Despite soaring production and revenues the gas industry is not paying more tax

Australia produces more than six times the amount of gas needed to supply our manufacturing industry, power stations and homes. But more than 80% either heads overseas as LNG exports or is used to convert natural gas into LNG:

We export much more gas than we used to. In the 2000s we exported around 14m tonnes of LNG a year. Now, due to the opening of the Gladstone LNG terminal, we send 83mt overseas – the second most of any nation.

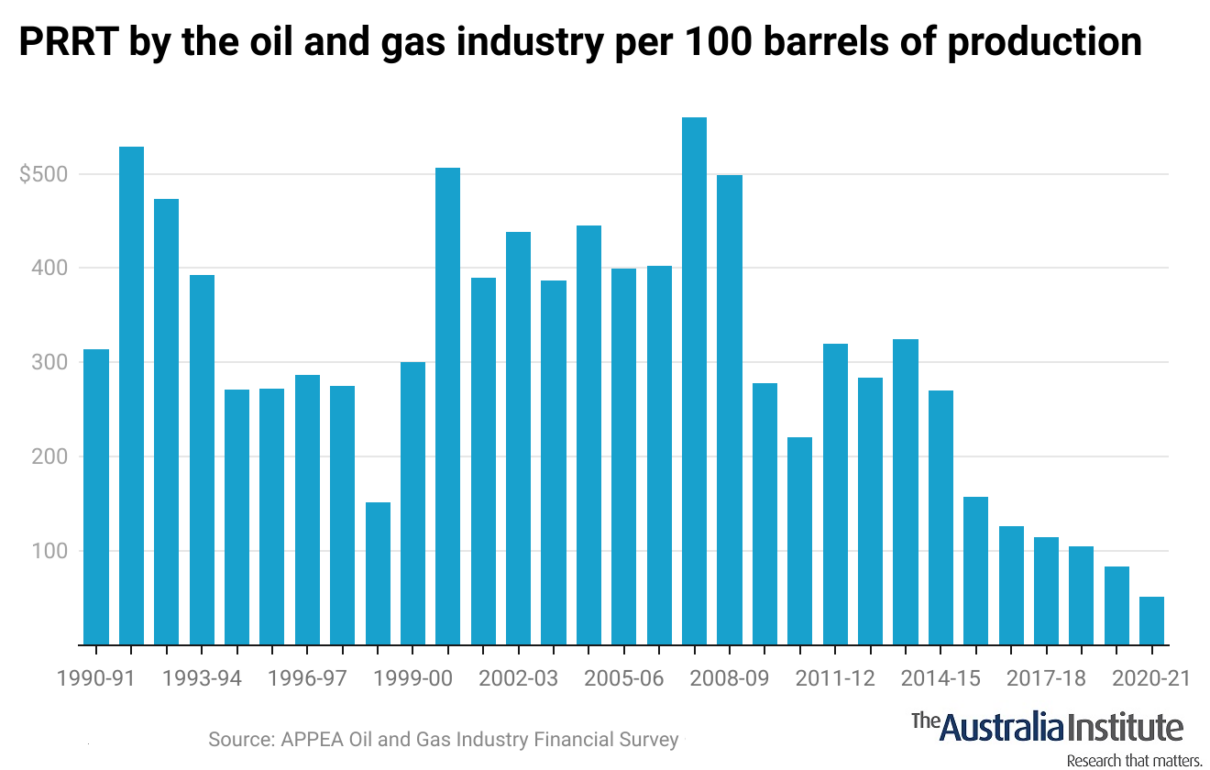

But more production and more revenue has not led to more tax, even though the petroleum resources rent tax (PRRT) is in place to supposedly raise revenue from windfall profits such as those generated by the gas industry after the Russian invasion of Ukraine.

When Australia exported 15.4mt of LNG in 2008-09, the government raised $2.2bn in PRRT. In 2022-23, exports had increased 437% to 83mt but PRRT revenue was up just 7% to $2.4bn.

Did gas suddenly become unprofitable?

No, the problem is that the PRRT is open to manipulation that enables companies to use costs to reduce their PRRT liability such that it appears they are never making “super profits”.

In last year’s budget, the government finally proposed limiting the deductions to the PRRT in any year to 90% of LNG project revenues. Alas that proposal also had a punchline. The government announced the changes would raise an extra $2.4bn in PRRT over the next four years. That was roughly a 30% increase in tax.

Thirty per cent!

You would think the gas industry would launch the mother of all campaigns against it. But no. They loved it.

The day it was announced the gas industry peak body recommended bipartisan support as the changes “would see more revenue collected earlier”. The key word was “earlier”. It won’t raise more tax; it just moves some tax from later to earlier.

But it won’t even do that.

In December’s midyear economic and fiscal outlook, the government announced it was revising down its estimate of how much PRRT would be raised over the next four years.

How much did it reduce its estimate by?

You guessed it: $2.4bn.

We need to change the way the PRRT operates, we need to tax our gas more and we need to do it now.

Between the Lines Newsletter

The biggest stories and the best analysis from the team at the Australia Institute, delivered to your inbox every fortnight.

You might also like

The great gas rip off: how the government can stop us all getting burned

The Albanese government could soon intervene to start fixing one of the biggest ongoing public policy fiascos in this country’s history: Australia’s rampant, uncontrolled gas export industry.

I’ll admit it. Dutton is spot on about one thing when it comes to gas

It’s not often I agree with Peter Dutton, but I can admit when he’s right and he’s right about two things.

SA Premier spreads gas industry misinformation

South Australian Premier Peter Malinauskas has told an event sponsored by the gas lobby that a new gas project in Narrabri, NSW, is needed to firm up his state’s electricity supply.