Right now, the big numbers of the economy look pretty good. Unemployment in June was just 3.5% – the lowest since 1974. So why has consumer confidence crashed and why are so many Australians worried about a recession?

Labour market and fiscal policy director, Greg Jericho writes in Guardian Australia that the rising level of inflation, which combined with low wages growth has led to massive falls in real wages, has many Australians wondering if increasing interest rates is going bring the economy to a halt.

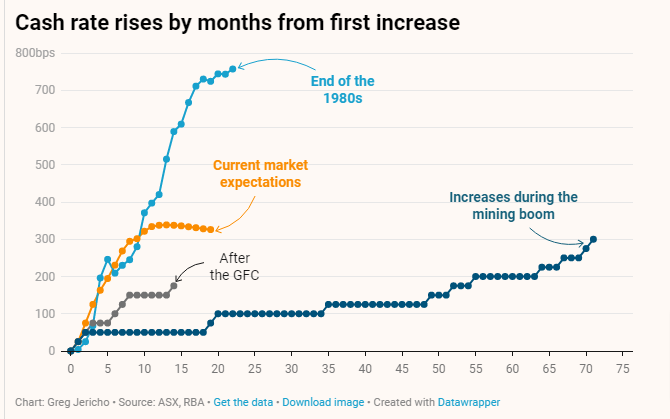

He writes that for now a recession is unlikely, but the risks remain. Previous periods of sharply increasing rates have been followed by rising unemployment, and the current market expectations for the cash rate rising above 3.5% within a year would certainly create a massive brake on the economy.

The story from overseas is also worrying, with the United States battling even higher inflation than Australia and suggestions that the market is already pricing in a recession.

It all highlights that while today’s labour force figures are on the surface very promising, they also show just how affected the economy continues to be by the pandemic. Nearly 300,000 employed in June worked zero hours because of sickness or injury – well over double the usual amount.

The nearly 50-year low unemployment rates are also failing to lead to wages growth anywhere near what would have been expected in previous years, let alone at a level that is keeping up with inflation.

While inflationary pressure do remain, the risk that the Reserve Bank will raise rates too high and too fast remains very much in place – especially given the lack of wages growth.

Between the Lines Newsletter

The biggest stories and the best analysis from the team at the Australia Institute, delivered to your inbox every fortnight.

You might also like

The continuing irrelevance of minimum wages to future inflation

Minimum and award wages should grow by 5 to 9 per cent this year

If business groups had their way, workers on the minimum wage would now be $160 a week worse off

Had the Fair Work Commission taken the advice of business groups, Australia lowest paid would now earn $160 less a week.

Analysis: Will 2025 be a good or bad year for women workers in Australia?

In 2024 we saw some welcome developments for working women, led by government reforms. Benefits from these changes will continue in 2025. However, this year, technological, social and political changes may challenge working women’s economic security and threaten progress towards gender equality at work Here’s our list of five areas we think will impact on