August 2018

Medibank Private – reported full year results on 24 August 2018

New analysis by The Australia Institute shows that based on Medibank Private’s annual report, the company tax cut would be a $554.9 million gift over the first decade of the cut to just this one company. Return to Revenue Watch $ million Profit 2017-18 628.3 Company tax 2017-18 183.2 Benefit from company tax cut based

Coca-Cola Amatil – reported half year results on 22 August 2018

New analysis by The Australia Institute shows that based on Coca-Cola Amatil’s annual report, the company tax cut would be a $201.7 million gift over the first decade of the cut to just this one company. Return to Revenue Watch $ million Profit 2017-18 232.1 Company tax 2017-18 66.6 Benefit from company tax cut based

Sydney Airport – reported half year results on 22 August 2018

New analysis by The Australia Institute shows that based on Sydney Airport’s annual report, the company tax cut would be a $65.4 million gift over the first decade of the cut to just this one company. Return to Revenue Watch $ million Profit 2017-18 194.8 Company tax 2017-18 21.6 Benefit from company tax cut based

Seven Group – reported full year results on 22 August 2018

New analysis by The Australia Institute shows that based on Seven Group’s annual report, the company tax cut would be a $192.3 million gift over the first decade of the cut to just this one company. Return to Revenue Watch $ million Profit 2017-18 468.7 Company tax 2017-18 63.5 Benefit from company tax cut based

Lendlease – reported full year results on 22 August 2018

New analysis by The Australia Institute shows that based on Lendlease’s annual report, the company tax cut would be a $825.7 million gift over the first decade of the cut to just this one company. Return to Revenue Watch $ million Profit 2017-18 1,066.2 Company tax 2017-18 272.6 Benefit from company tax cut based on

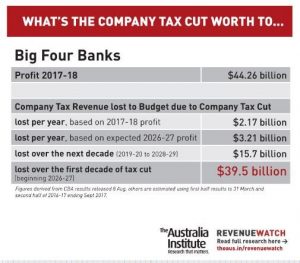

Big Four Banks

New analysis by The Australia Institute shows that based on the big four banks’ reporting, the company tax cut would be a $39.49 billion gift over the first decade of the cut to just these four companies. Big Four Banks $ million Profit 2017-18 44,262 Benefit from company tax cut based on 2017-18 profit 2,173

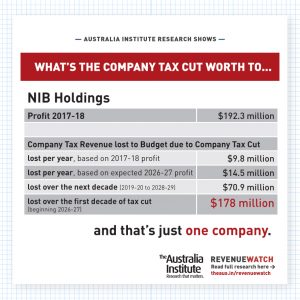

NIB Holdings – reported full year results on 20 August 2018

New analysis by The Australia Institute shows that based on NIB Holdings’s annual report, the company tax cut would be a $178.1 million gift over the first decade of the cut to just this one company. Return to Revenue Watch $ million Profit 2017-18 192.3 Company tax 2017-18 58.8 Benefit from company tax cut based

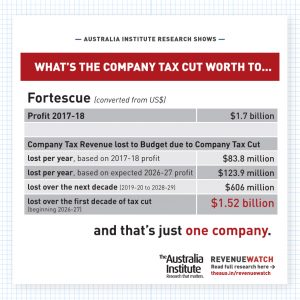

Fortescue – reported full year results on 20 August 2018

New analysis by The Australia Institute shows that based on Fortescue’s annual report, the company tax cut would be a $1.523 billion gift over the first decade of the cut to just this one company. Return to Revenue Watch $ million (converted from US$) Profit 2017-18 1,705.7 Company tax 2017-18 502.8 Benefit from company tax

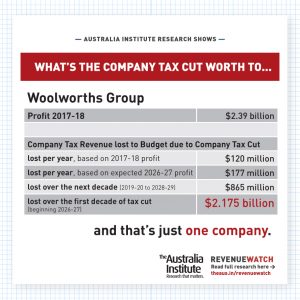

Woolworths Group – reported full year results on 20 August 2018

New analysis by The Australia Institute shows that based on Woolworths Group’s annual report, the company tax cut would be a $2.175 billion gift over the first decade of the cut to just this one company. Return to Revenue Watch $ million Profit 2017-18 2,394 Company tax 2017-18 718 Benefit from company tax cut based

