August 2018

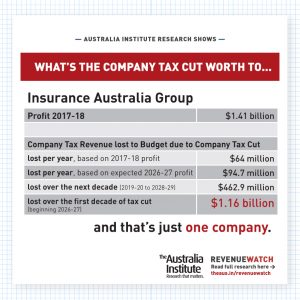

Insurance Australia Group Limited – reported full year results on 15 August 2018

New analysis by The Australia Institute shows that based on Insurance Australia Group Limited’s annual report, the company tax cut would be a $1.2 billion gift over the first decade of the cut to just this one company. Return to Revenue Watch $ million Profit 2017-18 1,410.0 Company tax 2017-18 384.0 Benefit from company tax

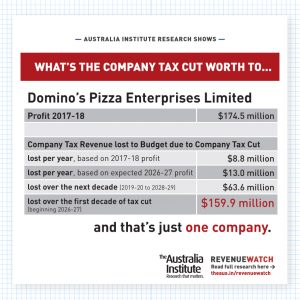

Domino’s Pizza Enterprises Limited – reported full year results on 14 August 2018

New analysis by The Australia Institute shows that based on Domino’s Pizza Enterprises Limited’s annual report, the company tax cut would be a $159.9 million gift over the first decade of the cut to just this one company. Return to Revenue Watch $ million Profit 2017-18 174.5 Company tax 2017-18 52.8 Benefit from company tax

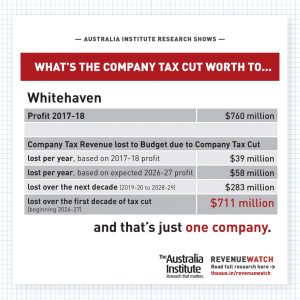

Whitehaven – reported full year results on 14 August 2018

New analysis by The Australia Institute shows that based on Whitehaven’s annual report, the company tax cut would be a $711 million gift over the first decade of the cut to just this one company. Return to Revenue Watch $ million Profit 2017-18 760 Company tax 2017-18 235 Benefit from company tax cut based on

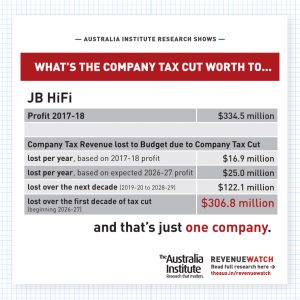

JB Hifi – reported full year results on 13 August 2018

New analysis by The Australia Institute shows that based on JB Hifi’s annual report, the company tax cut would be a $306.8 million gift over the first decade of the cut to just this one company. Return to Revenue Watch $ million Profit 2017-18 334.5 Company tax 2017-18 101.3 Benefit from company tax cut based

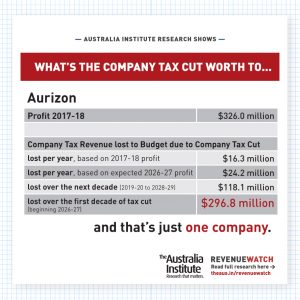

Aurizon – reported full year results on 13 August 2018

New analysis by The Australia Institute shows that based on Aurizon’s annual report, the company tax cut would be a $296.8 million gift over the first decade of the cut to just this one company. Return to Revenue Watch $ million Profit 2017-18 326.0 Company tax 2017-18 98.0 Benefit from company tax cut based on

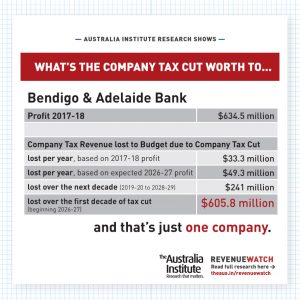

Bendigo and Adelaide Bank – reported full year results on 13 August 2018

New analysis by The Australia Institute shows that based on Bendigo and Adelaide Bank’s annual report, the company tax cut would be a $605.8 million gift over the first decade of the cut to just this one company. Return to Revenue Watch $ million Profit 2017-18 634.5 Company tax 2017-18 200 Benefit from company tax

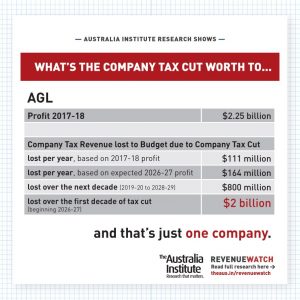

AGL – reported full year results on 9 August 2018

New analysis by The Australia Institute shows that based on AGL’s annual report, the company tax cut would be a $2.011 billion gift over the first decade of the cut to just this one company. Return to Revenue Watch $ million Profit 2017-18 2,251 Company tax 2017-18 664 Benefit from company tax cut based on

