of the idea.

Australia has long used taxes on tobacco, alcohol and luxury cars to simultaneously change people’s behaviour and raise revenue. The main arguments against collecting capital gains tax on expensive homes can be summarised as “I don’t like the idea because it would work”.

FAIRNESS FRONT AND CENTRE

Malcolm Turnbull said he wanted to put innovation at the heart of his policy agenda. He also said he wanted to put fairness front and centre. While economic theory often suggests that there is a trade-off between what is fair and what is efficient, sometimes we turn up policy reforms that increase equity and productivity at the same time. Reforming the tax treatment of luxury homes is one such example – Mr Turnbull would be ill-advised to turn away economists bearing both economic and political gifts.

Thanks to the long-term harm Peter Costello did to the budget’s ability to collect revenue and the long-term harm Tony Abbott and Joe Hockey did to the Coalition’s economic credibility, conservative voters are still waiting for the budget surpluses they have been told are so important. With big spending cuts off the agenda, and unlikely to pass the Senate, new sources of revenue are the only way forward.

Just as smokers don’t like the argument that tobacco taxes discourage smoking, there is no doubt that the owners of multimillion-dollar homes won’t like hearing that capital gains tax reform will discourage excessive investment in spare bedrooms. But as all successful prime ministers know, driving reform is different to chasing popularity.

But while some of the Coalition’s biggest donors might not like it, the political reality is that the vast majority of Australian voters have never even been invited inside a house that cost more than $2 million. Reforming the tax treatment of mansions would be good policy and good politics. What’s more, unlike spending cuts or a GST increase, it would likely breeze through the Senate.

The Coalition government has made it clear that it has the resolve to take on the union movement in the name of boosting economic performance. Time will tell if it is willing to show the same resolve when it comes to taking on the residents of Toorak and Vaucluse.

Richard Denniss is the chief economist at The Australia Institute. @RDNS_TAI

Related documents

Between the Lines Newsletter

The biggest stories and the best analysis from the team at the Australia Institute, delivered to your inbox every fortnight.

You might also like

Taxes on tampons, tax breaks for luxury utes: gender in the budget

Last week, the federal government announced plans to define menstrual products as “lifestyle-related” and exclude them from NDIS funding.

5 ways and 63 billion reasons to improve Australia’s tax system

With a federal election just around the corner, new analysis from The Australia Institute reveals 63 billion reasons why our next Parliament should improve the nation’s tax system.

The changes to superannuation tax concessions are needed and very fair

The arguments against the government’s changes to the taxation of superannuation are nothing more than lies and fear.