Trash the Reef, dodge the tax

- Global interest in Australian fossil fuel subsidies

- Trash the Reef, dodge the tax

- Ministers should do their research

- TAI in the media

- Infographic

Global interest in Australian fossil fuel subsidies

The Institute’s recent research into massive taxpayer subsidies provided to the Australian mining industry have begun to attract international attention. Executive Director Richard Denniss was invited to present our research at an international conference in London earlier this month. Richard reported back:

“I think it is hard for international audiences to comprehend either the scale of the Australian coal mining industry, or the scale of subsidies to that industry. Last year, Australia dug up enough coal to make a road of coal one metre deep, ten metres wide, and more than 40,000 kilometres long. That’s long enough to make it around the world.

But rather than rest on our laurels, Australian governments, state and federal, are not just supportive of plans to more than double our coal exports, they are keen to subsidise that expansion through tax concessions, free infrastructure and a wide range of smaller subsidies.

Building international awareness of Australia’s perverse approach to tackling climate change, and perverse approach to subsidising the major cause of climate change, is an important part of shifting our national debate.”

Richard Denniss will be speaking at the Coal & Democracy Forum:

- Date: Wednesday 24 September

- Time: 5:00-8:00pm

- Venue: General Lecture Theatre N205, The Quadrangle, University of Sydney

You can see more about it here. Sydney Democracy Network Festival of Democracy

You can donate to support our work on mining and help get us even further out there!

Trash the Reef, dodge the tax

It’s been a roller-coaster week or two for Queensland coal, particularly for Indian energy company Adani, who are behind some of the biggest proposals for major mines and the expansion of the Abbot Point coal port near the Great Barrier Reef.

First there was some good news. Adani and other backers of the Abbot Point project, including Gina Rinehart’s GVK Hancock and the Queensland Government-owned port company, backed down on their determination to have dredge spoil from the Abbot Point expansion dumped inside the Great Barrier Reef Marine Park. Instead, they started looking around for sites on land where the 3 million cubic meters of mud and sand could be parked. Opponents of the project and lovers of the reef greeted this news with cautious optimism.

After that, the news went a bit sour. Fairfax Media journalists went out to an Adani construction project in Gujurat, India, and spoke to some of the workers there. They were told of child labour, unpaid workers and living quarters for workers “with poor sanitary conditions leading to 15 cholera outbreaks since January.” Union representatives said they had been “repeatedly barred from entering [Adani’s] worksite”. Is this really a company Australia wants to entrust with the management of parts of the Great Barrier Reef?

Then from bad to worse. Fairfax’s business columnist, Michael West, and Tim Buckley from the Institute for Energy Economics and Financial Analysis, got hold of Adani’s latest financial reports. Not only did they conclude that Adani’s projects are financially a “white elephant with purple polka dots”, something Buckley has been saying for a long time, but they uncovered the company’s plans for dodging tax through inter-company loans. The Adani parent company is lending money to its Australian subsidiary at interest rates higher than the parent can borrow at. The subsidiary will claim the excessive interest expenses on this loan as a deduction on any tax it might have to pay in Australia, effectively transferring any profits to India.

Finally, for the mining giant, there was some good news. Good news for Adani, dreadful news for Queensland taxpayers. The Queensland Government is proposing to pay Adani and its partners for the dredged mud. Last week they wanted to dump it at sea, but now they want to use this “valuable resource” to reclaim land near the port “to host more port businesses”…..or to “enhance wetlands”…or something. Has there been a cost benefit analysis done on this, as Treasurer Tim Nicholls promised would be done on all such projects? Errr…no.

You have to hand it to these guys – they’re good. They’re a foreign company with a miserable labour and environmental record, getting Queensland to buy its own mud back from them, in order to facilitate a project that will lose money for everyone. If they can get away with this, then selling more coal in the age of climate change should be easy.