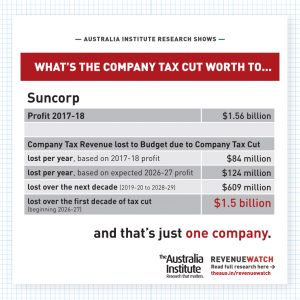

Suncorp – reported full year results on 9 August 2018

New analysis by The Australia Institute shows that based on Suncorp’s annual report, the company tax cut would be a $1.53 billion gift over the first decade of the cut to just this one company. Return to Revenue Watch $ million Profit 2017-18 1,564 Company tax 2017-18 505 Benefit from company tax cut based on

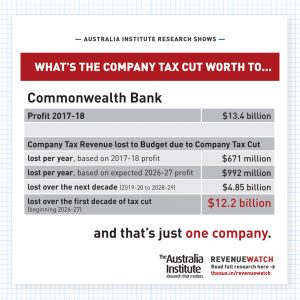

Commonwealth Bank – reported full year results on 8 August 2018

New analysis by The Australia Institute shows that based on Commonwealth Bank’s annual report, the company tax cut would be a $12.195 billion gift over the first decade of the cut to just this one company. Return to Revenue Watch Commonwealth Bank $ million Profit 2017-18 13,420 Company tax 2017-18 4,026 Benefit from company tax

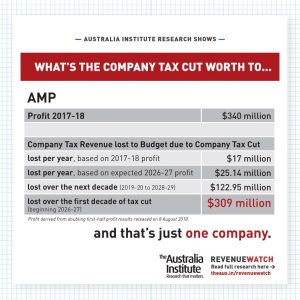

AMP – reported half year results on 8 August 2018

New analysis by The Australia Institute shows that based on AMP’s annual report, the company tax cut would be a $308.95 million gift over the first decade of the cut to just this one company. Return to Revenue Watch AMP $ million Profit 2017-18 340 Company tax 2017-18 102 Benefit from company tax cut based

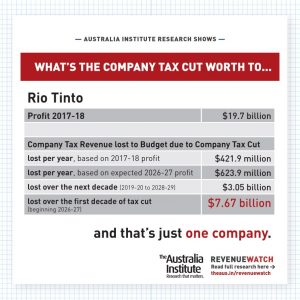

Rio Tinto – reported half year results on 1 August 2018

New analysis by The Australia Institute shows that based on Rio Tinto’s half year report, the company tax cut would be a $7.67 billion gift over the first decade of the cut to just this one company. Return to Revenue Watch Rio Tinto $ million Worldwide Income 2017-18 54,844 Profit 2017-18 19,699 Company tax 2017-18

Introducing Revenue Watch

This August, The Australia Institute will be launching our latest initiative: Revenue Watch.

July 2018

Possibly Surprising Insights on the Future of Work

Trade unionists are gathering this week at the ACTU’s triennial Congress in Brisbane. Jim Stanford, Director of the Centre for Future Work, participated in a panel on the Future of Work (an apt title!) at the Congress.

Centre for Future Work at #ACTUCongress18

Trade unionists from across Australia are gathering in Brisbane this week for the 2018 Congress of the Australian Council of Trade Unions. And the Centre for Future Work will be there!

June 2018

Cutting through the Company Tax Cuts Guff

Below you will find all research papers on company tax cuts produced by The Australia Institute to date [updated 25.06.18] The big four banks get an extra $7.4 billion dollars: Australia’s big four banks are some of the most profitable banks in the world and are the big winners here, getting an extra $7.4 billion dollars in the first 10

Tax cuts by electorate

Read the full report: 2018 tax cuts by electorate. Table of electorates Rank Electorate Percentage of average Party 1 Wentworth 192% LIB 2 North Sydney 180% LIB 3 Warringah 172% LIB 4 Sydney 167% ALP 5 Melbourne Ports 160% ALP 6 Higgins 159% LIB 7 Bradfield 158% LIB 8 Kooyong 156% LIB 9 Grayndler 154% ALP

The Dimensions of Insecure Work in Australia

Less than half of employed Australians now hold a “standard” job: that is, a permanent full-time paid job with leave entitlements. That’s the startling finding of a new report on the growing insecurity of work published by the Centre for Future Work.

