In the past 7 months, the Reserve Bank has increased the cash rate by 275 basis points. That is as fast as any time since the RBA became independent. Given the pace of inflation growth, the rises are not wholly without cause, but as policy director, Greg Jericho notes in his Guardian Australia column the main drivers of inflation are now easing, and wages are yet to take off. In that case, should the RBA continue to raise rates given it will only slow the economy further?

Over the past year, the main driver of inflation has been house prices accounting for a quarter of the 7.3% rise in the CPI. And yet we know that house price growth is now either slowing dramatically or even falling in some areas. The RBA has also noted that commodity prices are falling and supply-side issues are being dealt with and that these aspects, which are not influenced by interest rates, will reduce inflation next year.

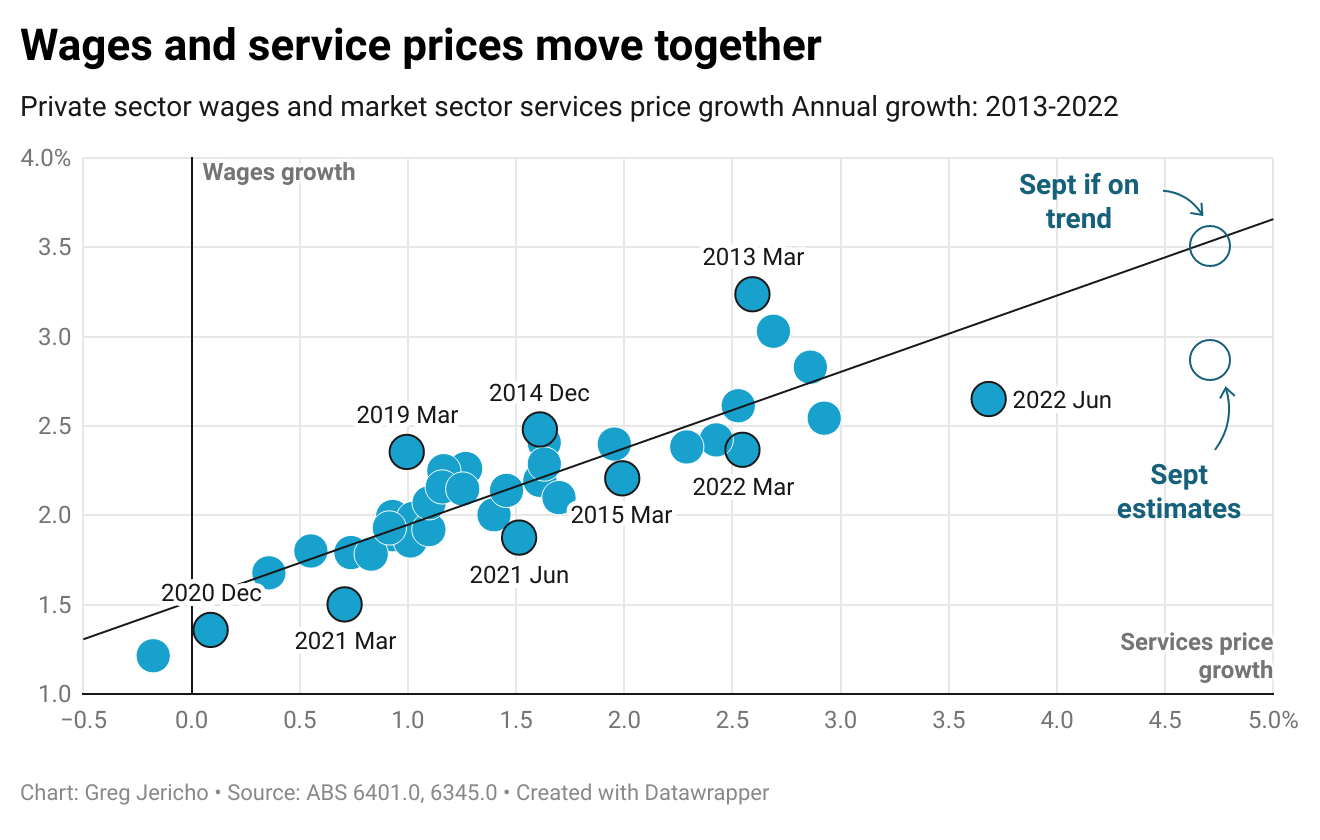

At the same time, the Reserve Bank continues to sound warnings of a wage-price spiral despite any evidence of such a thing occurring. Indeed the latest CPI figures show that overwhelmingly inflation is driven by the price rises of goods rather than services. This is important because service prices and wages are strongly linked.

More rate rises will certainly continue to reduce demand in the economy as the cost of servicing a mortgage rises. But to what end? The main factors driving inflation are easing, wages have not risen above 3% yet, let alone to a rate anywhere near inflation.

Even if wages were to rise in line with the historical link with service prices, in September they would have risen 3.5% – a level very much consistent with inflation growth of between 2% and 3%. And yet we know that wages are unlikely to rise that fast. The most recent estimates have it closer to 2.8%.

The great risk now is that further rate rises will only hurt the economy for little gain and see wages growth stunted before they even get to a level that would see real wages rising.

Between the Lines Newsletter

The biggest stories and the best analysis from the team at the Australia Institute, delivered to your inbox every fortnight.

You might also like

Corporate Profits Must Take Hit to Save Workers

Historically high corporate profits must take a hit if workers are to claw back real wage losses from the inflationary crisis, according to new research from the Australia Institute’s Centre for Future Work.

“Right to Disconnect” Essential as Devices Intrude Into Workers’ Lives

Australia’s Parliament is set to pass a new set of reforms to the Fair Work Act and other labour laws, that would enshrine certain protections for workers against being contacted or ordered to perform work outside of normal working hours. This “Right to Disconnect” is an important step in limiting the steady encroachment of work

New laws for ‘employee-like’ gig workers are good but far from perfect

The Workplace Relations Minister Tony Burke has described proposed new laws to regulate digital platform work as building a ramp with employees at the top, independent contractors at the bottom, and gig platform workers halfway up. The new laws will allow the Fair Work Commission to set minimum standards for ‘employee-like workers’ on digital platforms.