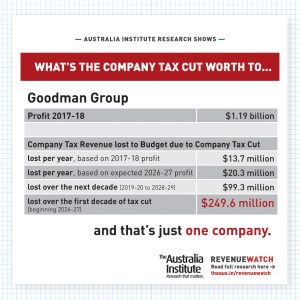

Goodman Group – reported full year results on 17 August 2018

New analysis by The Australia Institute shows that based on Goodman Group’s annual report, the company tax cut would be a $249.6 million gift over the first decade of the cut to just this one company. Return to Revenue Watch $ million Profit 2017-18 1,185.2 Company tax 2017-18 82.4 Benefit from company tax cut based

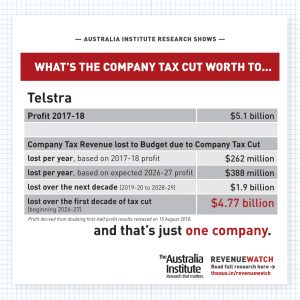

Telstra – reported full year results on 16 August 2018

New analysis by The Australia Institute shows that based on Telstra’s annual report, the company tax cut would be a $4.765 billion gift over the first decade of the cut to just this one company. Return to Revenue Watch $ million Profit 2017-18 5,102 Company tax 2017-18 1,573 Benefit from company tax cut based on

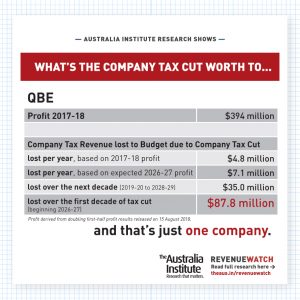

QBE – reported half year results on 15 August 2018

New analysis by The Australia Institute shows that based on QBE’s annual report, the company tax cut would be a $87.8 million gift over the first decade of the cut to just this one company. Return to Revenue Watch $ million Profit 2017-18 394.0 Company tax 2017-18 29.0 Benefit from company tax cut based on

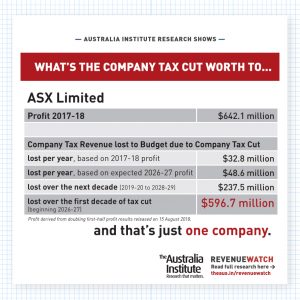

ASX Limited – reported full year results on 16 August 2018

New analysis by The Australia Institute shows that based on ASX Limited’s annual report, the company tax cut would be a $596.7 million gift over the first decade of the cut to just this one company. Return to Revenue Watch $ million Profit 2017-18 642.1 Company tax 2017-18 197.0 Benefit from company tax cut based

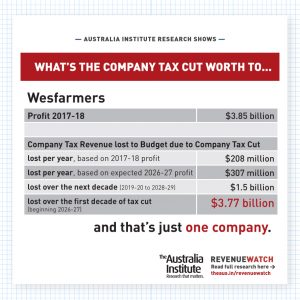

Wesfarmers – reported full year results on 15 August 2018

New analysis by The Australia Institute shows that based on Wesfarmers’s annual report, the company tax cut would be a $3.77 billion gift over the first decade of the cut to just this one company. Return to Revenue Watch $ million Profit 2017-18 3,850 Company tax 2017-18 1,246 Benefit from company tax cut based on

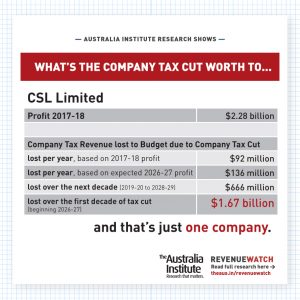

CSL Limited – reported full year results on 15 August 2018

New analysis by The Australia Institute shows that based on CSL Limited’s annual report, the company tax cut would be a $1.67 billion gift over the first decade of the cut to just this one company. Return to Revenue Watch $ million Profit 2017-18 2,281 Company tax 2017-18 552 Benefit from company tax cut based