Ministers should do their research

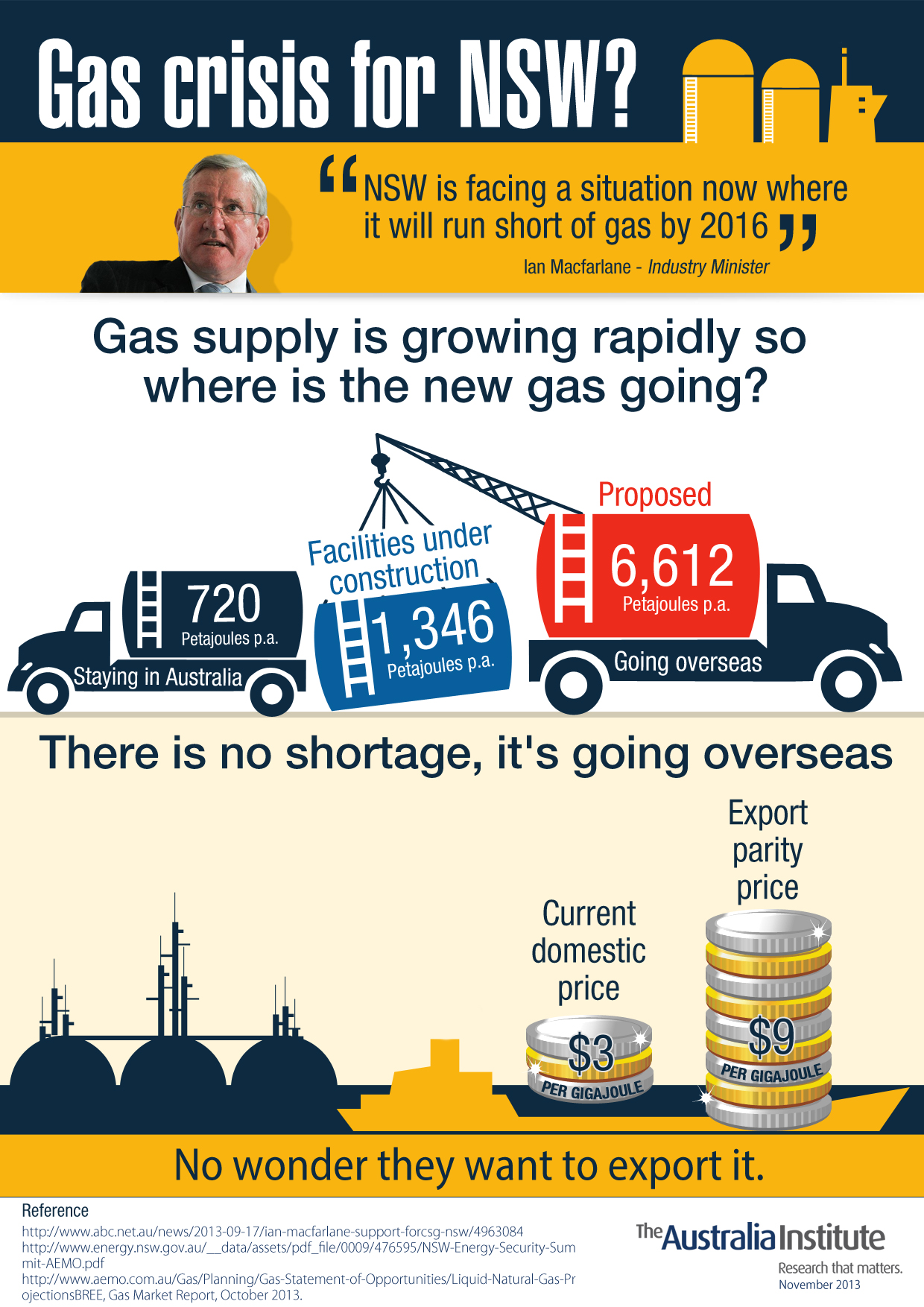

Ian Macfarlane is again criticising the NSW government for its restrictions on CSG. He warns that gas prices will be “north of $10 a gigajoule.” The only solution “is to flood the market with gas”. The minister’s solution shows how confused he is about how the gas market works, and what is causing the gas price to rise.

More on that in a moment. First it is interesting to look at the seeming transformation of the minister’s opinion on the NSW CSG restrictions pre and post election. Before the election, he not only agreed with the restrictions but claimed responsibility for them. Video of Mr Macfarlane reassuring farmers on the Cecil Plains in Queensland before the last federal election shows him saying “I was the one who drove the issue in New South Wales where the resource companies were told they couldn’t drill within two kilometres of houses.”

He goes on to say that he drove those restrictions because they were the “right thing to do”.

“I try and do the right thing. So if you need a voice at a federal level on this issue then I’m always there.”

Since the election, he has attacked the NSW government for its restrictions on CSG. It would be interesting to know how the farmers who heard his talk and others who saw it before the election feel about his ‘voice at the federal level’.

But even if the minister was not betraying a group that he said he’d support before the election, his solution, raising the price, will achieve nothing but grow the profits of the predominately foreign-owned mining companies.

Gas prices are rising because, for the first time in eastern Australia, gas companies will be able to export to the rest of the world. This will occur with the completion of three huge gas export facilities near Gladstone in Queensland.

When complete, they will push the gas price up to equal the export parity price. This is the price of gas overseas minus the cost of getting it there. While gas prices have been between $3 and $4 a gigajoule in eastern Australia in recent years, the export parity price is $9 to $10 per gigajoule. That’s a doubling or tripling of wholesale gas prices.

Since the Australian gas price will be linked to the world gas price, only changes in the world price will change the Australian price. An increase in supply of gas in NSW will not have any material effect on the world price. Flooding the gas market in NSW will not lower prices, it will just increase gas exports.

Look at it like this; if you’re a profit maximising gas company and you can sell gas to the export facility for $10 a gigajoule, you’re not going to sell gas to a domestic consumer for less than $10. If the amount of gas you drill doubles, you’re still not going to sell the gas for less than $10. Only if the gas export facility is offering less will you sell for less. Once Australia is linked to the world price, more supply is not going to unlink it.

So why is the gas industry and Ian Macfarlane pushing this solution? The gas price has doubled or tripled. Gas is more profitable that it has ever been and gas companies are keen to sell as much as they can.

Too bad for the farmers who will see their land dotted with CSG wells. The same farmers that Mr Macfarlane was happy to reassure before the election.

TAI in the media

NSW miners are fighting the cane toad factor

OPINION: Real threat is Queensland’s coal industry

Menzies, a failure by today’s rules, ran a budget to build the nation

Community group says it has evidence T4 should be rejected

Infographic

Between the Lines Newsletter

The biggest stories and the best analysis from the team at the Australia Institute, delivered to your inbox every fortnight.

You might also like

Trashing a treasure. 28 days after the election, the Australian government faces a critical test of its priorities

Just 28 days after tomorrow’s federal election, the government faces a critical decision, which will send a message to the world about its priorities.

Business groups want the government to overhaul the tax system? Excellent – we have some ideas.

The landslide win by the ALP has seen business groups come out demanding the government listen to their demands despite having provided them no support, and plenty of opposition, over the past 3 years.

5 ways and 63 billion reasons to improve Australia’s tax system

With a federal election just around the corner, new analysis from The Australia Institute reveals 63 billion reasons why our next Parliament should improve the nation’s tax system.