April 2025

The talk about domestic and family violence prevention is big, the funding less so

The amount committed by both political parties to preventing domestic and family violence suggests they believe there are other, more important, priorities.

The Liberal Party’s proposed funds are just boondoggles of budgetary make believe

The announced funds are an exercise in dodgy budgeting and do nothing to properly tax Australia’s mining and gas companies.

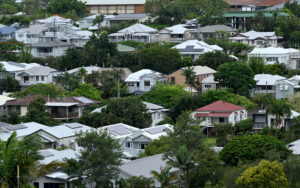

Home economics: housing, living standards and the federal election

With housing affordability at an all-time low and the spectre of Trump looming large over our region, Australians’ standard of living will be at the heart of the debate from now until election day.

March 2025

Migrants are not to blame for soaring house prices

The problem of housing affordability is not too many migrants, but too many tax breaks for investors.

.Fuel excise cut: bad policy and not worth as much as advertised

Halving the fuel excise is bad for the environment and for most Australians won’t deliver the cost-of-living benefits that are being spruiked.

Nurses pay more tax than the oil and gas companies

Over the 10 years to 2023-24 nurses paid $7bn more in tax than did the oil and gas companies.

February 2025

Stop the steel

We discuss Trump’s new tariffs on steel and aluminium imports and what they’ll mean for Australia.

What’s driving the wealth inequality crisis?

Without addressing the wealth inequality crisis, Australia’s economy and society will suffer.

January 2025

The HAFF is a small start to tackle housing affordability, but investors still get all the breaks

Increasing the number of houses is welcome, but unless the government tackles the expensive tax breaks for investors, housing will remain unaffordable for many.

.December 2024

Another hold likely. So, what was the point of the RBA review?

Will the RBA cut interest rates tomorrow? Probably not. It’s Groundhog Day and they’re locked into repeatedly making to same mistake over and over again. A mistake that the recent RBA review criticised them for making just before the pandemic.

Tasmanian MPs rate of pay

Tasmanian MPs have not had a pay increase since 2018.

November 2024

Two new housing policies, both doomed to fail

The government’s latest housing affordability policies, “help to buy” and “build to rent” are the latest in a long line of policies from both major parties that will do nothing to ease the housing crisis.

Research shows people living in rural areas have a much lower life expectancy

The closer you live to the city and the richer your post code, the more likely you are to have a longer life.

.How to fix Australia’s broken childcare system so everybody wins

The potential social and economic benefits of early childhood education and care are huge.

September 2024

Profits over people

Big business says wants a more productive economy, but its complaints about industrial relations are really about its profit margins, says Matt Grudnoff.

Nothing in reserve: households “smashed” by rate hikes

The Reserve Bank is home to the experts on monetary policy – but what happens when they get it wrong?

Public spending keeps the economy going as the private sector is hit by rate rises

Fast rising interest rates have slowed the economy so sharply that only government spending is keeping it growing

August 2024

Australians hate gambling ads, so why is the government tiptoeing around a ban?

A tax on the digital giants could be used to support free, public-interest journalism while implementing a total ban on gambling advertising, says Matt Grudnoff.

July 2024

Would you like a recession with that? New Zealand shows the danger of high interest rates

New Zealand’s central bank raised interest rates more than Australia and went into a recession – twice.

Australia wastes billions making housing more expensive

It’s not easy to screw up the housing market this badly – it’s taken Australia decades of bad policy and billions of dollars to get here, Matt Grudnoff says.

Supermarxist? Dutton and the duopoly

The prime minister joked that the Coalition is turning communist, but having strong powers to break up the Coles-Woolies duopoly is sensible economic policy, Matt Grudnoff says.

Dutton’s divestiture plan would help with cost-of-living, keep lid on inflation

The Coalition’s proposed divestiture powers to break up major hardware and grocery retailers could help keep inflation down and assist with cost-of-living pressures. “The introduction of divestiture laws is a sensible tool to stop large companies like Woolworths and Coles misusing their market power. It would be good for prices at the checkout and help

June 2024

How Australia created a housing crisis (and what we can do to fix it)

Australia is in the midst of a housing crisis, fuelled by poor government policy.

May 2024

Teachers pay more tax than the oil and gas industry

Oil and gas companies claim they pay the wages of teachers and other public sector services, but teachers actually pay twice the tax.

‘Scattergun’ budget misses chance to tackle big issues

The government failed to make a dent in the structural challenges facing housing, social security and the climate in its pre-election budget, says Senior Economist Matt Grudnoff.

Budget 2024: what you need to know

Budget 2024 had a little bit for a lot of people, but in trying to please everyone, has the government disappointed everyone instead?

The budget vs inflation

Millions of Australians are struggling to make ends meet, yet when it comes to the federal budget, too often we hear that governments ‘can’t afford’ additional spending.

Six ways the government can reduce inflation in next week’s budget

It is often said that the only way to reduce inflation is by higher interest rates. That’s not true – the government can also reduce inflation and cost of living pressures

The debate about inflation, interest rates, and the cost of living is broken.

Spreading fear about inflation not falling fast enough distorts the true picture

April 2024

Busting the myth that Australia collects too much income tax

New Australia Institute research reveals claims Australia is over-reliant on income tax are significantly overstated and founded on a narrow and misrepresentative definition of income tax.

General Enquiries

Emily Bird Office Manager

mail@australiainstitute.org.au

Media Enquiries

Glenn Connley Senior Media Advisor

glenn.connley@australiainstitute.org.au