Society works best when everyone feels like they have a stake in its success.

But decades of neoliberalism have reversed Australia from being a place where everyone gets a fair go to one primarily concerned with growing the wealth of the already wealthy.

If you feel like the economy is growing but you’re getting left behind, it’s because you are. The data shows 90 per cent of Australians are largely missing out on the benefits of economic growth and that’s a problem for the government, both economically and politically.

Inequality harms economic growth.

For decades now, we’ve been sold the lie of trickle down economics; that if we give more money and tax breaks to the rich, it will trickle down to those on low and middle incomes. Trickle-down economics is – to put it politely-complete nonsense.

Reversing decades of neoliberalism cannot be done overnight, but if Australia wants continued economic growth, it’s important the federal government begins the work of dismantling neoliberal policies and replacing them with policies that will see Australians share more equally in the benefits of economic growth.

Three tax reforms come to mind immediately: preserving our progressive income tax system by scrapping the stage three tax cuts, capturing a larger share of windfall profits from the gas industry, and making it easier for every Australian to have a shot at having a roof over their head.

Let’s start with scrapping the stage three tax cuts. Australia’s budget is in deficit, and we are in the middle of a cost-of-living crisis, yet the government is about to blow a quarter of a trillion dollars giving CEOs, surgeons and politicians a $9000 a year tax cut. The stage three tax cuts will permanently make Australia’s tax system less progressive by removing an entire income tax bracket.

Young people and those on the minimum wage get bupkis, while about half of the benefit ($122 billion) goes to those earning over $180,00 per year.

It makes little sense economically or politically. They were a bad idea when introduced by Scott Morrison and they are an even worse idea now, when Australia is in completely different economic circumstances.

This week, the Australia Institute released shocking research showing that since the GFC, the bottom 90 per cent of income earners received just seven per cent of the benefits of real per adult economic growth, while the top 10 per cent got 93 per cent of the benefits. It’s a radical reversal from how things used to be not too long ago.

In the economic period that followed the second world war, Australian society shared pretty equally in the spoils of economic growth, with the bottom 90 per cent of income earners enjoying around 90 per cent of benefits between 1950-1960, under Australia’s longest-serving prime minister Robert Menzies.

We often imagine economic growth as a growing pie that gives everyone more, and in the past decades the vast majority of Australians got 96 per cent of that larger pie, now they only get seven per cent. Not so much getting more to eat, but rather fighting over some crumbs falling from the table. This maldistribution of gains from economic growth makes Australia a global outlier too, falling behind the EU, US, UK, China and Canada – whose economies are all sharing the benefits of economic growth more equally.

It’s massively unfair, it’s bad for Australia in the long run and it’s not the only trend that has gotten worse in recent decades.

Corporate profits and wages used to grow at about the same rate. Now profits and wages have completely decoupled and massive corporate profits are driving inflation. When it comes to profits, gas companies are the worst offenders.

Gas companies have been profiteering from the war in Ukraine while driving up domestic gas prices for households, adding to inflation. Worse still, our defective Petroleum Resource Rent Tax (PRRT) means Australia gets hardly any additional revenue from the gas industry’s $40 billion windfall profits.

By fixing the massive loopholes in the PRRT, Treasurer Jim Chalmers could get a fair return for Australians and the budget bottom line, all without introducing a single new tax.

Just as corporate profits are skyrocketing, so too is the cost of buying or renting a house.

Just as the benefits of economic growth now flow to the top 10 per cent of income earners, housing too is becoming something only wealthy people can afford. For a whole generation of young people, being able to afford to buy a house is as fanciful an idea as winning the lottery.

As my colleague Greg Jericho pointed out, for the first time since the second world war, less than half (49.7 per cent) of all people between 30 and 34 years old own a home.

Again, it wasn’t always this way. Back in the 1950s, Menzies saw buying a house as a way to ensure young people felt invested in Australia’s future and for around 68 per cent of 30-34 year olds, that was a reality.

It’s essential to change the tax breaks from those designed to make it easier for investors to add to their property portfolio, to a system that gives all Australians a roof over their head.

Scrapping the stage three tax cuts and properly taxing the gas industry would go a long way to both addressing Australia’s budget deficit as well as reducing the gap between Australia’s richest and poorest citizens.

Reforming Australia’s tax system to reduce inequality and preserve the fair go is not going to be politically easy for the Treasurer, but it is necessary. If the budget doesn’t address at least some of these issues, the Treasurer may find that economic problems can fast become electoral problems.

Between the Lines Newsletter

The biggest stories and the best analysis from the team at the Australia Institute, delivered to your inbox every fortnight.

You might also like

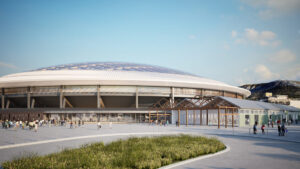

Tasmania can afford a new stadium. Here’s how.

The Macquarie Point stadium proposal is controversial. It’s also painfully expensive.

Fixing Australia’s “arse-backwards” environment laws

Environment laws that don’t stop new gas and coal are like putting screen doors on a submarine.

Defending nature with Bob Brown

Protecting Australia’s incredible natural environment from bad policy, spurred on corporate interests and a hostile media, can sometimes feel like an impossible task. But sometimes, people power wins out.