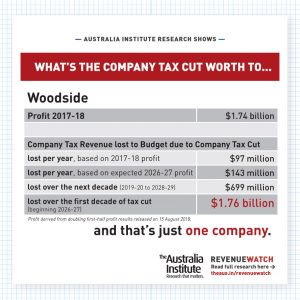

Woodside – reported half year results on 15 August 2018

New analysis by The Australia Institute shows that based on Woodside’s annual report, the company tax cut would be a $1.76 billion gift over the first decade of the cut to just this one company. Return to Revenue Watch $ million Profit 2017-18 (Twice half year result) 1,740 Company tax 2017-18 (Twice half year result)

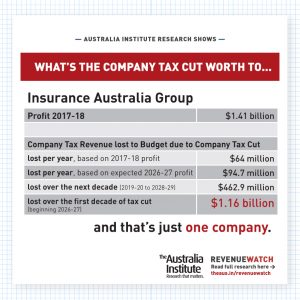

Insurance Australia Group Limited – reported full year results on 15 August 2018

New analysis by The Australia Institute shows that based on Insurance Australia Group Limited’s annual report, the company tax cut would be a $1.2 billion gift over the first decade of the cut to just this one company. Return to Revenue Watch $ million Profit 2017-18 1,410.0 Company tax 2017-18 384.0 Benefit from company tax

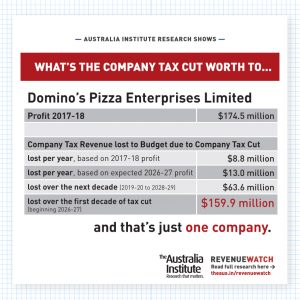

Domino’s Pizza Enterprises Limited – reported full year results on 14 August 2018

New analysis by The Australia Institute shows that based on Domino’s Pizza Enterprises Limited’s annual report, the company tax cut would be a $159.9 million gift over the first decade of the cut to just this one company. Return to Revenue Watch $ million Profit 2017-18 174.5 Company tax 2017-18 52.8 Benefit from company tax

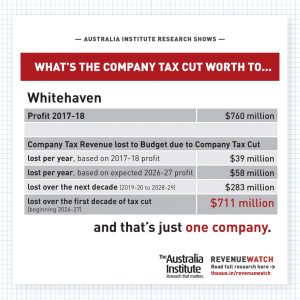

Whitehaven – reported full year results on 14 August 2018

New analysis by The Australia Institute shows that based on Whitehaven’s annual report, the company tax cut would be a $711 million gift over the first decade of the cut to just this one company. Return to Revenue Watch $ million Profit 2017-18 760 Company tax 2017-18 235 Benefit from company tax cut based on

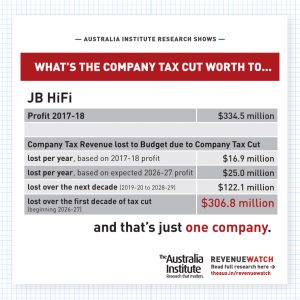

JB Hifi – reported full year results on 13 August 2018

New analysis by The Australia Institute shows that based on JB Hifi’s annual report, the company tax cut would be a $306.8 million gift over the first decade of the cut to just this one company. Return to Revenue Watch $ million Profit 2017-18 334.5 Company tax 2017-18 101.3 Benefit from company tax cut based

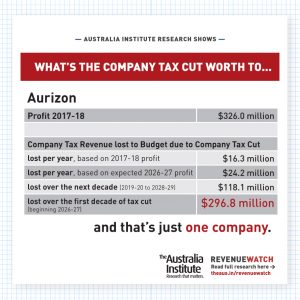

Aurizon – reported full year results on 13 August 2018

New analysis by The Australia Institute shows that based on Aurizon’s annual report, the company tax cut would be a $296.8 million gift over the first decade of the cut to just this one company. Return to Revenue Watch $ million Profit 2017-18 326.0 Company tax 2017-18 98.0 Benefit from company tax cut based on

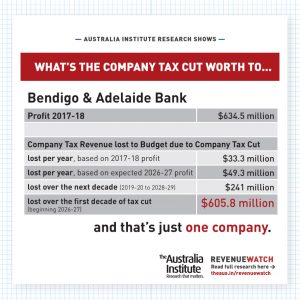

Bendigo and Adelaide Bank – reported full year results on 13 August 2018

New analysis by The Australia Institute shows that based on Bendigo and Adelaide Bank’s annual report, the company tax cut would be a $605.8 million gift over the first decade of the cut to just this one company. Return to Revenue Watch $ million Profit 2017-18 634.5 Company tax 2017-18 200 Benefit from company tax

