18 Reasons why the Stage 3 tax cuts should be redesigned

Australia Institute research shows the Stage 3 income tax cuts are fiscally irresponsible, massively expensive and completely unfair. Here are 18 reasons why they should be redesigned.

1/ FACT: the Stage 3 tax cuts are massively expensive and massively unfair

The Stage 3 tax cuts are forecast to cost almost a third of a trillion dollars ($313 billion) over a decade, of which $157.5 billion (50%) will go to those earning more than $180,000 a year.

2/ Giving a $313 billion tax cut to the rich means there’s $313 billion that cannot be spent on things like Aged Care or Education

The Stage 3 tax cuts would permanently damage Australia’s revenue base.

Every dollar of the cost of the Stage 3 tax cuts to the wealthy, is a dollar Australia cannot spend on government services that are crying out for funds like Aged Care and Medicare, or increasing the rate of Jobseeker above the poverty line.

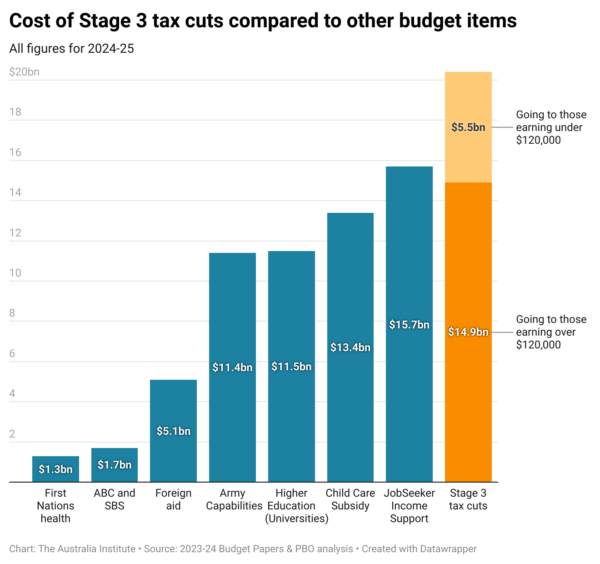

In its first year, the Stage 3 tax cuts will cost $20.4 billion. This is more than the federal government spends on:

– The Pharmaceutical Benefits Scheme ($18.1b)

– Childcare subsidies ($13.4b)

– Public universities ($11.5b)

– Army capabilities ($11.4b)

And it’s four times as much as the government spends on foreign aid.

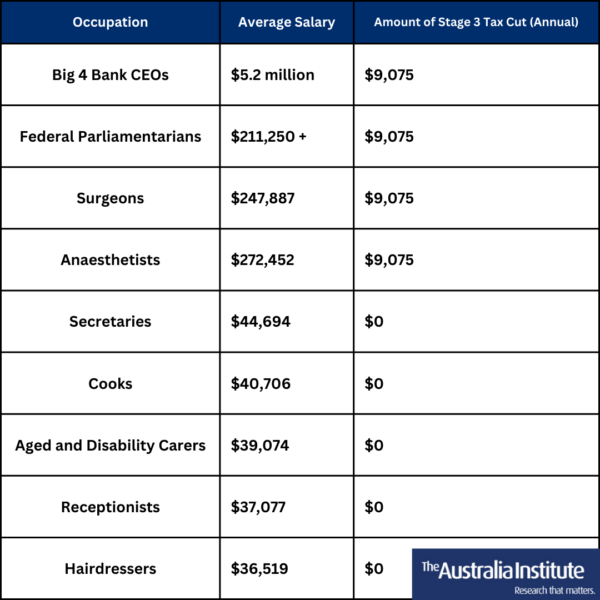

3/ They will give bankers, surgeons, and MPs an extra $9075 a year, while hospo workers, aged care workers, and hairdressers get nothing

Bank CEOs, federal parliamentarians, and surgeons will get more than $9,000 a year from the stage 3 tax cuts. While cooks, receptionists, hairdressers, and aged and disability carers will get nothing.

Australia is in the middle of a cost-of-living crisis, and the Stage 3 tax cuts will deliver nothing for those struggling to make ends meet on the minimum wage or on low incomes.

