Articles

January 2019

Trans Tarkine Track clips

Over the summer, we have been busy recording what Tasmanians think about a whole range of issues. Tassie is cool and tourism is hot – with our state having the largest rise in visitor numbers this quarter. Whilst some in the South and East are worried about over crowding and under funding of infrastructure, the

Rebuilding Vocational Training in Australia

Australia’s manufacturing sector has been experiencing an important and welcome rebound during the last two years. The turnaround has been documented and analysed in previous Centre for Future Work research (including studies published in 2017 and 2018 as part of the National Manufacturing Summit, co-sponsored by the Centre).

December 2018

New Video: Australia Needs a Pay Rise!

Jim Stanford, Director of the Centre for Future Work, was recently featured in a new video produced in collaboration with United Voice and the Flip production company.

Let’s Unpack the Government’s Anti-Corruption Watchdog Announcement

The Australia InstituteFollowDec 13, 2018 BREAKING: the government has announced it will establish a Commonwealth Integrity Commission to investigate corrupt conduct at the federal level. Prime Minister Scott Morrison and Attorney General Christian Porter this morning held a press conference where they made the announcement to set up a new federal anti-corruption watchdog. Australia Institute

November 2018

New Book: The Wages Crisis in Australia

Australian wage growth has decelerated in recent years to the slowest sustained pace since the 1930s. Nominal wages have grown very slowly since 2012; average real wages (after adjusting for inflation) have not grown at all. The resulting slowdown in personal incomes has contributed to weak consumer spending, more precarious household finances, and even larger government deficits.

Go Home on Time Day 2018

Wednesday 21 November is Australia’s official “Go Home On Time Day,” sponsored by the Centre for Future Work and the Australia Institute. This represents the 10th year of our initiative, to provide light-hearted encouragement to Australian workers to actually leave their jobs when they are supposed to. Instead of working late once again – and allowing your employer to “steal” even more of your time, without even paying for it – why not leave the job promptly. Spend a full evening with your family or friends, visit the gym, see a movie – do anything other than work.

6 key takeaways from Joseph Stiglitz’s National Press Club Address

Why would the IMF put dealing with inequality at the centre of their economic agenda? Professor Joseph Stiglitz explains in his National Press Club Address. The Australia InstituteFollowNov 16, 2018 Professor Joseph Stiglitz. (photo: Sasha Maslov) 1 // Progressive economics make more equal societies. “Why would an institution like the International Monetary Fund (IMF) put dealing with inequality

October 2018

Gas & coal power has broken down 114 times so far this year, fair dinkum.

On average, that’s one gas & coal plant breakdown every 2.6 days. The Australia InstituteFollowOct 23, 2018 Above: Yallourn W Power Station, image used under Creative Commons license. The Australia Institute’s Gas & Coal Watch has been tracking gas and coal power plant breakdowns and gas and coal power plants have broken down 114 times this calendar

The Price is Not Right — Australia’s Environment Minister and the Pacific

The Australia InstituteFollowOct 19, 2018 The Pacific Islands will potentially suffer the worst impacts of climate change Richie Merzian is The Australia Institute’s Climate & Energy Program Director — @RichieMerzian When the lights are on and the cameras are rolling, most government Ministers know that they must at least pretend to believe in and care about the impacts of

Government way off mark for Paris Target: new analysis

When it comes to meeting the Paris Target, new analysis from The Australia Institute shows the Government is way off the mark and off-message The Australia InstituteFollowOct 11, 2018 A new report from The Australia Institute debunks the government’s claims that Australia will meet the Paris target ‘in a canter’, demonstrating total emissions have been

The Emissions Data the Government Didn’t Want You To See

The Government released it’s Quarterly Greenhouse Gas Inventory last Friday, but don’t be shocked if you missed it. The Government released its Quarterly Greenhouse Gas Inventory late last Friday afternoon, before a long weekend and the football finals, at the same time as the interim report into the banking royal commission and it was a month late. A more

September 2018

5 ways the ABC board appointment process can be reformed right now

The crisis currently engulfing the ABC demonstrates clearly that the process for ABC Board appointments, including the appointment of the Chair, is in urgent need of reform in order to depoliticise future appointments and protect the ABC’s independence. “Revelations that many directors of the ABC’s eight-member board were directly appointed by the minister rather than

How consumers could cash in from the National Energy Market using Demand Response

The Australia Institute, Total Environment Centre, and the Public Interest Advocacy Centre have submitted a rule change request to AEMC, with support from Energy Consumers Australia. One of the largely unknown features of our national electricity system is that anyone is entitled to submit a request to reform the market rules. The Australia Institute has

7 reasons why using ‘environmental water’ for farming is a really bad idea.

Bad for the environment, bad for irrigators’ rights, not helpful for the farmers it is supposed to help — in a competitive field, this is truly one of the worst water policy ideas of recent times. Much of Australia is experiencing drought, so why don’t we give farmers water that would just be ‘wasted’ on the environment? That’s the

An Open Letter to the Western Australian Government calling for permanent ban on fracking

PDF of Open Letter can be downloaded in full here. Full text of open letter and list of signatories below. Dear Premier and Ministers of the Government of Western Australia — Unconventional oil and gas development in Western Australia should not go ahead under any circumstances. The consequences of global warming are already extremely serious;

Climate of the Nation 2018 wrap

The annual Climate of the Nation report has tracked Australian attitudes on climate change for over a decade. This is the first Climate of the Nation report produced by The Australia Institute, after being produced for a decade by the Climate Institute. Key findings > 73% of Australians are concerned about climate change, up from

As of September, Gas & Coal Power Plants have broken down 100 times so far in 2018

On average, that’s one gas & coal plant breakdown every 2.4 days. Above: Yallourn W Power Station, image used under Creative Commons license. The Australia Institute’s Gas & Coal Watch has been tracking gas and coal power plant breakdowns, and as of 2 September 2018, has recorded 100 such breakdowns this calendar year. So we crunched the

August 2018

Infographic: The Shrinking Labour Share of GDP and Average Wages

The Centre for Future Work recently published a symposium of research investigating the long-term decline in the share of Australian GDP paid to workers (including wages, salaries, and superannuation contributions). The four articles, published in a special issue of the Journal of Australian Political Economy, documented the erosion of workers’ share of national income, its causes, and consequences.