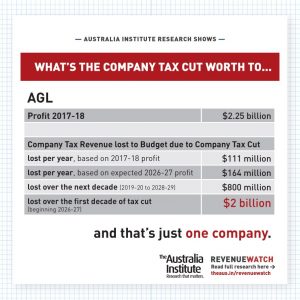

AGL – reported full year results on 9 August 2018

New analysis by The Australia Institute shows that based on AGL’s annual report, the company tax cut would be a $2.011 billion gift over the first decade of the cut to just this one company. Return to Revenue Watch $ million Profit 2017-18 2,251 Company tax 2017-18 664 Benefit from company tax cut based on

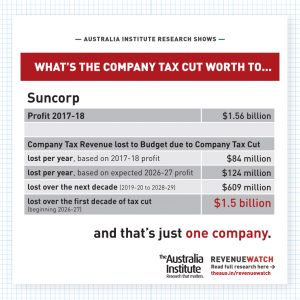

Suncorp – reported full year results on 9 August 2018

New analysis by The Australia Institute shows that based on Suncorp’s annual report, the company tax cut would be a $1.53 billion gift over the first decade of the cut to just this one company. Return to Revenue Watch $ million Profit 2017-18 1,564 Company tax 2017-18 505 Benefit from company tax cut based on

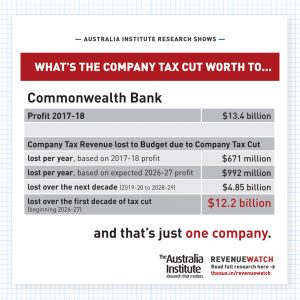

Commonwealth Bank – reported full year results on 8 August 2018

New analysis by The Australia Institute shows that based on Commonwealth Bank’s annual report, the company tax cut would be a $12.195 billion gift over the first decade of the cut to just this one company. Return to Revenue Watch Commonwealth Bank $ million Profit 2017-18 13,420 Company tax 2017-18 4,026 Benefit from company tax

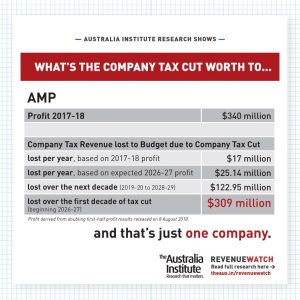

AMP – reported half year results on 8 August 2018

New analysis by The Australia Institute shows that based on AMP’s annual report, the company tax cut would be a $308.95 million gift over the first decade of the cut to just this one company. Return to Revenue Watch AMP $ million Profit 2017-18 340 Company tax 2017-18 102 Benefit from company tax cut based

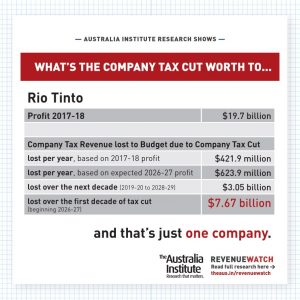

Company tax cuts: $7.67 billion to just one company

New analysis by The Australia Institute shows that based on Rio Tinto’s half year report, the company tax cut would represent a $7.67 billion gift to Rio Tinto over the first decade of the cut. The Australia Institute has today launched a new Revenue Watch initiative, looking at companies over reporting season, to quantify how

Rio Tinto – reported half year results on 1 August 2018

New analysis by The Australia Institute shows that based on Rio Tinto’s half year report, the company tax cut would be a $7.67 billion gift over the first decade of the cut to just this one company. Return to Revenue Watch Rio Tinto $ million Worldwide Income 2017-18 54,844 Profit 2017-18 19,699 Company tax 2017-18

Introducing Revenue Watch

This August, The Australia Institute will be launching our latest initiative: Revenue Watch.

General Enquiries

Emily Bird Office Manager

mail@australiainstitute.org.au

Media Enquiries

Glenn Connley Senior Media Advisor

glenn.connley@australiainstitute.org.au