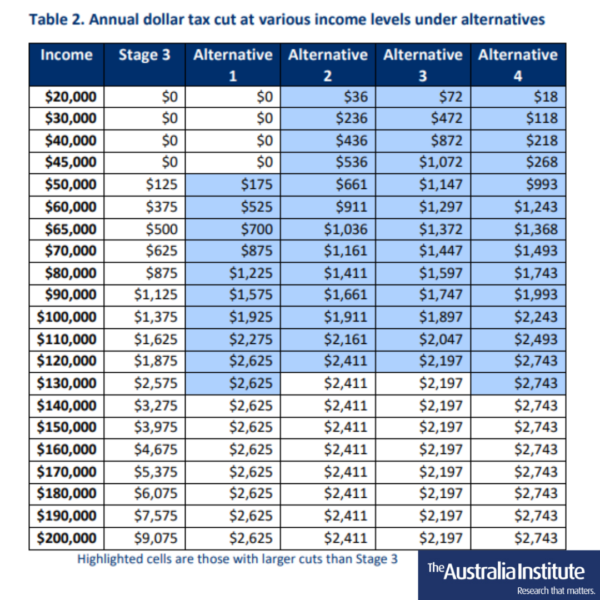

4/ There are much fairer (and cheaper) ways to give people a tax cut

Here are four alternatives, each of which would be between $70 billion and $130 billion cheaper over ten years than Stage 3 as it stands today, delivering a bigger slice of the pie to 80% of taxpayers.

Under all four alternatives, everyone earning between $45,000 and $124,600 would also receive a more significant tax cut. In three of the alternatives those earning less than $45,000 — who will receive no tax cuts under the current Stage 3 — will all be better off.

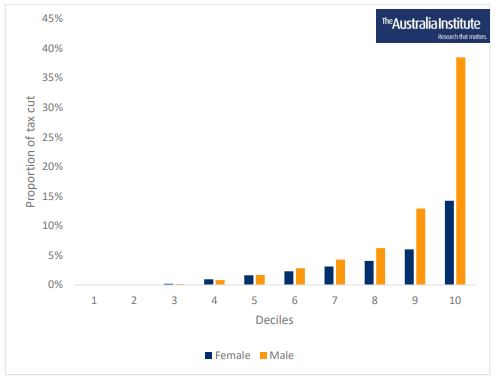

5/ Men get twice as much benefit as women do

For every dollar of Stage 3 tax cuts women get, men will get two dollars. This will only serve to increase the wealth divide, and worsen gender inequality.

6/ Gen Z will receive only 2.8% of the Stage 3 tax cuts in the first year

Despite making up 12.7% of taxpayers, Gen Z (those under 25) will only receive 2.8% of the benefit in the first year of operation of the Stage 3 tax cuts.

7/ Rural and regional areas miss out, while metro areas get most of the benefit

Of the 20 electorates that get the least benefit from Stage 3, 12 are rural seats. That’s 60%! And of the 20 electorates that get the most benefit from Stage 3, 17 are inner metro seats, with half of the top 20 electorates in Sydney, a quarter in Melbourne.

8/ The Stage 3 tax cuts will be responsible for up to 58% of the Budget deficit

Treasury estimates the Budget deficit in 2024-25 will fall to $35.1b, but the cost of Stage 3 cuts in that year will rise to $20.4b.

That means in 2024-25 the Stage 3 cuts will account for 58% of the total budget deficit.

When times are bad, spending for the poor is cut, and when times are good, there are tax cuts for the wealthy. Make no mistake, those calling for tax cuts today will be calling for service cuts tomorrow.

9/ They were promised in wildly different economic circumstances

The Stage 3 tax cuts legislation was passed in 2019 under the Coalition government, and Labor made a commitment to keep them going into the 2022 election. There is pressure on Labor to keep this promise, even though it was made in very different economic circumstances. Australia is now facing a cost of living crisis, skyrocketing inflation, and a potential recession. Doesn’t really seem like a good time to blow more money on tax cuts for the rich, does it?

It also turns out a majority of Australians think that adapting economic policy to suit changing circumstances, even if that means breaking an election promise, is more important than keeping an election promise. So if they are bad economic policy, promised under very different circumstances, and the people want them gone, why are the government keeping them?