Remember, economic debates should still be democratic.

Dr Richard Denniss, Chief Economist of The Australia Institute, joins JOY radio to discuss: What happens if… we rebuild the economy? “I think we’re at a really interesting point in Australian politics,” says Dr Richard Denniss, Chief Economist of the Australia Institute. Deniss has joined JOY radio’s Dan Roberts & Jan Di Pietro to talk about the economy. He highlights,

Medibank Private – reported full year results on 24 August 2018

New analysis by The Australia Institute shows that based on Medibank Private’s annual report, the company tax cut would be a $554.9 million gift over the first decade of the cut to just this one company. Return to Revenue Watch $ million Profit 2017-18 628.3 Company tax 2017-18 183.2 Benefit from company tax cut based

Coca-Cola Amatil – reported half year results on 22 August 2018

New analysis by The Australia Institute shows that based on Coca-Cola Amatil’s annual report, the company tax cut would be a $201.7 million gift over the first decade of the cut to just this one company. Return to Revenue Watch $ million Profit 2017-18 232.1 Company tax 2017-18 66.6 Benefit from company tax cut based

Sydney Airport – reported half year results on 22 August 2018

New analysis by The Australia Institute shows that based on Sydney Airport’s annual report, the company tax cut would be a $65.4 million gift over the first decade of the cut to just this one company. Return to Revenue Watch $ million Profit 2017-18 194.8 Company tax 2017-18 21.6 Benefit from company tax cut based

Seven Group – reported full year results on 22 August 2018

New analysis by The Australia Institute shows that based on Seven Group’s annual report, the company tax cut would be a $192.3 million gift over the first decade of the cut to just this one company. Return to Revenue Watch $ million Profit 2017-18 468.7 Company tax 2017-18 63.5 Benefit from company tax cut based

Lendlease – reported full year results on 22 August 2018

New analysis by The Australia Institute shows that based on Lendlease’s annual report, the company tax cut would be a $825.7 million gift over the first decade of the cut to just this one company. Return to Revenue Watch $ million Profit 2017-18 1,066.2 Company tax 2017-18 272.6 Benefit from company tax cut based on

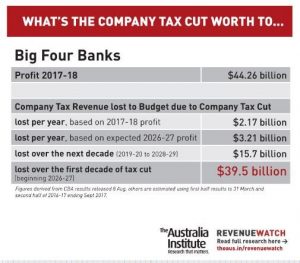

Big Four Banks

New analysis by The Australia Institute shows that based on the big four banks’ reporting, the company tax cut would be a $39.49 billion gift over the first decade of the cut to just these four companies. Big Four Banks $ million Profit 2017-18 44,262 Benefit from company tax cut based on 2017-18 profit 2,173

The 3 key arguments for the company tax cut make no economic sense, here’s why.

We often hear the government’s company tax cuts are ‘good for the economy,’ but are they? The argument goes something like this: ‘everyone else is cutting company tax rates, if we don’t match their cuts no one will invest in Australia, we’ll lose money and jobs and wages will decline.’ That sounds bad. But what does

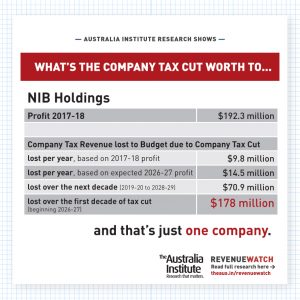

NIB Holdings – reported full year results on 20 August 2018

New analysis by The Australia Institute shows that based on NIB Holdings’s annual report, the company tax cut would be a $178.1 million gift over the first decade of the cut to just this one company. Return to Revenue Watch $ million Profit 2017-18 192.3 Company tax 2017-18 58.8 Benefit from company tax cut based

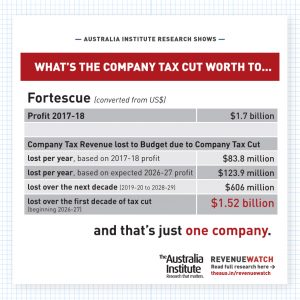

Fortescue – reported full year results on 20 August 2018

New analysis by The Australia Institute shows that based on Fortescue’s annual report, the company tax cut would be a $1.523 billion gift over the first decade of the cut to just this one company. Return to Revenue Watch $ million (converted from US$) Profit 2017-18 1,705.7 Company tax 2017-18 502.8 Benefit from company tax

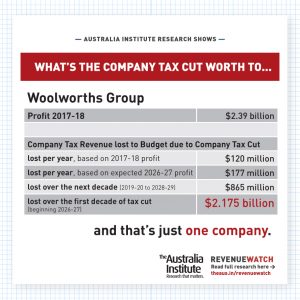

Woolworths Group – reported full year results on 20 August 2018

New analysis by The Australia Institute shows that based on Woolworths Group’s annual report, the company tax cut would be a $2.175 billion gift over the first decade of the cut to just this one company. Return to Revenue Watch $ million Profit 2017-18 2,394 Company tax 2017-18 718 Benefit from company tax cut based

General Enquiries

Emily Bird Office Manager

mail@australiainstitute.org.au

Media Enquiries

Glenn Connley Senior Media Advisor

glenn.connley@australiainstitute.org.au