May 2018

A Comprehensive and Realistic Strategy for More and Better Jobs

The Australian Council of Trade Unions has released a major policy paper outlining an ambitious, multi-faceted program to address the chronic shortage of work, and the steady erosion of job quality, in Australia. The full paper, Jobs You Can Count On, is available on the ACTU’s website. It contains specific proposals to stimulate much stronger job-creation, reduce unemployment and underemployment, improve job quality (including through repairs to Australia’s industrial relations system), and ensure that all communities (including traditionally marginalised populations like indigenous peoples, women, youth, and people with disability) have full access to the decent work opportunities that the plan would generate.

January 2018

Scare Tactics for Corporate Tax Cuts Do Not Stand Fact Checks

In the wake of the Trump Administration’s success in pushing a major company tax cut through the U.S. Congress, the Australian Treasurer has stepped up his calls for reduced company taxes here. He claims Australia will bypass the growth-inducing benefits of these tax cuts, but Dr. Anis Chowdhury, Associate of the Centre for Future Work, has compiled the economic evidence. The U.S. experience shows no statistical evidence of any “trickle-down” growth dividend from company tax cuts.

July 2017

The Future of Work is What We Make It

Progressives everywhere are grappling with developing policy proposals to improve the quantity and quality of work in our economy, as part of their broader vision for building more successful and inclusive societies. To this end, the Fabians Society in NSW recently published an interesting booklet of policy proposals, to inject into debate within the Labor Party and other fora. One chapter written by Sarah Kaine (Associate Professor at UTS and a member of the Centre for Future Work’s Advisory Committee) and Jim Stanford (Economist and Director of the Centre) deals head-on with the challenges facing work, and what can be done to make it better; it is reprinted below.

The Paradox of Rising Underemployment and Growing Hours

Paradoxically, underemployment and number of hours actually worked are both on the rise in Australia.

May 2017

Budget Wrap-Up

Commonwealth Treasurer Scott Morrison tabled his 2017-18 budget in Parliament House on May 9, and the Centre for Future Work’s Director Jim Stanford was there in the lock-up to analyse its likely impacts. Here are some of our main impressions and comments:

April 2017

Economists Debunk Job-Creation Claims of Penalty Rate Cut

The Fair Work Commission has ruled that penalty rates for Sunday and public holiday work in the retail and hospitality sectors should be reduced, which would reduce hourly wages on those days by up to $10 per hour. Business lobbyists predict this will spark a hiring surge in stores and restaurants, as employers take advantage of lower wages to extend hours and ramp up operations. The economic logic of this claim is highly suspect, however – especially in light of the fundamental factors which truly limit employment in these sectors (namely, the sluggish growth of personal incomes). 78 Australian economists have signed a public letter debunking these job-creation claims, arguing that the FWC’s decision will lead to more inequality, not more employment.

November 2016

Go Home on Time: Wednesday 23 November

The Centre for Future Work is proud to host this year’s Go Home on Time Day. It’s the eighth annual edition of this event, which draws light-hearted attention to a serious issue: the economic, social, and health consequences of excess working hours.

October 2016

What’s Wrong With Privatization?

You know that the tides of public opinion are starting to turn, when even the head of the Australian Competition and Consumer Commission, Mr. Rod Sims, will come out in public and criticize the usual claims that privatization is good for efficiency and national well-being.

June 2016

Looking for “Jobs and Growth”: Six Infographics

We have prepared six shareable infographics based on material in our research paper, “Jobs and Growth… and a Few Hard Numbers,” which compared Australia’s economic performance under the respective postwar Prime Ministers.

Cut the Company Tax Rate – Why Would You?

There have been a lot of big claims made about cutting company tax cuts.

Jobs and Growth… and a Few Hard Numbers

Voters typically rank economic issues among their top concerns. And campaigning politicians regularly make bold (but vague) pronouncements regarding their competence and credibility as “economic managers.” In popular discourse, economic “competence” is commonly equated with being “business-friendly.”

November 2015

Pension Loan Scheme Costings by PBO

New costings from the Parliamentary Budget Office (PBO) show the government could help retirees boost their own incomes at nearly no cost to the budget by making the Pension Loans Scheme to available to all who wish to use it to have a comfortable retirement while living in their own homes. Costings requested by Senator

February 2014

General Enquiries

Emily Bird Office Manager

mail@australiainstitute.org.au

Media Enquiries

Glenn Connley Senior Media Advisor

glenn.connley@australiainstitute.org.au