Today the opposition leader, Anthony Albanese was asked about wages in the following exchange:

Journalist: “You said that you don’t want people to go backwards. Does that mean that you would support a wage hike of 5.1% just to keep up with inflation?

Anthony Albanese: “Absolutely”.

Any other response would be to suggest that real wages – and thus people’s ability to purchase goods and services with the money they earn – should decline.

The suggestion that wages rising in line with inflation or even marginally above inflation will increase inflation in a “return to the 1970s” wage spiral ignores basic economics and the advice of the Treasury department.

Real wages should rise – and unless they are outpacing productivity there is no case to be made that they are driving inflation.

This very point was made in February by the Secretary of the Treasury, Steven Kennedy when he noted

“if we can achieve productivity growth of 1.5 per cent, then nominal wages [assuming inflation of 2.5 per cent] can grow at four per cent and put no pressure on inflation”[i].

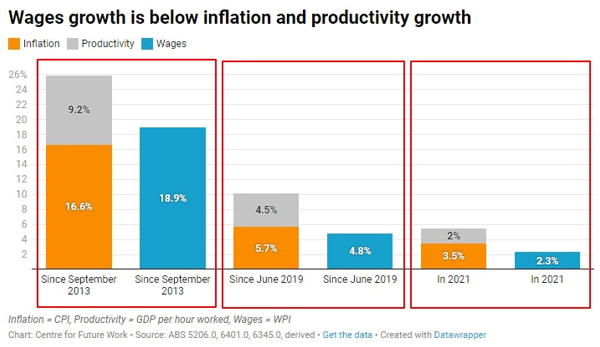

The problem is not that wages are growing too fast, but that over the past 3 years they have not kept pace with inflation and productivity growth.

From June 2019 to the end of 2021 inflation has increased 5.7% and productivity has grown by 4.5%. And yet rather than wages growth being equal to the sum of those two measures, nominal wages in that period increased just 4.8%, and real wages have fallen 0.8%. Real wages have thus declined, while real labour productivity increased.

The evidence is clear that wages did not cause the current surge in inflation. There is no reason to believe that suppressing wages will cause inflation to moderate. Asking workers to accept a permanent reduction in their real living standards to fight inflation that they did not cause is neither fair nor economically sensible.

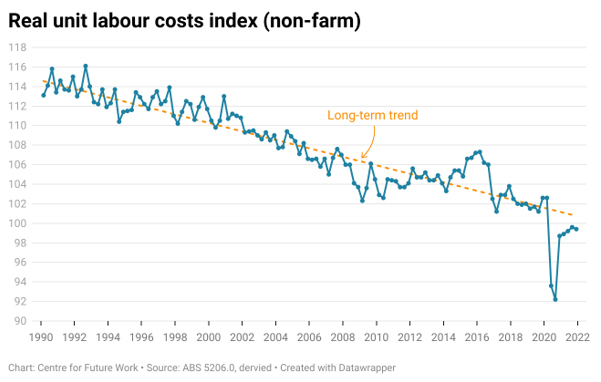

The Reserve Bank has rightly suggested that it will keep an eye on labour costs, however it should be noted that in the 12 months to March while the Consumer Price Index grew 5.1%, the Producer Price Index, which measures the inflation of input costs, rose 4.9%, and nominal unit labour costs grew just 4.0%. This confirms that inflation is not being driven by labour costs.

Moreover, Non-farm, Real Unit Labour Costs are now 3.1% below their pre-pandemic level of December 2019.

That decline is even faster than the long-term trend.

A fall in real wages will only continue the transfer of national income from workers to corporate profits – something which also occurred when inflation was falling. Workers were told then to accept lower wages growth (and also public-sector wage caps) because inflation was low. Now they are being told to accept lower wages because inflation is high – and for no fault of their own.

[i] Economics Legislation Committee, 16 February 2022.

Between the Lines Newsletter

The biggest stories and the best analysis from the team at the Australia Institute, delivered to your inbox every fortnight.

You might also like

Corporate Profits Must Take Hit to Save Workers

Historically high corporate profits must take a hit if workers are to claw back real wage losses from the inflationary crisis, according to new research from the Australia Institute’s Centre for Future Work.

Blame Game on Inflation has Only Just Begun

Every inflationary episode embodies a power struggle within society over who benefits from inflation, who loses out – and who will bear the cost of getting inflation back down.

Opening statement to the ACTU Price Gouging Inquiry

This week Professor Allan Fels, the former head of the Australian Competition and Consumer Commission (ACCC), has begun an inquiry into price gouging across a range of industries, including banks, insurance companies, supermarkets, and energy providers. The inquiry commissioned by the ACTU comes off the back of the highest inflation in 30 years and the biggest falls in real wages on record.