Explainer: How the government collects more from HECS/HELP than the PRRT

The government consistently collects more from people repaying their student debts than it does from the Petroleum Resource Rent Tax.

“Choices matter.”

During his address to the National Press Club, our Executive Director Dr Richard Denniss emphasised that the way we collect and spend tax revenue is one of biggest factors in shaping our economy. It’s also one of the few things we have complete control over.

As Richard said: “…just consider the fact that in Norway, they tax the fossil fuel industry and give kids free university education, in Australia we subsidise the fossil fuel industry and charge kids a fortune to go to university.”

“Indeed, the Commonwealth collects more revenue from HECS fees than it gets from the Petroleum Resource Rent Tax.”

This line stood out for a lot of people – so today we’re taking a look at the numbers behind it.

On the need for wider tax reforms:

“The Australian Government collects more money from HECS than it does from the Petroleum Resource Rent Tax – Richard Denniss at @PressClubAust @RDNS_TAI #insiders #auspolpic.twitter.com/osD3SWF4wF

— Australia Institute (@TheAusInstitute) February 3, 2024

Firstly – what are PRRT & HECS/HELP?

The Petroleum Resources Rent Tax (PRRT) is a special levy designed to make sure Australia benefits from the extraction of our gas and oil resources. Similarly, HECS/HELP is a special levy on tertiary students designed to enable them to contribute to the costs of their tuition once they have begun earning.

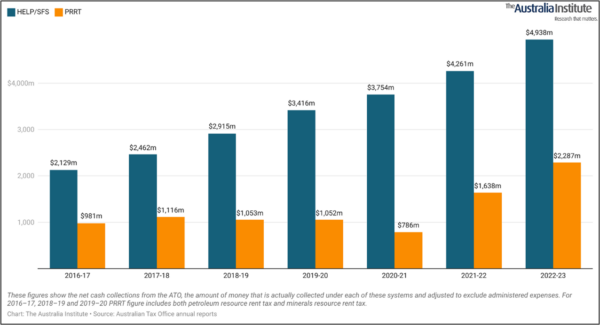

The government consistently collects more from people repaying their student debts than from the Petroleum Resource Rent Tax. These figures can be found in the annual reports of the Australian Tax Office and are displayed below.

Collections by ATO by financial year

Source: ATO Annual Report (2016-17 to 2022-23), “Revenue Collection”

In his 2023 Budget address, the Treasurer, Dr Jim Chalmers, told parliament that the purpose of the PRRT was to ensure “Australians receive a fairer return on the sale of our natural resources” and that changes the government were proposing were to ensure this would occur “sooner”.

It is clear that this is not occurring given in the seven years to 2022-23 the government collected a total of $14,962m more in HECS/HELP than it did from the PRRT – equivalent to 168% more in tax from HECS/HELP than PRRT.

What about other taxes?

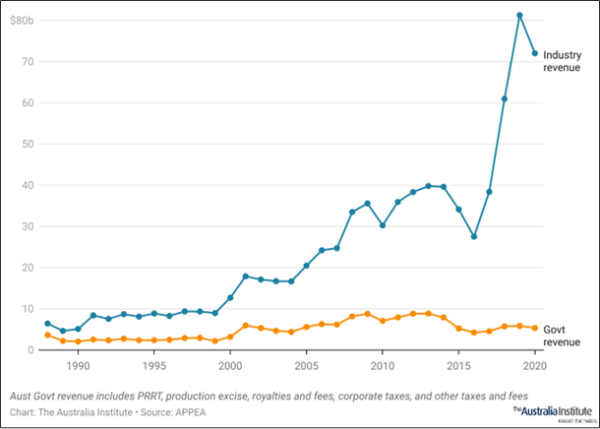

Australia does collect other revenues from the oil and gas industry, some of which are paid by other industries (such as company income tax) and some that are more specific (such as production excises) and the business costs of state royalties. However, government revenues are a small percentage of industry revenue and the gap has grown in recent years.

According to the gas industry’s own figures, in the 5 years from 2015-16 to 2020-21, Australian gas industry production rose 269%, industry revenue rose 196% but the PRRT rose only 20% while company tax actually fell 33%.

Australian industry and government revenue from gas and oil

Additionally, in 2022 Australia Institute analysis showed that five of the gas industry’s most prominent companies paid no company income tax for several years, including Shell, Chevron and Santos.

Similarly, tertiary students also pay other taxes including personal income tax and the GST. They also are required to pay numerous costs towards their higher education, from equipment and textbooks to the costs of accommodation which can often involve moving interstate.

A better way: Norway’s approach

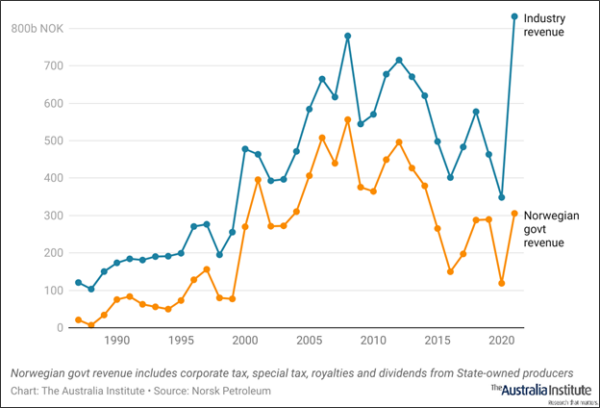

Norway taxes its oil and gas industry in various ways, including the ‘special tax’ which is similar to the PRRT but raises far more revenue.

Norway also captures the revenue flowing from extraction of its resources in various other ways, such as public ownership of companies involved in extraction. This has led to the Norwegian public capturing far more of the benefits of growing industry revenues than Australia.

Norwegian industry and government revenue from gas and oil

Between the Lines Newsletter

The biggest stories and the best analysis from the team at the Australia Institute, delivered to your inbox every fortnight.

You might also like

In 2023-24 Australians paid more than 4 times on HECS/HELP than gas companies did on PRRT

In 2023-24 tax from the PRRT was less than an quarter the amount raised by HECS/HELP debts repayments.

It’s time to reduce the cost of university

Today’s students are finishing their degrees with much larger debts that take longer to pay off, and some young people are now paying close to $50,000 for a three-year bachelor’s degree.

Five reasons why young Australians should be pissed off

1. Uni graduates pay more in HECS than the gas industry pays in PPRT University used to be free but is now more expensive than ever. After graduating with an arts degree a young Australian will now repay the government around $50,000. Meanwhile, Australia is one of the world’s largest gas exporters, but multinational gas