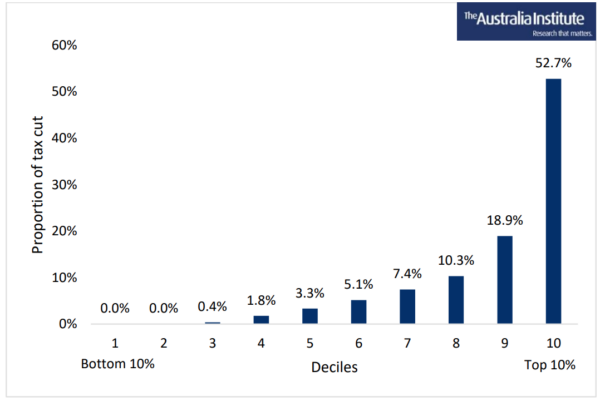

10/ More than half of the benefit goes to the top 10% of income earners

Those earning more than $200,000 will receive a tax cut of $9075 per year, while those earning less than $45,000 will receive nothing. In fact, more than half of the Stage 3 tax cuts goes to the top 10% of taxpayers. If these tax cuts are really supposed to provide cost-of-living relief, giving most of them to those who need it least is incredibly badly thought-out.

11/ They will make inflation worse

Inflation is estimated to still be above the RBA target range when the Stage 3 tax cuts come into effect in July 2024. Handing out a quarter of a trillion in tax cuts to high income earner, during a time of already high inflation, is only going to make inflation worse, and hurt those on lower incomes more. In fact, an FOI from former Senator Rex Patrick revealed that, to date, our central bankers have done precisely zero analysis on the inflationary impact of the Stage 3 tax cuts.

12/ The RBA will keep interest rates higher for longer, making mortgages even more expensive

Because the RBA is focused on reducing inflation, the inflationary Stage 3 tax cuts mean they will will keep interest rates higher for longer. This will cause more pain to mortgages holders who are already doing it tough.

13/ Over 100 economists and tax experts agree Stage 3 tax cuts are unfair and unaffordable

More than 100 economists and tax experts have published an open letter in the Sydney Morning Herald and the Age newspapers, calling on Prime Minister Anthony Albanese to reconsider the Stage 3 tax cuts for high income earners, calling the tax cuts economically unaffordable and unfair.

High-profile signatories include Nobel Prize Winning Economist Professor Joseph Stiglitz, former Governor of the RBA Bernie Fraser, Former ACCC Chair Professor Alan Fels AO, tax expert Professor Miranda Stewart, Professor John Quiggin, and former Department of Prime Minister & Cabinet Secretary Dr. Mike Keating AC.

14/ More Australians oppose them than support them

Almost twice as many Australians support the Labor Government repealing stage 3 income tax cuts (41%) than oppose (22%).

A majority of Australians (61%) also think that adapting economic policy to suit the changing circumstances, even if that means breaking an election promise, is more important than keeping an election promise regardless of how economic circumstances have changed.

Just 15% of Australians say proceeding with Stage 3 is better for Australia’s long term national interests than increased spending on health and education, or increased defence spending.

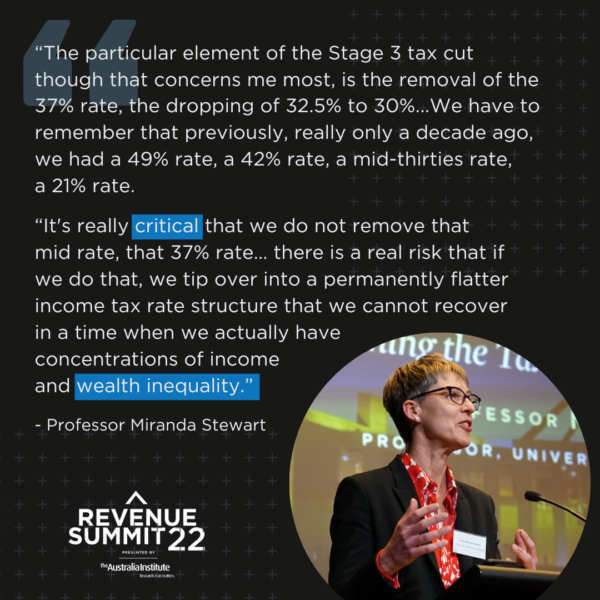

15/ They will permanently flatten our progressive tax system

The highest income earners in Australia pay the highest proportion of tax. It is not a design flaw, it is the system working as designed, and the jewel in the crown of our progressive income tax system. It’s an system designed to promote equality that has served Australia well.

