Australian super funds investing in nuclear weapons companies

How would you feel if your super was invested in nuclear weapons companies? Well, in Australia, there’s a high chance it is.

The Australia Institute and Quit Nukes looked at the holdings of Australia’s 14 biggest public superfunds, and found that 13 of those invest their members’ money in nuclear weapons.

This might seem strange, especially if your superfund says things like, “we believe in building a sustainable future,” or “we do what’s right with your money”.

Some funds do exclude so-called “controversial weapons”, at least from their “ethical options”. But their definition of “controversial weapon” includes for instance chemical or biological weapons, but not nuclear weapons.

In 2021, Quit Nukes and the Australia Institute analysed the investment portfolios of Australia’s largest superfunds and found that most of them invested their members’ money in companies involved in nuclear weapon production and development, such as Airbus, Honeywell or Thales.

So, how are superfunds tracking?

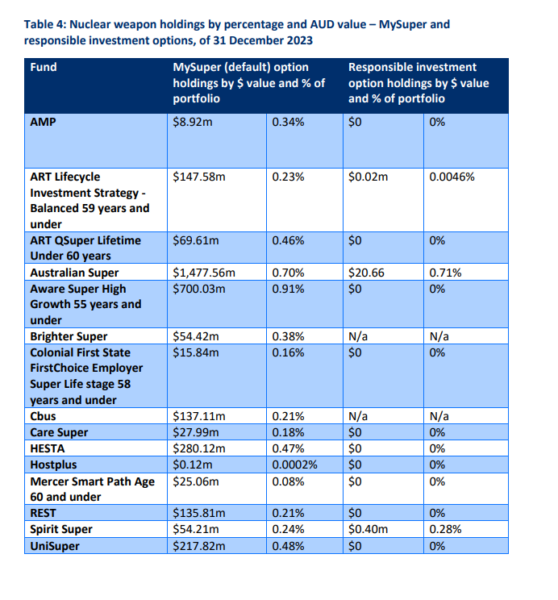

Well…as of December 2023, all of those funds, at the exception of HostPlus, continued to invest in nuclear weapons companies. This adds up to $3.4 billion dollars’ worth of your money invested in nuclear weapons companies.

At the top of the list, Australian Super, who claims to be “Australia’s most trusted fund” and to be “working hard for your future”, invests almost $1.5 billion of Australians’ money in nuclear weapon companies.

Together with Spirit Super, Australian Super also includes nuclear weapons companies in its “socially aware” option.

Aware Super held the greatest percentage of its default MySuper portfolio invested in nuclear weapon companies, with investments in 16 companies.

$3.4 billion is money invested by Australians for their retirement. Are nuclear weapons really where we want to put our money?

In 2021, the world got the first legally binding international agreement to comprehensively prohibit nuclear weapons, the UN Treaty on the Prohibition of Nuclear Weapons.

It says that as long as nuclear weapons exist, nuclear war is an ever-present risk to a safe and sustainable future. Needless to say, nuclear war would also be disastrous for global financial markets.

Our research shows that there is a clear disconnect between what members want and think their funds are doing, and what superannuation funds are actually doing.

As the Australian government is considering joining the UN Treaty on the Prohibition of Nuclear Weapons, it is past time for Australian superannuation funds to meet with international obligations and member expectations.

For Australian superannuation funds to be compliant with evolving norms, international law, and member expectations, and to address systemic risks posed by nuclear weapons they should:

- adopt controversial weapons exclusion policies which include nuclear weapons in the definition of controversial weapons, and;

- exclude NW companies across the whole of their portfolios, with a zero-revenue threshold.

Curious about whether your super invests in nuclear weapons companies?

You can also check here for a list of funds that do not invest in nuclear weapons companies.

Between the Lines Newsletter

The biggest stories and the best analysis from the team at the Australia Institute, delivered to your inbox every fortnight.

You might also like

Dutton’s nuclear push will cost renewable jobs

Dutton’s nuclear push will cost renewable jobs As Australia’s federal election campaign has finally begun, opposition leader Peter Dutton’s proposal to spend hundreds of billions in public money to build seven nuclear power plants across the country has been carefully scrutinized. The technological unfeasibility, staggering cost, and scant detail of the Coalition’s nuclear proposal have

No nukes: Australia must push for serious global nuclear disarmament | Tilman Ruff

Nuclear weapons are still a threat to humanity. In our age of uncertainty, Australia isn’t doing enough to rid the world of these weapons.

Do you have $3 million in super? Me neither. These changes will actually help you

Labor’s planned reforms to superannuation tax concessions may be being reported as “controversial” but the fact is they are popular.