Premium price: The impact of climate change on insurance costs

Authors

Media release

Climate change driving insurance premiums adding to cost of living pressure and inflation

Around the world, climate change is increasing the costs of insurance and Australia is no exception.

Between 2022 and 2023, the average home insurance premium in Australia rose by 14%, the biggest rise in a decade.

Major floods in eastern Australia pushed insured losses in 2022 to a record $7 billion, almost double previous records. Perhaps more alarmingly, since 2013, insured losses in each year have exceeded the combined losses of the five years from 2000 to 2004.

Modelling from The McKell Institute estimated that the direct cost of natural disasters in Australia could reach $35 billion per year (in 2022 dollars) by mid-century, an average of more than $2,500 per household per year. However, such averages hide more than they reveal. In areas at high risk of extreme weather events, insurance costs are multiples of national averages.

Research from the Actuaries Institute shows that nearly one in eight households – 1.25 million people – suffer home insurance affordability stress and pay more than four weeks gross income on home insurance premiums. One in 20 households pay more than seven weeks of gross income on home insurance. In other words, these households work from New Year’s Day almost to the end of February, simply to pay their home insurance.

In northern Western Australia, home and contents insurance costs on average $4,395 per year, which is more than double the $1,779 per year cost for Australians in the southern two thirds of the country. It is also significantly more than the $3,069 that the average Australian household spends on electricity in a year. In the Northern Territory average premiums are $2,922, and in North Queensland $2,918, roughly 60% higher than the rest of the country.

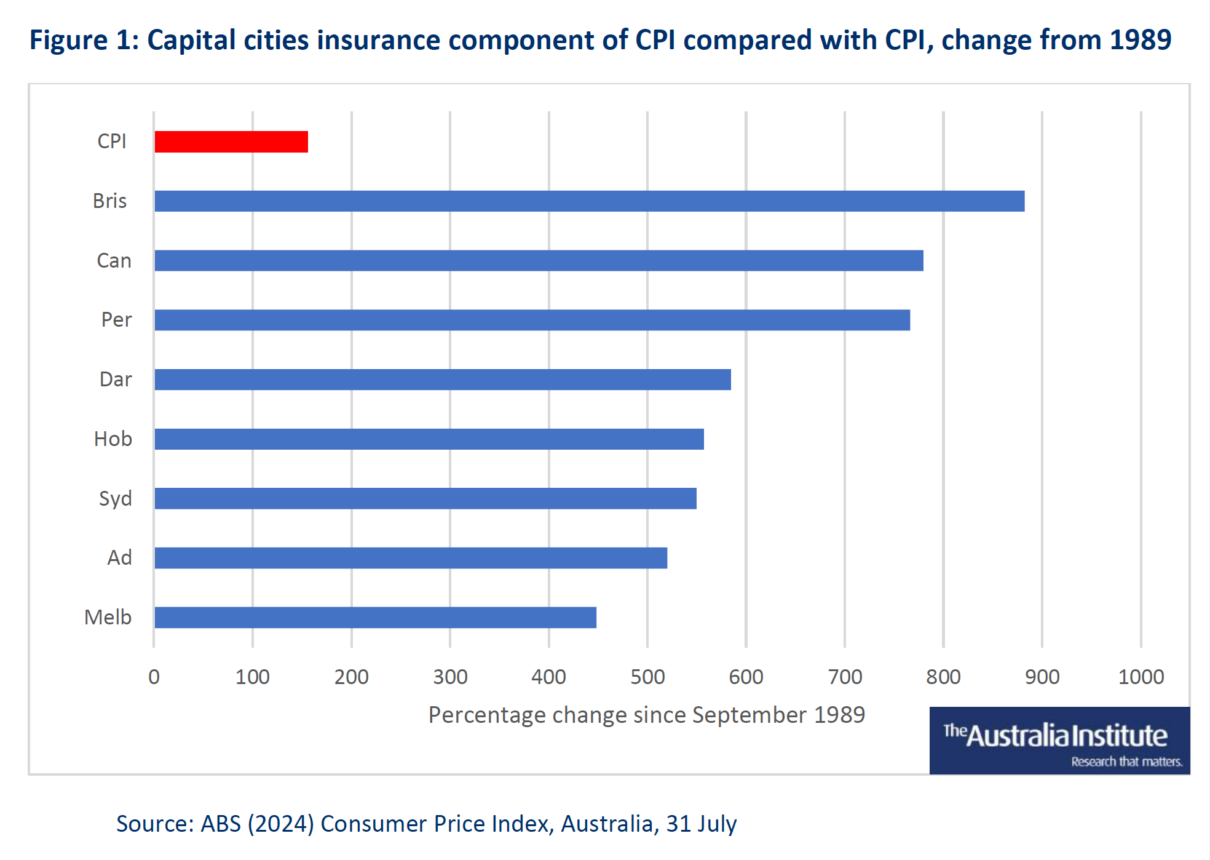

Even considering only capital city insurance costs, the cost increases are significant, and place significant pressure on inflation. Over the past 35 years insurance costs in every capital city have vastly exceeded the increase in the Consumer Price Index (CPI). In Brisbane, insurance costs rose by more than five times CPI, while even in Melbourne, where the increase has been lowest, the rise in insurance costs was still 2.8 times CPI.

Figure 1 below shows how insurance costs in capital cities have exceeded the increase in CPI over the last 35 years.

The profitability of home insurance has declined significantly with many insurers and underwriters making substantial losses.

The most obvious policy response is to address climate change, both mitigating its magnitude and adapting to its impacts. Beyond this, specific policies to engage with the insurance market may be required but will need to be carefully calibrated and regularly reviewed. The Morrison Government’s $10 billion fund to help address insurance affordability in cyclone-affected areas appears to have had only modest impact, with the Australian Consumer and Competition Commission reviews of the fund, finding:

“It still may be some time before the full effects of changes to prices and choice are seen across the industry, and it may be difficult to isolate the effects of the pool from the range of other factors impacting insurance markets.”

Careful policy responses will be required to ensure that Australians can insure their homes in a way that is equitable, affordable and without unintended consequences.