The Stage 3 tax cuts will cost $300bn in their first 9 years. A new tool shows how we can spend the money better

Just before Christmas last month the Parliamentary Budget Office released a “Build Your Own Budget” tool that reveals the interactions of taxes, spending and economic conditions that go into determining the budget balance.

While the tool is an invaluable device for economists, its real value as noted by Labour Market and Fiscal Policy Director Greg Jericho, is how it highlights the massive cost of the Stage 3 tax cuts.

In his Guardian Australian column, Jericho notes that the Stage 3 tax debate has become about all-or-nothing rather than realising the $300bn cost of the tax cuts over 9 years provides an opportunity for the Albanese government to amend the tax cuts and also increase support for benefits and government services.

The Stage 3 tax cuts are so expensive that the PBO’s budget tool reveals you could raise Jobseeker from its current rate of $668 a fortnight to $1,925 and the budget deficit in 2032-33 would still be lower than it is currently predicted to be with the Stage 3 tax cuts.

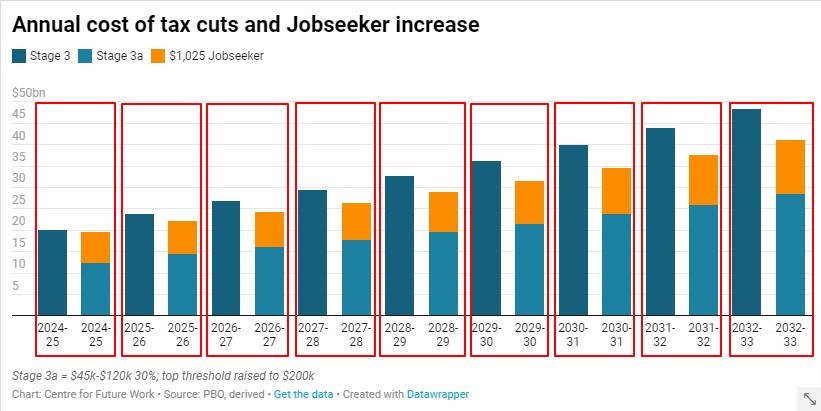

The Stage 3 tax cuts could be amended to reduce the 32.5% tax rate for earnings between $45,000 to $120,000 to 30% and still raise the top tax threshold from $180,000 to $200,000. These still very large tax cuts would cost $120bn less over the first 9 years than would the Stage 3 cuts. That would enable the government to, for example, increase Jobseeker to $1,025 and still have a better budget position than current predicted with the Stage 3 cuts.

This highlights just how many options are available to the government.

Budget are about choices, government is about choices. The Albanese government has a massive choice to make – either continue with the Stage 3 tax cuts that massive hit the budget for little reason other than to hand wealthy people a huge tax cut, or it can take this opportunity to create a fairer economy and society.

Between the Lines Newsletter

The biggest stories and the best analysis from the team at the Australia Institute, delivered to your inbox every fortnight.

You might also like

Stage 3 Better – Revenue Summit 2023

Presented to the Australia Institute’s Revenue Summit 2023, Greg Jericho’s address, “Stage 3 Better” outlines an exciting opportunity for the government to gain electoral ground and deliver better, fairer tax cuts for more Australians.

Analysis: Will 2025 be a good or bad year for women workers in Australia?

In 2024 we saw some welcome developments for working women, led by government reforms. Benefits from these changes will continue in 2025. However, this year, technological, social and political changes may challenge working women’s economic security and threaten progress towards gender equality at work Here’s our list of five areas we think will impact on

Greg’s budget wishlist

The Australian Government can’t afford to do everything, but it can afford to do anything it wants.