The Stage 3 tax cuts remove the 37% tax bracket entirely and as a consequence flattens Australia’s income tax system and reduces its progressive nature.

16/ Tax cuts for low and middle income earners were temporary, tax cuts for high income earners are a permanent hit to Australia’s revenue base

The Stage 3 tax cuts were announced as part of the Morrison Government’s legislated tax plan, Stage 1 of which was the low and middle income tax offset (LMITO). The LMITO delivered more benefit to those on lower incomes than the Stage 3 tax cuts. So what’s the issue? The LMITO was only a temporary measure, and ended last year. The Stage 3 tax cuts are permanent. Again, delivering temporary fixes for the poor, permanent boosts to the wealthy, and flattening our progressive tax system.

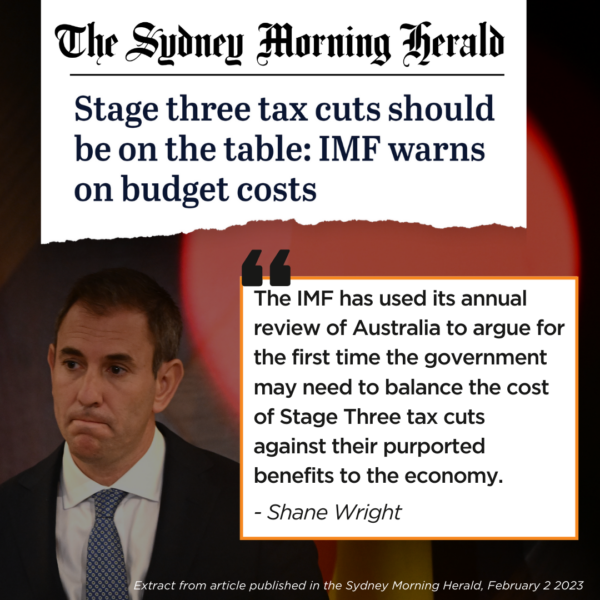

17/ Even the IMF thinks the Stage 3 tax cuts are risky

An IMF report on the Australian economy underscored the economic and budgetary risks of proceeding with the Stage 3 Tax Cuts for high income earners.

18/ FACT: those on lower incomes are more affected by bracket creep than higher incomes, not the other way around

One of the reasons often given in support for the Stage Three tax cuts is that they will reduce the impact of bracket creep. In reality, although those on lower incomes are more affected by bracket creep, Stage Three disproportionally compensates people on higher incomes for bracket creep.

Someone earning $60,000 a year is $1,919 a year better off when compared to the bracket creep baseline. Someone on $200,000 is $19,785 better off than the bracket creep baseline.

If the government is really concerned about bracket creep, Stage 3 is not the way to fix it.

Reduce inequality in Australia by adding your name to our petition

The Stage 3 tax cuts are unfair, irresponsible, and will impact the Government’s ability to delivery quality services that are desperately needed. They should be redesigned, or scrapped altogether.

If you agree, add your name to our petition.

Between the Lines Newsletter

The biggest stories and the best analysis from the team at the Australia Institute, delivered to your inbox every fortnight.

You might also like

The Liberal Party defies its own history on tax

For decades, the Liberal Party has prided itself on being the “party of lower taxes”.

Youth Cultural Passes Could Revive Australian Live Music Industry

With ticket prices rising and the ongoing cost-of-living crisis, a youth cultural pass could make live music more accessible, providing young people with opportunities to support local artists and foster a lifelong love of the arts.

Stage 3 Better – Revenue Summit 2023

Presented to the Australia Institute’s Revenue Summit 2023, Greg Jericho’s address, “Stage 3 Better” outlines an exciting opportunity for the government to gain electoral ground and deliver better, fairer tax cuts for more Australians.